MWG Corporation (listed on HoSE as MWG) has announced that it will finalise the list of shareholders on July 25, 2025, to carry out a 10% cash dividend for fiscal year 2024.

This equates to VND 1,000 per share, with an expected payment date of August 8, 2025. The source of funding for this dividend is the retained earnings as per the 2024 audited financial statements.

With approximately 1.479 billion shares in circulation, MWG Corporation is expected to disburse VND 1,479.7 billion for this dividend payout.

As of the end of 2024, Chairman Nguyen Duc Tai owned 32.4 million MWG shares and is estimated to receive VND 32.4 billion in dividends. Retail World Investment Consulting Company, also chaired by Mr. Nguyen Duc Tai, holds 153.4 million shares and is expected to receive VND 153.4 billion in dividends.

Mr. Tran Huy Thanh Tung, former member of the Board of Directors and former General Director, owns 11.13 million shares and is estimated to receive VND 11.13 billion in dividends. Tran Huy Investment Consulting Company, of which Mr. Tran Huy Thanh Tung is a Board member, holds 32.26 million shares and is expected to receive VND 32.26 billion in dividends.

Mr. Robert Alan Willett, a non-executive member of the Board of Directors of MWG, owns 6.9 million shares and is estimated to receive VND 6.9 billion in dividends.

Board member Dang Minh Luom owns 2.2 million shares and is expected to receive VND 2.2 billion in dividends. Board member Doan Van Hieu Em holds 2.6 million shares and is estimated to receive VND 2.6 billion in dividends.

In other news, MWG Corporation recently reported the repurchase of 324,161 treasury shares in June 2025 through a transfer of rights via VSDC. The purpose of this repurchase was to retrieve ESOP shares from employees who have left the company. Following this transaction, MWG Corporation now holds 1.08 million treasury shares.

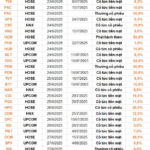

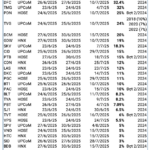

“Top Dividend Payouts: Hòa Phát, VNDirect, and More Announce Cash Dividends of Up to 32% This Week”

Introducing the top 25 dividend-paying companies: an elite group offering cash returns ranging from a substantial 32% to a modest yet still notable 1%. These companies stand out in the market, showcasing their commitment to rewarding investors and providing an attractive income stream.

“MIC Announces 10% Dividend Payout for 2024”

Military Insurance Company (MIC) is proud to announce its planned dividend distribution for the year 2024. The company intends to share its success with its valued shareholders through a dividend payout comprising a healthy mix of cash and stock. This planned dividend distribution strategy includes a 5% cash dividend and a 5% stock dividend, with the payout expected to take place in the third quarter of 2025. This approach showcases MIC’s commitment to rewarding investors while also strengthening its capital structure for continued growth and stability.