Real Value and Growth Expectations

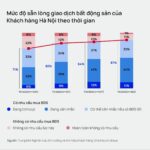

It’s evident that low-rise housing in many once-popular investment areas is showing signs of stagnation and even decline after a period of overheating. According to the Ministry of Construction’s report for Q4 2024, in Hanoi, areas like Gia Lam, Dong Anh, and Hoai Duc witnessed price increases of 30-40% compared to 2023, with some areas and projects seeing hikes of up to 60-70%. The common price range was VND 100-250 million/sqm, but now it’s cooling down due to reduced demand and cautious sentiment.

In Ho Chi Minh City, low-rise housing prices within projects have remained stable, with some areas increasing by about 5-10% compared to 2023. The common selling price ranged from VND 90-250 million, but the market is now slowing down, with little to no transactions.

Towards the end of Q2 2025, some large projects on the outskirts of Ho Chi Minh City also faced a situation of vacant houses with few customers, despite grand events attracting tens of thousands of participants during the peak sales period last year.

It’s clear that projects with inflated prices are revealing their limitations. Price increases based on expectations rather than intrinsic value lead to weakened liquidity and a quick withdrawal of speculative money when the market turns.

Hanoi and Ho Chi Minh City’s low-rise real estate markets are cooling down

The decline of these speculative hotspots is pushing the market into a natural cycle of selection, where only assets with real value will stand firm. Savvy investors are now turning to real estate that offers both residential and business opportunities, along with sustainable growth potential over time.

Areas like Da Nang – Hoi An are emerging as sought-after investment destinations due to their genuine potential, a solid foundation for socio-economic development, and ample room for growth. Da Nang is on its way to becoming a center for maritime economy, international finance, and high technology, continuing to attract foreign experts and entrepreneurs seeking premium living spaces that meet international standards.

Hoi An, after a period of dormancy due to the pandemic, is bouncing back strongly with the recovery of tourism and a series of key infrastructure projects, including road, water, rail, and air transport connections, as well as inter-regional links to Quang Nam, Da Nang, and Thua Thien Hue.

Unaffected by inflated prices and trends, Hoi An currently offers a “value basin” with reasonable price levels and ample growth potential, especially with its unique combination of nature, culture, relaxation, and trade connections.

Casamia Balanca Hoi An – A True Asset for Discerning Investors

Market fluctuations are precisely when astute investors clarify their goals: they must seek out and choose assets with a foundation for sustainable development, real value coupled with real growth potential, avoiding herd mentality and accepting the risk of “peak-chasing.”

In reality, the concept of “real estate accumulation” is not new to those with a sustainable financial mindset. This type of asset not only preserves its value during volatile times but also offers dual profitability: it can be rented out to generate a stable cash flow and appreciates over time due to its unique location and synchronized development planning that aligns with the macro trends of the region.

Amidst the market adjustments and differentiation, Casamia Balanca Hoi An stands out with its authentic value and long-term exploitation advantages. Located within a rare ecological complex in the buffer zone of the world biosphere reserve, along the Co Co River, near the Cua Dai Bay, and just a few minutes away from the ancient town of Hoi An, the project not only inherits the original natural and cultural values and architectural characteristics of the old town but is also positioned as an ideal living destination for those who prioritize sustainable living values.

Casamia Balanca Hoi An – An ideal destination for those who prioritize sustainable values

Casamia Balanca Hoi An not only boasts a rare location but also excels with its development philosophy, adhering to the model of a premium eco-urban area by the river. It maintains a modern yet nature-preserving approach, a model that has proven successful in developed countries like the US and Europe. The project offers synchronized infrastructure, nature-inspired designs, low construction density, transparent legal procedures, and endless potential for profitable exploitation.

This is a place where owners can live and simultaneously generate a steady cash flow through rentals, embodying the value of long-term real estate accumulation to be passed down through generations.

Early ownership of a multi-value asset like Casamia Balanca Hoi An is not only a safe choice but also a wise move. This project is for those who understand that genuine value endures, exclusive locations are scarce, and inheritable real estate deserves to be a quality and timeless living space.

3 Reasons Why Sei Harmony is the Top Choice for Customers

In the bustling urban district of Binh Tan, Sei Harmony emerges as an oasis of Japanese-inspired living. This rare gem of a residential development offers a truly unique opportunity to immerse oneself in a bona fide Japanese lifestyle, right at the heart of the city. With a trio of prime assets – a central location, reputable developers, and a host of quality amenities – Sei Harmony presents the epitome of refined living, blending the essence of Japan with the vibrancy of modern Vietnam.

The Heart of Administrative and Commercial Urbanity: Thu Thua, the Thriving Hub Neighboring Ho Chi Minh City

The soaring property prices in Ho Chi Minh City can be attributed to the scarcity of land and escalating input costs, prompting savvy investors to look beyond the southern region. This shift in focus is driven by a strategic optimization of cash flow, as investors seek out areas offering more reasonable price tags.

The Aristo: Elevating Living Spaces into a Timeless Legacy

When it comes to choosing a premium urban real estate, the discerning elite value longevity. Their homes are not just for the present, but are also future-oriented. Ownership is not merely a statement of self-worth, but also a ‘living legacy’ passed on to the next generation.