The market lacked supportive pillars today as less motivating news started to emerge, such as MSCI’s decision to not consider upgrading Vietnamese stocks and the impending announcement of retaliatory tariffs by the US.

The index ended slightly lower, down 1.08 points to 1,365.67, with a relatively balanced market breadth of 155 declining stocks versus 141 gainers. The market’s weakness was evident in the lack of strong pillars like the Vin group or banks to prop it up. While the real estate sector showed positivity in mid and small caps, with industrial park stocks KBC and SZC surging on expectations of lower taxes, their impact on the overall market was insignificant. Meanwhile, VIC fell by 0.84%; VHM dropped sharply by 2.44%, and VRE declined by 0.61%.

Banks also showed weakness in large caps such as VCB and BID, while MBB posted a modest gain of 1.17%, and TCB and CTG rose marginally. Notably, the securities group disappointed, with the exception of VND, which climbed by 1.18%. A slew of stocks in this sector turned south, including MSB, HCM, FTS, VCI, and VIX. Information technology and software stocks were generally negative.

The transport sector reacted positively to the market today, especially aviation stocks. ACV rose by 3.23%, HVN gained 1.07%, and SCS climbed 4.15%. Meanwhile, maritime transport stocks saw mild gains, including PVT and HAH. Construction stocks witnessed CC1’s strong performance, along with CII, CTD, and DPG, buoyed by public investment prospects.

Investor caution was reflected in the day’s liquidity, with the total matched transactions on the three exchanges falling below 20 trillion dong. Foreign investors net sold 323.9 billion dong, and their matched selling amounted to 489.4 billion dong. Their top buys on a matched basis included SSI, CTG, DGW, MSN, KBC, VND, VHC, GEX, VCG, and HAH. On the selling side, they offloaded FPT, HPG, STB, VNM, KDH, ACB, VCB, GMD, and HDB.

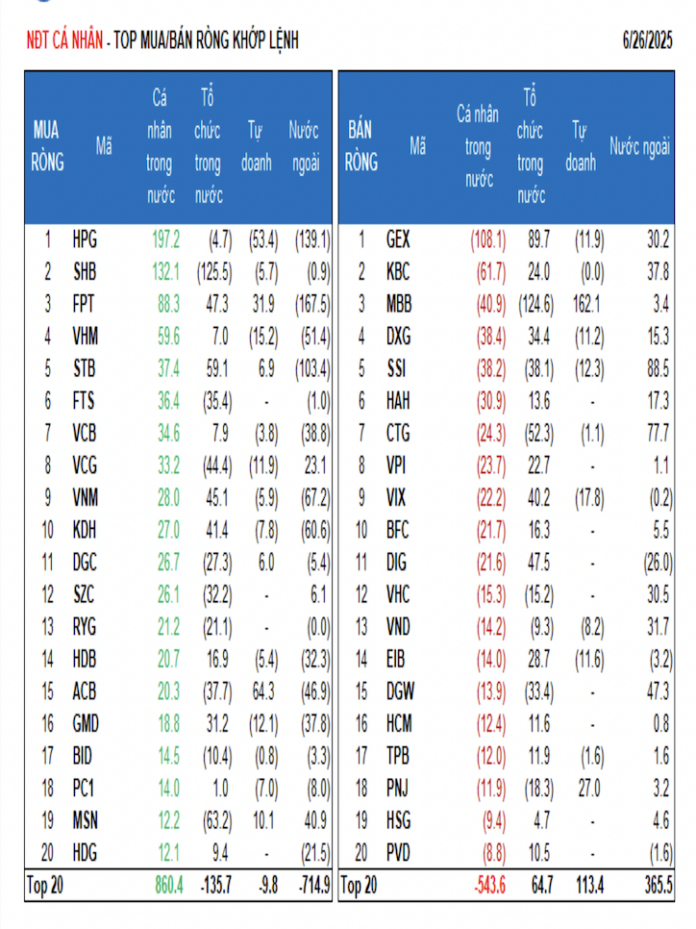

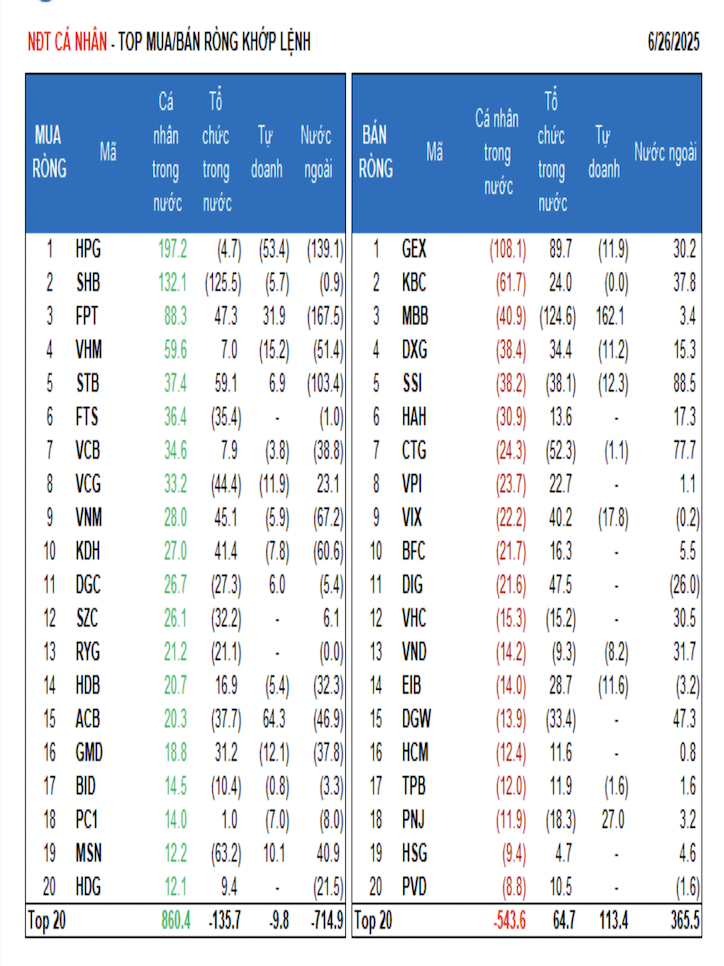

Individual investors net bought 1,304.6 billion dong, of which 309.8 billion dong was on a matched basis. In terms of matched transactions, they net bought 9 out of 18 sectors, mainly Basic Materials. Their top buys included HPG, SHB, FPT, VHM, STB, FTS, VCB, VCG, VNM, and KDH. On the selling side, they offloaded GEX, KBC, MBB, DXG, SSI, HAH, VPI, VIX, and BFC.

Proprietary trading accounts net bought 601.9 billion dong, with a matched net purchase of 28.0 billion dong. In matched transactions, proprietary trading accounts net bought 6 out of 18 sectors, with the largest purchases in Banks and Information Technology. Their top buys on a matched basis were MBB, ACB, FPT, PNJ, FRT, MSN, FUEVFVND, STB, DGC, and PLX. Their top sells were in the Real Estate sector, including HPG, VIC, DBC, VIX, VHM, MWG, SSI, GMD, VCG, and GEX.

Domestic institutions net sold 1,635.2 billion dong, with a net purchase of 151.6 billion dong on a matched basis. In terms of matched transactions, domestic institutions net sold 9 out of 18 sectors, with the largest value in Banks. Their top sells included SHB, MBB, MSN, CTG, VCG, SSI, ACB, FTS, DGW, and SZC. Their net buys were mainly in Real Estate. Their top purchases included GEX, STB, DIG, FPT, VNM, KDH, MWG, VIX, DXG, and GMD.

Today’s matched transactions totaled 4,577.7 billion dong, up 14.7% from the previous session and contributing 21.8% to the total transaction value. Notable transactions included nearly 51 million HDB shares, equivalent to 1,071 billion dong, which a domestic institution sold to an individual investor. Additionally, domestic proprietary trading accounts and domestic institutions continued to trade bank stocks (TCB, MBB, STB, VPB) among themselves.

Cash flow allocation ratio increased in Real Estate, Construction, Food & Beverage, Retail, Warehousing, Logistics & Maintenance, while decreasing in Securities, Steel, Chemicals, Electrical Equipment, Oil & Gas, Software, Rubber & Plastics.

In terms of matched transactions, the cash flow allocation ratio increased in mid-cap stocks (VNMID) and decreased in large-cap stocks (VN30) and small-cap stocks (VNSML).

“Chinese Conglomerate, the Tu Lien Bridge Constructor, Eyes More Mega Projects in Vietnam”

As part of his attendance at the World Economic Forum’s 16th Annual Meeting of the Global Pioneers, during his working visit to China, in the afternoon of June 26th, in Shanghai, Prime Minister Pham Minh Chinh met with Mr. Yim Kie Woo, Chairman of the Pacific Group, and senior executives of the Group.

Surging MSN Trading Volume: Small-Cap Stocks Surge as Large-Caps Curb Index Gains

Let me know if you would like me to tweak it further or provide additional suggestions!

Positive news about the prospects of trade negotiation results within the next two weeks has supported the market in the morning session. After a dip due to strong selling pressure, bottom-fishing funds started to buy, pulling prices higher. There was no clear sector leadership except for the surge in MSN, but money is flowing into small and mid-cap stocks.

“Prime Minister Pham Minh Chinh Rings the Bell to Open Trading at Asia’s Largest Stock Exchange”

“The Prime Minister proposed that the Singapore Exchange (SGX) continue its close and effective collaboration with Vietnam’s stock exchanges. Emphasizing the importance of knowledge sharing and capacity building, the Prime Minister encouraged SGX to share its expertise and provide support for the development of Vietnam’s stock market and its aspiration to establish an international financial center. This includes facilitating exchanges of experience and offering training opportunities to foster the growth of a robust and dynamic financial ecosystem in Vietnam.”

“Proposal to Expand the North-South Expressway via PPP Model”

The Ministry of Construction has reported on the research and investment into expanding the North-South Expressway Eastern Route through a public-private partnership (PPP) model.