VN-Index experiences a slight pullback as trading on June 26th is expected to be a tug-of-war with a potential dip to 1,360 points.

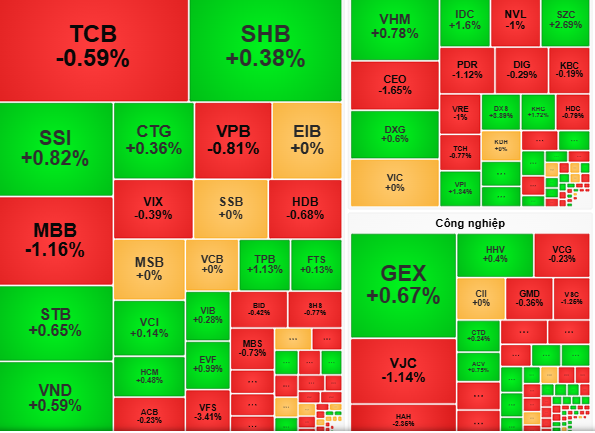

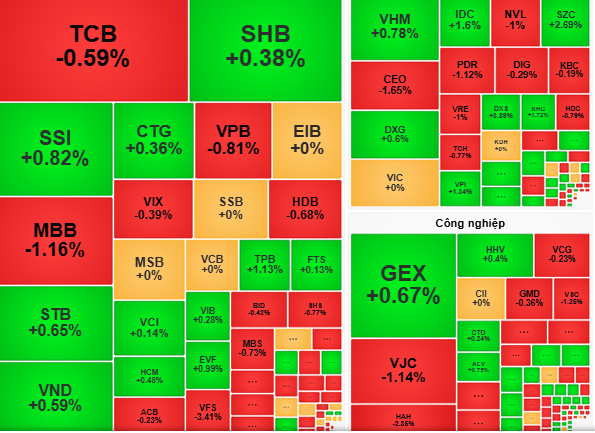

The VN-Index opened with a slight gain, fluctuating within a narrow range of 1366-1371 points throughout the morning session. Blue-chip stocks showed signs of stagnation, with some undergoing minor corrections. However, notable gains were observed in stocks such as GVR, VNM, FPT, and EIB, which helped maintain market balance during the morning trade.

In the afternoon session, the VN-Index continued its tug-of-war, facing pressure from the banking sector as most stocks in this industry underwent corrections. Money flowed unevenly across different sectors, causing the overall index to lose steam and close below the reference level.

According to VCBS Securities Company, the market is undergoing a supply-demand test around the 1360-1370 point region. This is a typical occurrence as the index challenges a significant resistance level. The market may experience a corrective phase during the June 26 session, with the 1,360-point mark acting as a support level.

Rồng Việt Securities Company (VDSC) attributes the decreased trading volume on June 25 to a cooling-off in buying support, although selling pressure hasn’t significantly intensified. The market remains in a state of supply-demand testing for stocks. This back-and-forth dynamic could persist, with a potential minor correction to 1,360 points before rebounding.

VCBS Securities recommends that investors consider taking profits on stocks facing corrective pressure at resistance levels, especially those that have surged significantly in the previous phase. Investors should maintain their holdings in stocks that sustain a stable upward trend. In the event of market fluctuations, this could present an opportunity to increase allocations in stocks with solid fundamentals.

Stock Market Outlook for June 23-27, 2025: Brace for More Volatility

The VN-Index surged back and successfully conquered the 1,370-point mark in the week’s final trading session. This rebound was primarily driven by large-cap stocks, as market liquidity remained weak and foreign investors continued their net-selling trend. With cautious sentiment prevailing, the index is expected to experience volatility in the 1,360-1,380 range in the upcoming sessions.

Market Pulse for June 27: Essential Consumer Staples Shine as VN-Index Surges by Almost 6 Points

The trading session concluded on a positive note, with the VN-Index climbing 5.77 points (+0.42%) to reach 1,371.44. The HNX-Index also experienced a boost, rising 0.11 points (+0.05%) to close at 227.81. The market breadth tilted towards the bulls, as 414 tickers advanced against 325 decliners. This bullish sentiment was echoed in the VN30 basket, where 20 stocks added value, 7 contracted, and 3 remained unchanged.