Specifically, the SBV approved VietABank’s proposal to increase its charter capital by issuing a maximum of 2.764 trillion VND worth of shares from its owner’s equity.

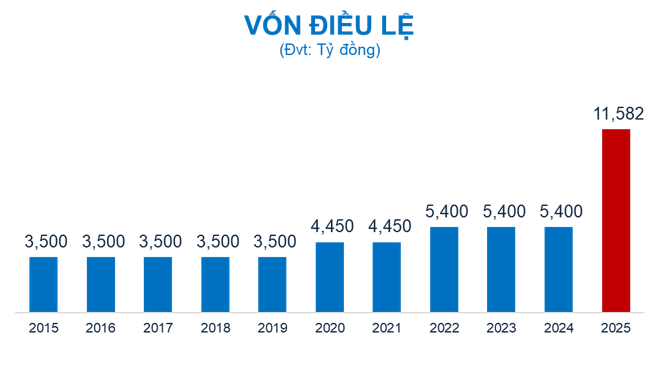

This capital increase plan was approved by the 2025 Annual General Meeting of Shareholders. Accordingly, VietABank plans to increase its charter capital in 2025 by 6.183 trillion VND through three methods.

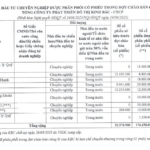

Firstly, VietABank will issue a maximum of over 285 million new shares to existing shareholders from the owner’s equity and undistributed profits. With a maximum ratio of 52.8%, shareholders owning 100 shares will receive 52.8 new shares. The total value of the issuance at par value is up to nearly VND 2.851 trillion.

Secondly, VietABank plans to issue 20 million shares to employees (ESOP) with an issuance ratio of 3.7%. With an expected issuance price of VND 10,000 per share, the bank could raise VND 200 billion.

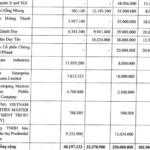

Thirdly, VietABank intends to issue a maximum of over 313 million shares in a private placement to existing shareholders. The entitlement ratio is 100:58 (for every 100 shares owned, shareholders will receive 100 rights, and 100 rights can buy 58 new shares). With an expected issuance price of VND 10,000 per share, the total expected proceeds are nearly VND 3.132 trillion.

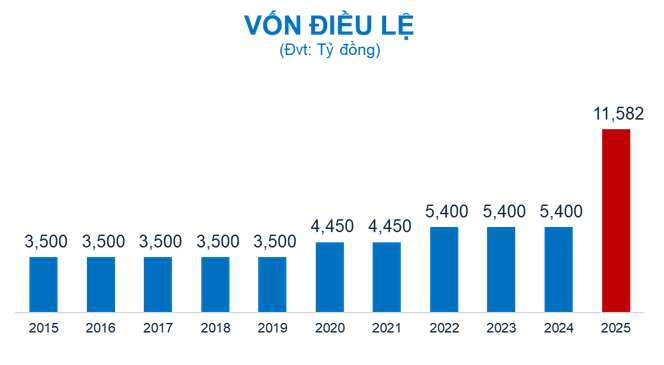

If all three methods are successfully implemented, VietABank’s charter capital will increase from VND 5,400 billion to over VND 11,582 billion.

Source: VietstockFinance

|

On the UPCoM exchange, VAB shares closed at VND 14,900 per share on June 26, 2025, up 60% since the beginning of the year. Average daily trading volume exceeded 1 million shares.

| VAB Share Price Movement since the Beginning of the Year |

– 4:19 PM, June 26, 2025

Unveiling the 9 Investors Who Spent Over VND 4,100 Billion on Private Placement Shares of Kinh Bac (KBC): VPBank Leads the Pack with Enthusiasm

With a remarkable surge in authorized capital, the company witnessed a significant jump from 7,676 billion to 9,418 billion VND, translating to approximately 941.8 million circulating shares.

The Unsold Shares: Kinh Bac’s Private Placement Fails to Entice Investors with 147.1 Million Unsold Stocks

The subscription period for purchasing shares has ended, and Kinh Bac is left with over 147.1 million unsold shares. The company plans to continue its offering at a price of VND 23,900 per share.