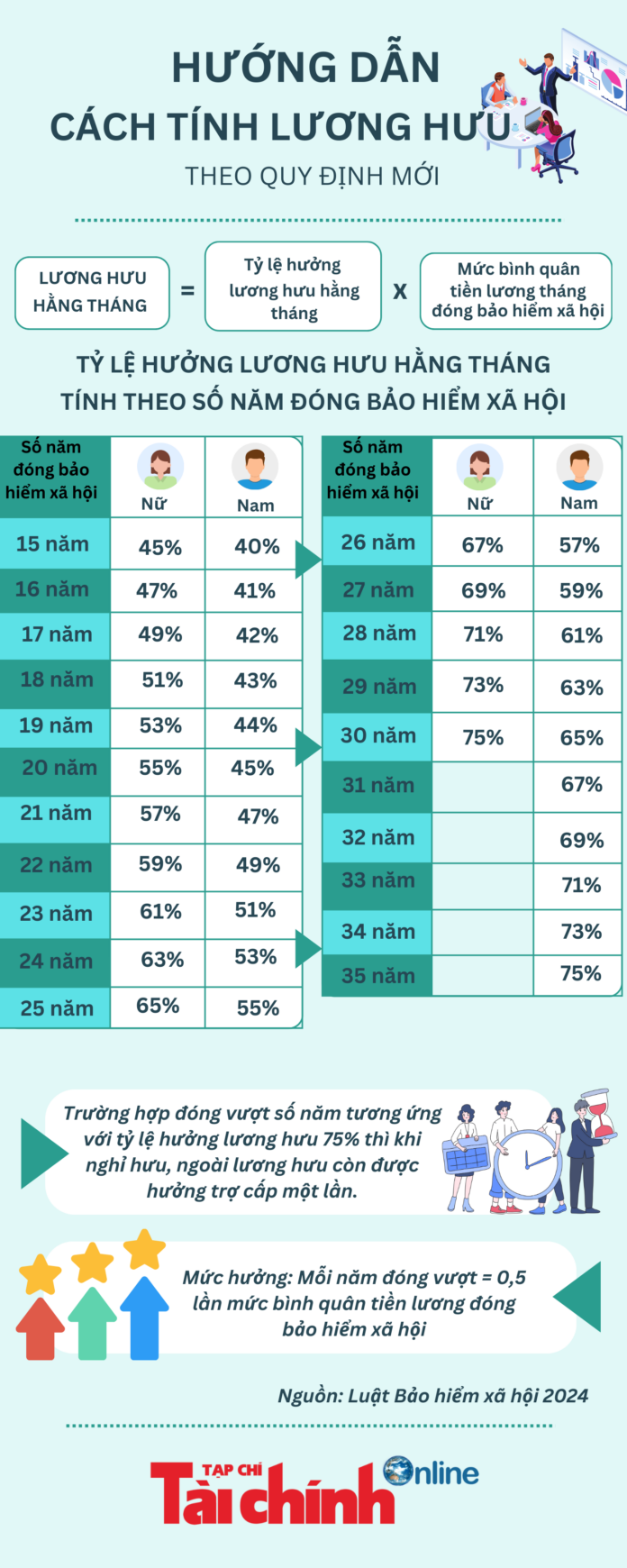

New Pension Calculation Method According to the 2024 Social Insurance Law

For Female Workers: The monthly pension amount is calculated as 45% of the average salary used as the basis for social insurance contributions, corresponding to 15 years of social insurance contributions. For each additional year of contributions, the rate increases by 2%, with a maximum of 75% for 30 years of contributions.

For Male Workers: The monthly pension amount is calculated as 45% of the average salary used as the basis for social insurance contributions, corresponding to 20 years of social insurance contributions. For each additional year of contributions, the rate increases by 2%, with a maximum of 75% for 35 years of contributions.

Infographic: Finance Magazine

Will These 3 Groups Soon Lose Their Monthly Pension Payments?

The Social Insurance Law of 2024, effective from July 1st, 2025, outlines provisions regarding the cessation of monthly pension benefits for certain individuals.

“Retirement in 2025: How Much Monthly Pension with 22 Years of Social Insurance Contributions?”

With the recent changes to the Social Insurance Law (Article 64), effective July 1, 2025, employees reaching retirement age with a minimum of 15 years of mandatory social insurance contributions are now entitled to receive a retirement pension upon leaving their employment.