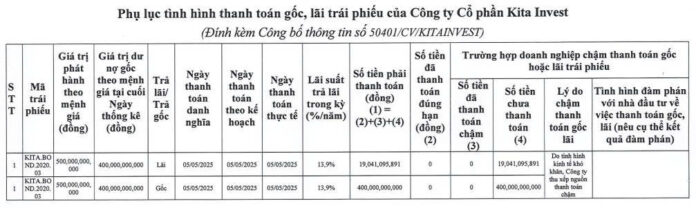

The Hanoi Stock Exchange (HNX) has recently published a disclosure on Kita Invest JSC’s bond principal and interest payment status.

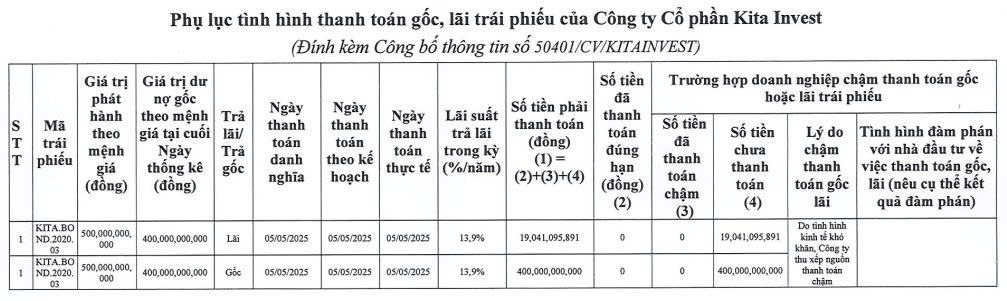

Specifically, according to the plan on May 5, 2025, Kita Invest was supposed to repay over VND 419 billion in principal and interest for the KITA.BOND2020.03 bond tranche, including VND 400 billion in principal and over VND 19 billion in bond interest. However, the company delayed this payment due to financial difficulties in arranging funds.

It is known that this bond tranche has a total issuance value of VND 500 billion, issued on May 5, 2020, with a term of 42 months and an expected maturity date of November 5, 2023. However, the bond tranche’s maturity was later extended by 18 months, with a new maturity date of May 5, 2025.

On June 12, 2023, Kita Invest repurchased VND 100 billion of this bond tranche, reducing the outstanding amount to VND 400 billion.

Source: HNX

Regarding Kita Invest’s bonds, on June 18, 2025, the company repurchased VND 200 billion of the KITA.BOND2020.07 bonds, fully settling this bond tranche. At the same time, the company also repurchased nearly VND 196 billion of the KITA.BOND2020.08 bonds.

It is known that both of these bond tranches were issued in 2020. On July 25, 2024, Kita Invest issued Document No. 03/2024/CV/KITA announcing a change in the bond term. Accordingly, the terms of KITA.BOND2020.07 and KITA.BOND2020.08 were extended from 48 months to 60 months, with a new maturity date of July 30, 2025. However, the company repurchased these bonds ahead of schedule, as mentioned above.

Kita Invest, established on January 15, 2019, mainly operates in the fields of mergers and acquisitions, real estate investment, and financial investment.

At its inception, the company had a charter capital of VND 100 billion with three founding shareholders: Kita Group Joint Stock Company (30%), Ms. Dang Thi Thuy Trang (30%), and Mr. Nguyen Duy Kien (40%). Ms. Dang Thi Thuy Trang (DOB: 1979) is the General Director and legal representative of the company.

Just a few days later, on January 21, 2019, Kita Invest significantly increased its charter capital to VND 1,150 billion, but the shareholder structure at this time was not disclosed.

In April 2019, the company’s legal representative changed from Ms. Dang Thi Thuy Trang to Mr. Nguyen Duy Kien (DOB: 1969), who is the Chairman of the Board of Directors.

According to a registration change in June 2019, Mr. Do Xuan Khanh (DOB: 1977) replaced Mr. Nguyen Duy Kien as the legal representative.

In the real estate market, Kita Invest is the investor of the Stella Mega City project in Binh Thuy district, Can Tho city.

The project has a scale of 150 hectares, with a total of 5,000 land plots ranging from 80-170 sq. m, including terraced houses, shophouses, villas, and apartments. The total investment capital for this project is VND 8,000 billion.

In terms of business performance, as of December 31, 2024, the company’s owner’s equity was nearly VND 1,238 billion, an increase of VND 33 billion compared to the previous year.

Net profit in 2024 was over VND 29 billion, a decrease of 35% compared to 2023. Total liabilities as of the end of 2024 were over VND 14,076 billion, an increase of VND 131 billion compared to the previous year, and nearly 11.4 times the owner’s equity.

Bank loans decreased from VND 2,002 billion to VND 1,602 billion, while other payables increased by VND 1,000 billion to VND 11,678 billion.

Regarding Kita Invest’s 2024 audited financial statements, the auditing organization highlighted some key points. During the financial year ended December 31, 2024, the Company had trade transactions and interest income transactions with related parties.

However, according to the assessment of the Board of Directors, this regulation only applies to interest expenses from related parties (not applicable to interest expenses from banks and other parties). Therefore, the Company’s Board of Directors did not recognize any impact on the consolidated financial statements if there were any deductible interest expenses when determining corporate income tax.

Kita Invest is known to be a member of Kita Joint Stock Company (Kita Group), owned by businessman Nguyen Duy Kien. The ecosystem of businessman Nguyen Duy Kien also includes a series of companies with the “Kita” brand, such as Kita Group Joint Stock Company, Kita Holding Joint Stock Company (Kita Holding), Kita Land Joint Stock Company (Kita Land), etc.

Kita Group, formerly known as F1 Food and Beverage Joint Stock Company (F1), initially focused on the wholesale beverage business.

As of August 2016, Mr. Nguyen Duy Kien and Ms. Dang Thi Thuy Trang owned 55% and 22.5% of F1’s charter capital, respectively.

In June 2018, the company increased its charter capital to VND 100 billion and changed its name to Kita Group. After several changes, as of July 2020, the company’s charter capital was VND 750 billion.

Businessman Nguyen Duy Kien also used to be the Chairman of the Board of Directors and legal representative of Kita Group. After several changes, according to the latest registration change in June 2024, Mr. Ta Quang Lam became the Chairman of the Board of Directors and legal representative of the company.

In the Northern market, Kita Group is known as the developer of Kita Capital in the Ciputra Urban Area, Hanoi; Stella Project in Quoc Oai, Hanoi; and the high-end Sukura Golf project in Hai Phong…

In the Southern market, in addition to Kita Airport City, Kita Group has successfully merged and acquired a series of projects such as Golden Hills eco-urban area (in Hoa Vang district and Lien Chieu district, Da Nang city) and some prime land funds in Ho Chi Minh City, Phan Thiet…

PV

“Redeeming a Bond Bonanza: Galaxy EE Retires a Bulk of Debt Securities”

“Galaxy EE has successfully repaid the interest and principal amount of the GMECH2123002 bond series. This marks a significant milestone for the company, as it showcases their financial stability and commitment to meeting their financial obligations.”

Tasco Sets Date for Offering Over 178.5 Million Shares to Existing Shareholders

“Tasco is offering its existing shareholders the opportunity to purchase over 178.5 million shares at a price of 10,000 VND per share, aiming to raise over VND 1,785 billion. The record date for this offering is June 30, 2025. This exclusive opportunity allows investors to become a part of Tasco’s growth story and contribute to its future success.”

The New Move of the Investor for the 3.6-Trillion VND 36-Hole Golf Course Project in Ha Nam Province

“The developer of the 36-hole golf course and auxiliary facilities is committed to assessing the environmental impact of the project’s construction. The development encompasses the construction of an administrative and hospitality hub, including a hotel and offices, as well as a residential enclave featuring luxurious villas and an entertainment complex designed to elevate the leisure experience.”