The trading session was lackluster and subdued. Liquidity plummeted, indicating investor caution as the VN-Index approached the resistance zone around 1,370 points – the highest level in over three years. This was also the first time in five sessions that the trading value on the HoSE dipped below 20 trillion VND.

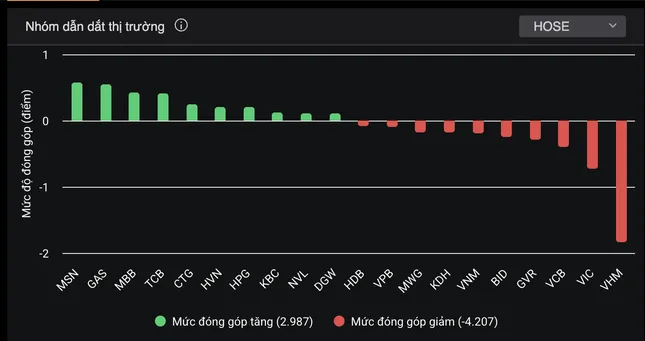

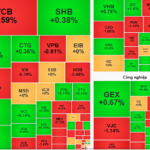

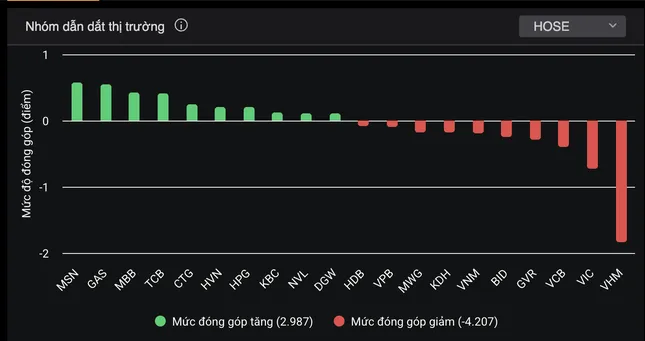

The market was highly polarized, with most large-cap stocks witnessing only slight fluctuations, failing to provide the necessary impetus. Among the VN30 group, MSN witnessed the sharpest surge of 2.4%, reaching 72,000 VND per share. This stock has exhibited a notable recovery in the past two months, with its market price surging by 43%. MBB and GAS trailed closely with gains of over 1%, whereas SHB, CTG, MCB, HPG, and TCB inched up marginally by approximately 0.5%.

VIC and VHM, the second and third largest capitalization stocks on the HoSE, faced challenges near previous highs.

On the downside, VHM lost more than 2.4%, while other large-cap stocks like VCB, TPB, HDB, VIB, PLX, VNM, and MWG witnessed declines of less than 1%. VIC and VHM, the second and third largest capitalization stocks on the HoSE, encountered resistance near previous peak levels. VHM remained in negative territory for most of the trading session.

Meanwhile, small-cap stocks like LGL, LDG, and SVD hit the daily limit-up. As the market lacked consensus from large-cap stocks, funds rotated in search of opportunities.

The market witnessed a stark division, with numerous sectors drowning in red. Nearly 20 securities stocks declined, while a handful of oil and gas stocks, including GAS, PET, PVS, and BSR, rebounded with gains of around 1%.

Foreign investors resumed net selling today, offloading a total of 324 billion VND. FPT witnessed the heaviest selling, with a net sell value of nearly 168 billion VND. HPG and STB also faced substantial net selling, exceeding 100 billion VND per stock.

At the close, the VN-Index slipped by over one point to 1,365 points. The HNX-Index edged up 0.04 points (0.02%) to 227.7 points, while the UPCoM-Index climbed 0.12 points (0.12%) to 100.06 points. Liquidity continued to wane, with the trading value on the HoSE dipping below 19 trillion VND.

“Vietcap: Market Average Liquidity to Surpass $1 Billion From 2026 Onwards, Say Brokerages, Foreseeing a New Growth Cycle”

The anticipated implementation of the KRX trading system is expected to reduce settlement cycles, thereby enhancing market liquidity and boosting trading activity.

The Ultimate Guide to Stock Market Investing: Navigating the Tumultuous Tides

Today’s trading session (June 25th) saw VHM continue its upward trajectory, albeit at a slower pace compared to the previous session. While the momentum behind the rally showed signs of easing, profit-taking pressure at the peak levels remained relatively subdued. The VN-Index once again failed to breach the 1,370-point mark.

Tomorrow’s Stock Market Outlook: Profit-Taking Opportunities in Adjusted Stocks

The Vietnamese stock market on June 25th witnessed a tug-of-war between buyers and sellers. The VN-Index barely budged, closing almost flat at 1,366 points, a slight dip of 0.02 points from the previous session.

Stock Market Outlook for June 23-27, 2025: Brace for More Volatility

The VN-Index surged back and successfully conquered the 1,370-point mark in the week’s final trading session. This rebound was primarily driven by large-cap stocks, as market liquidity remained weak and foreign investors continued their net-selling trend. With cautious sentiment prevailing, the index is expected to experience volatility in the 1,360-1,380 range in the upcoming sessions.