On June 27, 2025, Ocean Group Joint Stock Company (Ocean Group, Stock Code: OGC) held its 2025 Annual General Meeting of Shareholders.

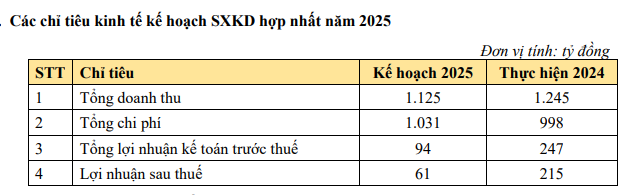

Accordingly, the Group’s consolidated revenue in 2024 reached VND 1,245 billion, equivalent to exceeding 13% of the plan, marking the continuous growth of revenue for 3 years since the implementation of the comprehensive restructuring strategy in 2022.

Profit after tax reached VND 215 billion, a growth of over 430% compared to the plan approved by the AGM. As of December 31, 2024, OGC’s total assets exceeded VND 4,500 billion. The ratios of solvency, debt, and business efficiency – ROA and ROE improved positively.

“The year 2024 affirms the effectiveness of Ocean Group’s strategic restructuring process in the 2022-2024 period,” said Mr. Le Vu Hai, CEO of Ocean Group. “The achievements in the past time will create a premise for the stable development of the Group in the coming years.”

Mr. Hai added that in 2024, the production and business activities of hotels and food at OGC’s member units were expanded in terms of products and market scale; key real estate projects are in the process of untangling the final knots to prepare for the re-commencement phase.

In 2024, the OGC Management Board announced that the Group also recorded a partial profit from the successful restructuring of one of the bad debts left over from the old phase.

OGC’s Chairwoman at the 2025 Annual General Meeting of Shareholders.

2025 – a pivotal year for OGC to implement a comprehensive restructuring plan

Also at the General Meeting, Ms. Le Thi Viet Nga – Chairwoman of the Board of Directors of Ocean Group shared with shareholders the Group’s orientation in the medium and long term. Accordingly, in 2025, Ocean Group defines it will be a pivotal year for the Group to implement the next phase in the comprehensive restructuring plan.

“In the past 3 years, Ocean Group has rearranged its structure to focus and optimize resources in each business field with 3 main spearheads,” Ms. Nga said. “Specifically, one, the real estate development sector is carried out by the parent company OGC, which are activities that require a lot of time to implement but bring in large profits. Two, the hotel and service sector is carried out by the subsidiary OCH. Three, the production and business of food is carried out by One Capital Consumer Company (OCC) – a subsidiary of OCH established in January 2025.”

“Each of these business fields will be developed independently but will support each other. While regular production and business activities will create stable cash flow and profits for the Group, real estate development with large revenue and profits will contribute to expanding the Group’s asset scale and increasing profits for shareholders in the future,” she added.

Currently, OGC owns land funds in prime locations that have not been exploited, such as: Project 25 Tran Khanh Du, Hoan Kiem, Hanoi with the function of commercial center, office, hotel apartment, area of 5,450m2; Lega Fashion House office and commercial service project in District 10, Ho Chi Minh City, area of 5,620m2; Hotel project at No. 10 Tran Vu, Ba Dinh, Hanoi… OGC is still carrying out procedures to continue implementing these projects. In addition, OGC has been and is approaching, researching and seeking new projects

Besides real estate – a long-term field that requires a lot of preparation time, the two remaining pillars of Ocean Group’s business, including hotel services and food production and business, have shown positive signals, through its member company OCH.

In the hotel – service sector, 5-star hotel brands such as Sunrise Nha Trang, StarCity Nha Trang, and recently, Dusit Cung dien Tu Hoa Hanoi Hotel have recorded stable recovery in revenue and customer segments.

In the food sector, two long-established brands, Kem Trang Tien and Banh Givral, have made remarkable developments in both brand identity and business efficiency.

The AGM approved the 2025 revenue plan of VND 1,125 billion and pre-tax profit of VND 94 billion.

Discussion:

Shareholder: Profit in 2024 was VND 215 billion but the plan for 2025 is only VND 61 billion. Is this plan too cautious?

OGC representative answered: The reason why the company’s management board came up with a rather modest and cautious number is because the world economy and the Vietnamese economy are facing a lot of fluctuations and risks.

Therefore, the Board of Directors and the Management Board of OGC made a cautious plan based on the company’s core business in recent years.

However, we affirm that OGC has the potential and activities that can bring higher profits than the plan for 2025.

For example, currently, OGC is investing in BOT Hanoi – Bac Giang Joint Stock Company. This investment was made more than 10 years ago, and BOT Hanoi – Bac Giang Joint Stock Company is currently doing very well in business. In 2024, its post-tax profit reached VND 170 billion. The capital is nearly VND 500 billion, of which OGC’s contributed capital is over VND 100 billion. The company’s current EPS is about VND 3,300/share.

We are looking for partners to transfer this investment. We believe that this transfer will bring good profits to shareholders.

Another part that will also contribute to the profit outside the 2025 business plan is the activities related to the restructuring and restructuring of bad debts. We have been doing this for more than 3 years, and the results of 2024 have recorded initial successes.

These are the two activities that we believe will bring higher profits than the plan for 2025.

Shareholder: What are OGC’s medium and long-term plans for the future?

OGC representative answered: In the past 3 years, OGC has restructured and rearranged the Group’s activities with a clear orientation and divided tasks between the parent company and its subsidiaries.

Accordingly, the parent company will focus on the development of real estate projects. As for OCH, it will focus on the field of hotel and accommodation project management. OCC, a newly established company since January 2025, will focus on food business.

Mr. Nguyen Duc Minh (Member of the Board of Directors of OGC) answered: Through OCH, OGC indirectly owns two 5-star hotels in Nha Trang – StarCity Nha Trang and Sunrise Nha Trang.

At StarCity Nha Trang, let me share some impressive figures: the room occupancy rate reached 111% compared to the plan, and the gross profit reached 172% compared to the plan set for 2024. Similarly, Sunrise Nha Trang also exceeded the room occupancy rate by 7%, and gross profit reached 161% compared to the plan. These are two projects currently operating under OCH, which is a subsidiary of OGC. This is a positive signal for OGC’s investment in the hotel and tourism sector.

In addition, OGC is focusing on developing and M&A some Grade A office buildings in Hanoi and Ho Chi Minh City through OCH. In addition, for the hotel real estate development sector, OGC will focus on M&A and development of other 5-star hotels.

In the field of resort real estate, we are planning to build a project next to Six Senses Ninh Van Bay.

In Hanoi, we are also planning to develop a high-end real estate project on Truc Bach Lake in 2025.

Shareholder: Please share more about the progress of legal untangling and key projects?

OGC representative answered: In the past time, the Government has had measures to remove difficulties, especially in the Ho Chi Minh City market. At the same time, the Government has also had directions to cut administrative procedures. However, all of these things are still in progress and have not been completed.

We assess that the real estate market in Hanoi and the northern provinces adjacent to Hanoi has been warming up. This is quite positive information for OGC.

Currently, OGC owns potential land funds in two big cities, Hanoi and Ho Chi Minh City. In Hanoi, the company has the StarCity Westlake project, No. 10 Tran Vu and the project at 25 Tran Khanh Du. These are two key projects expected to build a complex of commercial centers and accommodation services. In Ho Chi Minh City, OGC has the Lega Fashion House project and the Gia Dinh Plaza project.

We assess that these are projects with very favorable locations in the two big cities. OGC will focus on removing legal obstacles, actively cooperating with competent authorities as well as partners to complete the procedures and implement the projects.

It is expected that the project at Tran Vu will be the first project to be implemented in the near future. The remaining projects will be implemented in the following years.

“Mobile World of Nguyen Duc Tai to Spend $63 Million on Dividends, Shareholders to Cash Out After a Fortnight”

As of May 2025, MWG has recorded an impressive 13% year-over-year growth, with a revenue of VND 61,229 billion in the first five months of the year.