Hanoi Transformer and Electrical Equipment Joint Stock Company (BTH) Holds 2025 Annual General Meeting of Shareholders

Hanoi Transformer and Electrical Equipment Joint Stock Company (BTH) held its 2025 Annual General Meeting of Shareholders, approving a revenue plan of VND 194 billion and a net profit of nearly VND 101 billion, decreasing by 89% and 86%, respectively, compared to 2024.

In the first quarter of 2025, the company achieved remarkable growth with a revenue of over VND 12 billion, a 354-fold increase compared to the same period last year (only VND 34 million); and a net profit of nearly VND 11 billion, compared to a loss of over VND 1 billion in the previous year.

According to BTH, the significant increase in revenue and profit is attributed to the timing of revenue recognition. While the beginning of 2024 did not include any revenue, the first quarter of this year accounted for most of the sales from the sale of 326 out of 334 apartments and 8 out of 25 adjacent houses. Additionally, the substantial cash flow from the real estate transactions contributed to a notable increase in financial revenue.

250% Cash Dividend Results in Over VND 150 Billion Payout to Chairman’s Sons

Notably, BTH has approved a plan to pay an additional cash dividend of 250%, equivalent to VND 25,000 per share. The company expects to spend up to VND 625 billion, which accounts for 94% of retained earnings after establishing funds. The remaining profit stands at only VND 40.5 billion. The payment is scheduled for November 2025.

It is worth mentioning that this dividend is the remaining amount from 2024, following a 10% advance payment completed in October 2024. For the year 2024, BTH distributed dividends at a rate of 260%, totaling nearly VND 650 billion.

As a result, BTH’s parent company, Hoang Thanh Infrastructure Investment and Development Joint Stock Company (Hoang Thanh Group), with a 65% stake, will be the largest beneficiary of this substantial dividend, expecting to receive more than VND 406 billion.

Major individual shareholders include Mr. Hoang Ngoc Kien, son of Chairwoman Nguyen Thi Bich Ngoc, holding 19.39% of the capital, equivalent to receiving VND 120 billion. Her other son, Mr. Hoang Ngoc Quan, is expected to receive VND 32.5 billion.

Shareholders Express Concern Over High Dividend Payout; BTH Responds

Some shareholders raised concerns about the impact of distributing most of the 2024 profits as dividends on the company’s 2025 financial plan. In response, BTH representatives assured that the company’s 2024 performance witnessed a significant surge, and there are still numerous unaccounted products, including apartments and adjacent houses. These will serve as a financial guarantee for the company’s subsequent operations.

In 2024, BTH achieved impressive results with a revenue of nearly VND 1,815 billion, surpassing the plan by 33% and marking the highest in its history. The net profit reached over VND 708 billion, a remarkable increase of more than 6,700 times compared to 2023 and exceeding the plan by 78%.

The extraordinary profit was primarily driven by the real estate business, especially the Hoang Thanh Pearl project – a complex of residential, nursery, and green space in Cau Dien Ward, Nam Tu Liem District, Hanoi.

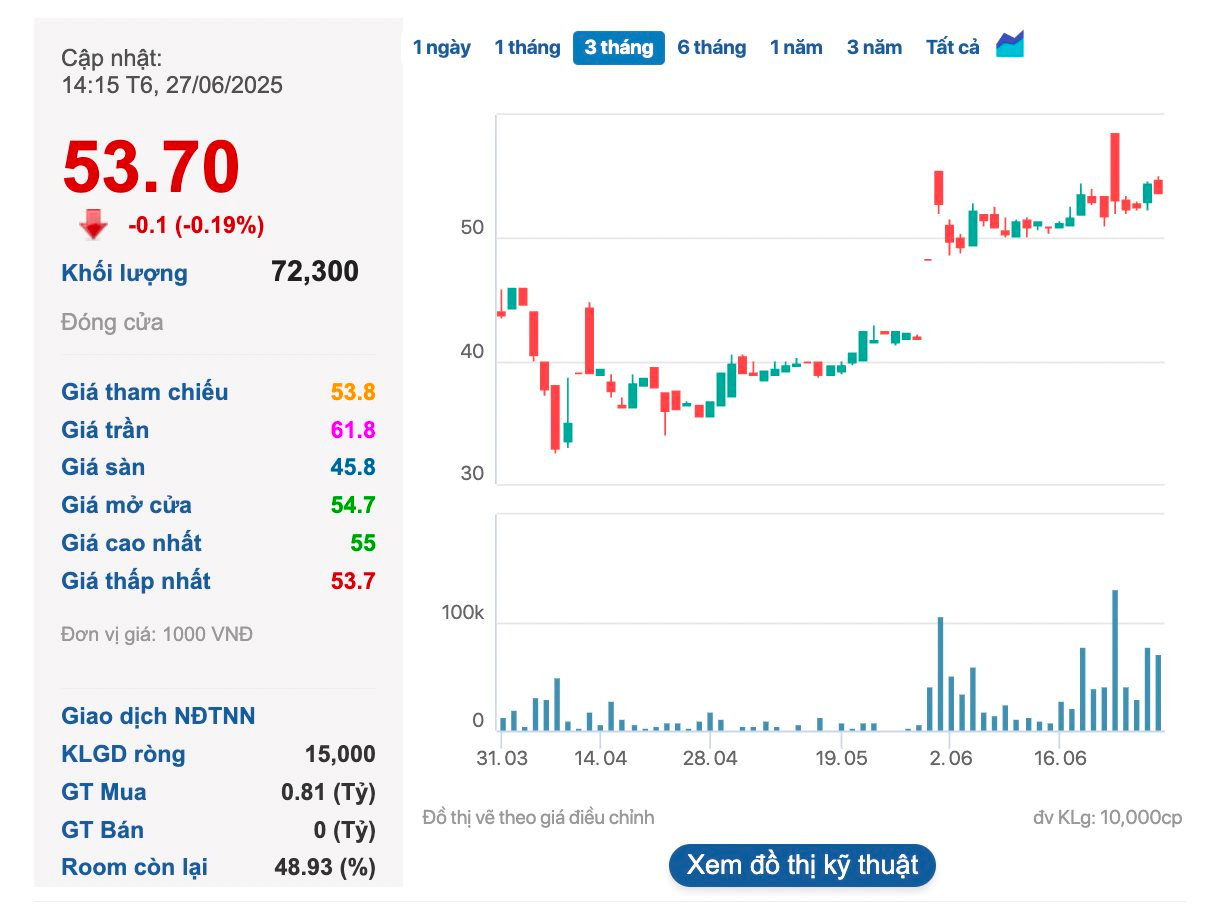

On the stock exchange, BTH’s share price surged following the dividend news. Currently, BTH is trading at VND 53,700 per share, reflecting a 30% increase over the past month.

BHT, formerly known as the Transformer Manufacturing Plant under the Vietnam Electrical Equipment Corporation, was established in 1963 at 10 Tran Nguyen Han, Hanoi. It was Vietnam’s first large-scale factory tasked with designing and manufacturing power transformers to serve the national economy.

In September 2005, Hanoi Transformer and Electrical Equipment Joint Stock Company was established by merging Hanoi Electrical Equipment Joint Stock Company and Hanoi Transformer Joint Stock Company under Decision No. 105/2005 of the General Technical Equipment Corporation (Gelex, stock code: GEX).

In August 2007, Gelex held a 45% stake in BTH. By November 2014, Gelex had completely divested its entire 49.49% capital in BTH, and Hoang Thanh Infrastructure Investment and Development Joint Stock Company (Hoang Thanh Group) acquired all these shares.

“Chairman of Phat Dat: With the Merger of Ba Ria – Vung Tau and Binh Duong into Ho Chi Minh City, the Company’s Total Land Bank Stands at Nearly 1,000 Hectares.”

With a land bank of nearly 1,000 hectares, Phat Dat Corporation is poised to focus on developing high-rise projects in Binh Duong. As for Ba Ria-Vung Tau, the province offers flexibility in developing mid-range or high-end segments depending on the location. For instance, in Ho Tram, there’s potential for condotels, villas, and more.

The HBS Conference Heats Up: Calls for a Forensic Audit and Investment in Crypto Firm

The annual General Meeting of HBS Securities Joint Stock Company (HNX: HBS) took place on the afternoon of June 26 in Hanoi, with a key focus on addressing concerns regarding financial statement discrepancies for the period of January 1, 2022, to December 31, 2024. The meeting approved a proposal for a re-audit of the financial statements due to significant discrepancies in the data. In addition to addressing these financial matters, the gathering also witnessed the introduction of new key personnel to the team. One notable decision from the meeting was the approval of the company’s investment in a cryptocurrency firm, marking a strategic move towards embracing the potential of decentralized finance.

“Untapped Prime Property: Ocean Group’s Visionary Project in Hanoi”

With prime projects located in Hanoi and Ho Chi Minh City, the leadership at OGC is focused on overcoming legal hurdles. They are actively collaborating with authorities and partners to streamline procedures and bring these projects to fruition.