Becamex IDC, one of the leading industrial development corporations in Vietnam, has recently announced its plans to issue private placement bonds in 2025. According to the resolution, the company aims to issue a maximum of 25,000 bonds, each with a face value of VND 100 million, raising up to VND 2,500 billion.

The bonds will be issued in the form of book-entry registration, with a maximum of 10 batches. Each batch will have a maturity of 3-5 years. The issuance is scheduled to take place from June to September 2025, with 6-7 batches, and from October to November 2025, with 2-3 batches.

These non-convertible, non-warrant-attached bonds will be secured by assets and issued in the domestic market. They are designed to strengthen Becamex IDC’s financial capacity and support its strategic initiatives.

Illustrative image

In another development, Becamex IDC has approved the plan to issue bonus shares as dividends for the year 2024, as agreed upon at the 2025 Annual General Meeting of Shareholders. The company intends to issue 113.85 million shares, equivalent to 11% of the total circulating shares. The ratio for implementing the rights is 100:11, meaning that for every 100 shares owned, shareholders will receive 11 new shares.

The capital for this issuance will come from undistributed post-tax profits on the audited financial statements for 2024. The issuance is expected to be completed in the second and third quarters of 2025.

Regarding its financial performance in the first quarter of 2025, Becamex IDC recorded impressive results with consolidated revenue of nearly VND 1,843 billion, more than doubling the figure from the same period last year. Despite a significant increase in cost of goods sold, gross profit still managed to grow by 23% to VND 704 billion.

The real estate segment contributed significantly to the company’s revenue, bringing in nearly VND 1,427 billion, 3.2 times higher than the previous year. Financial income also saw a remarkable surge, reaching VND 102 billion, a 38-fold increase, thanks to profits from cooperation contracts and dividends. Additionally, the company’s share of profits from joint ventures and associates amounted to VND 271 billion, 4.5 times higher than the same period last year.

Despite higher expenses, net profit for the period remained robust at over VND 358 billion, triple the figure from the first quarter of 2024.

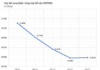

Looking ahead, Becamex IDC has set ambitious targets for 2025, aiming for consolidated revenue of VND 9,500 billion, a 29% increase from 2024, and a projected net profit of VND 2,470 billion, a 3% improvement from the previous year’s performance.