Vietnam Stock Market Review: VN-Index Surges Towards 1,370 Points as Blue-chips Take the Lead

Following a positive trading week, breaking through the short-term peak, the market continued its strong performance during the week of June 23-27. The VN-Index climbed towards the 1,370-point mark, supported by a rotation of large-cap stocks. While trading volume decreased and remained low, indicating investors’ cautious sentiment at these new index levels. By the week’s end, the VN-Index had gained 22.09 points (+1.64%) compared to the previous week, closing at 1,371.44 points.

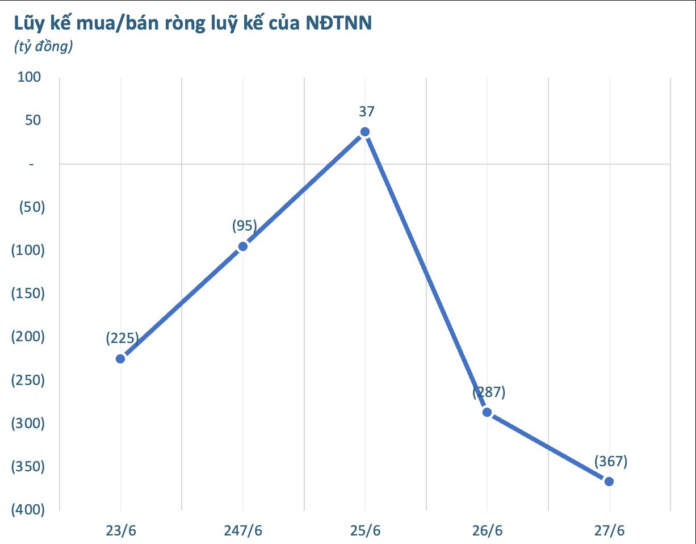

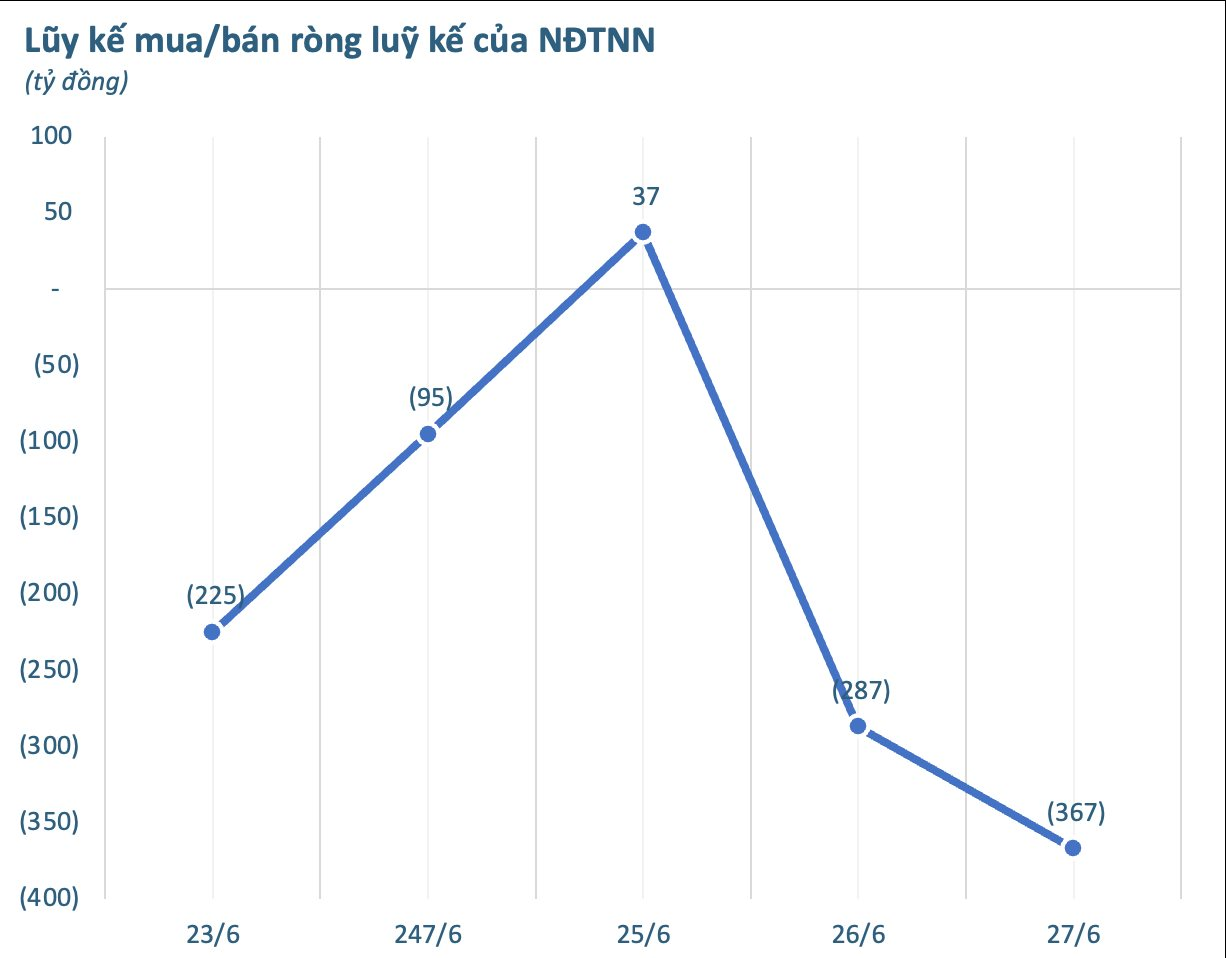

In this context, foreign investors’ activities were relatively mixed, with net buying at the beginning of the week but turning to net selling later on. Cumulatively, foreign investors sold a net amount of VND 367 billion on all markets during the five trading sessions.

Breaking down the figures by exchange, foreign investors sold a net amount of VND 39 billion on the HoSE, VND 269 billion on the HNX, and VND 59 billion on the UPCoM.

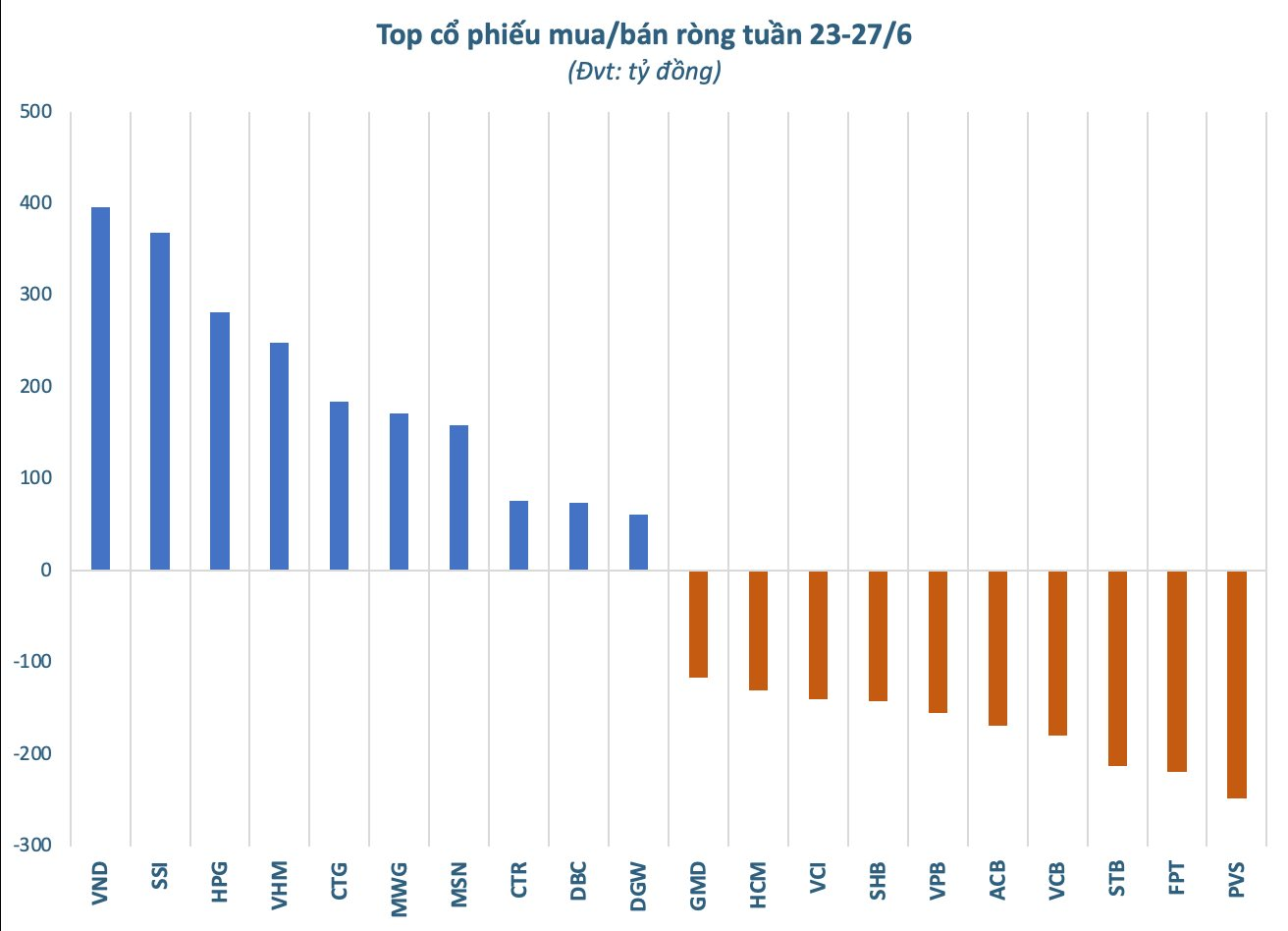

Focusing on individual stocks, PVS witnessed the highest net selling value, approximating VND 249 billion. FPT and STB also experienced net selling of VND 219 billion and VND 212 billion, respectively. VCB was another notable stock with net selling of nearly VND 179 billion. The list of stocks facing net selling by foreign investors during the week included ACB, VPB, SHB, VCI, HCM, GMD, and others, all recording net selling values exceeding VND 100 billion.

On the opposite side, VND stock surprisingly attracted the highest net buying from foreign investors, amounting to VND 396 billion. SSI and HPG also witnessed strong foreign inflows, with net buying of VND 368 billion and VND 281.5 billion, respectively, during the week. Other stocks that saw net buying included VHM, CTG, MWG, MSN, CTR, and DBC.