The PVI Infrastructure Investment Fund (PIF) reported on the day it became a major shareholder of Saigon Telecommunications Technology Joint Stock Company (code SGT-HOSE).

Accordingly, the PVI Infrastructure Investment Fund (PIF), managed by PVI Fund Management JSC, has just reported that it purchased 10 million new SGT shares on June 20, equivalent to 6.76% of capital, becoming a major shareholder in SGT, and this fund is not organizationally or personally related to Saigontel.

According to data on HOSE on June 20, the market recorded exactly 10 million SGT matches with a total value of VND 170 billion, corresponding to VND 17,000/share, 3% lower than the closing price of VND 17,600/share in that session and also the session with the highest liquidity of SGT in the past year.

According to the 2024 Annual Report, Saigontel recorded four major shareholders owning a total of 50.21% of the charter capital.

Previously, the SGT Board of Directors approved the suspension of the plan to sell 310 treasury shares at a price not lower than VND 10,000/share, which was approved on May 14. SGT said that this decision was made based on the actual situation and to ensure compliance with the plan to deploy activities related to the Company’s capital structure. The sale of treasury shares will be considered for implementation at a more appropriate time to ensure compliance with current regulations and the Company’s plan.

In the first quarter of 2025, SGT recorded a 690% increase in revenue to over VND 866 billion; gross profit increased by 805% to nearly VND 497 billion; profit from business activities increased by 1,815% to over VND 445.8 billion; and profit after tax surged by 6,577% to over VND 351 billion (in the same period last year, the profit was VND 5.26 billion). The reason is that the company has completed the legal procedures and started the implementation of the Dai Dong Hoan Son Project – Phase 2 of the Bac Ninh Branch in Bac Ninh province, which has brought about good business results.

In 2025, SGT shareholders approved a plan to increase total revenue by 62% from VND 1,844 billion to VND 3,000 billion and increase pre-tax profit by 82% from VND 219.6 billion to VND 400 billion.

In addition, SGT shareholders approved the cancellation of the plan to offer private placement shares, which was approved at the 2024 Annual General Meeting of Shareholders, due to unfavorable market conditions in 2024. The Company is considering more efficient and suitable capital-raising plans for the current situation.

However, SGT shareholders approved the plan to offer shares to existing shareholders at a ratio of 1:1. Accordingly, SGT offered 148,003,208 shares at a price of VND 10,000/share, expecting to raise VND 1,480 billion, to be implemented in 2025.

At the close of the trading session on June 27, SGT shares closed at the reference price of VND 17,500/share.

Unveiling Two Major Developments: Chairman of Phát Đạt (PDR) Announces Prime Land Acquisitions in Ho Chi Minh City and Binh Duong, Totalling Dozens of Hectares

“With an impressive track record of development projects, Phát Đạt (PDR) has yet again demonstrated its prowess in the industry. The company has recently secured approval for two new high-rise projects, spanning over 45 hectares in Binh Duong. In addition, PDR has acquired 23.9 hectares of land through a build-transfer project in Ho Chi Minh City. These endeavors showcase PDR’s unwavering commitment to expansion and their expertise in navigating the real estate landscape.”

Industrial Real Estate Stocks: Capturing the Interest of Savvy Investors

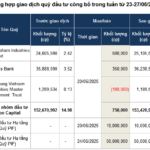

The industrial real estate sector was in the spotlight last week (June 23-27, 2025), attracting significant investment fund inflows, as per the latest transaction disclosures.