According to the unit’s analysis, the global retail industry is making a clear yet uneven recovery, with traditional models facing restructuring demands while flexible, experiential, and tech-integrated retail formats are surging forward. This comes after years of pandemic influence, supply chain disruptions, and macroeconomic instability.

Amid this dynamic landscape, Vietnam stands out as a vibrant market with evident recovery signals. Contrary to concerns about e-commerce entirely replacing physical retail, global consumers are returning to stores as a shopping, experiential, and interactive destination.

Savills’ Impacts 2025 report highlights that retailers worldwide are rebounding better than expected. This is evident in the US market, where mall footfall in 2024 increased by 1.5% year-on-year and 7.3% compared to the pre-pandemic period in 2019. Nearly 80% of total consumer spending in the US still occurs in traditional stores, a significant proportion in the digital age.

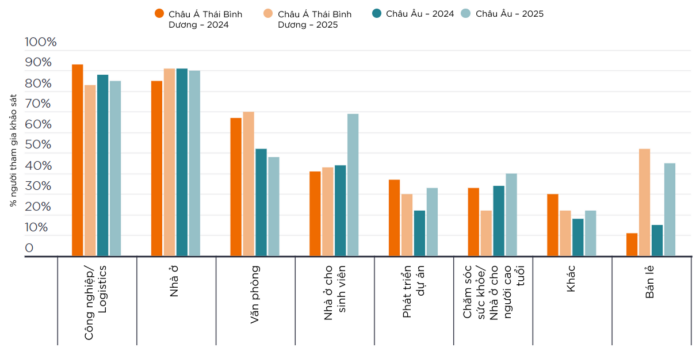

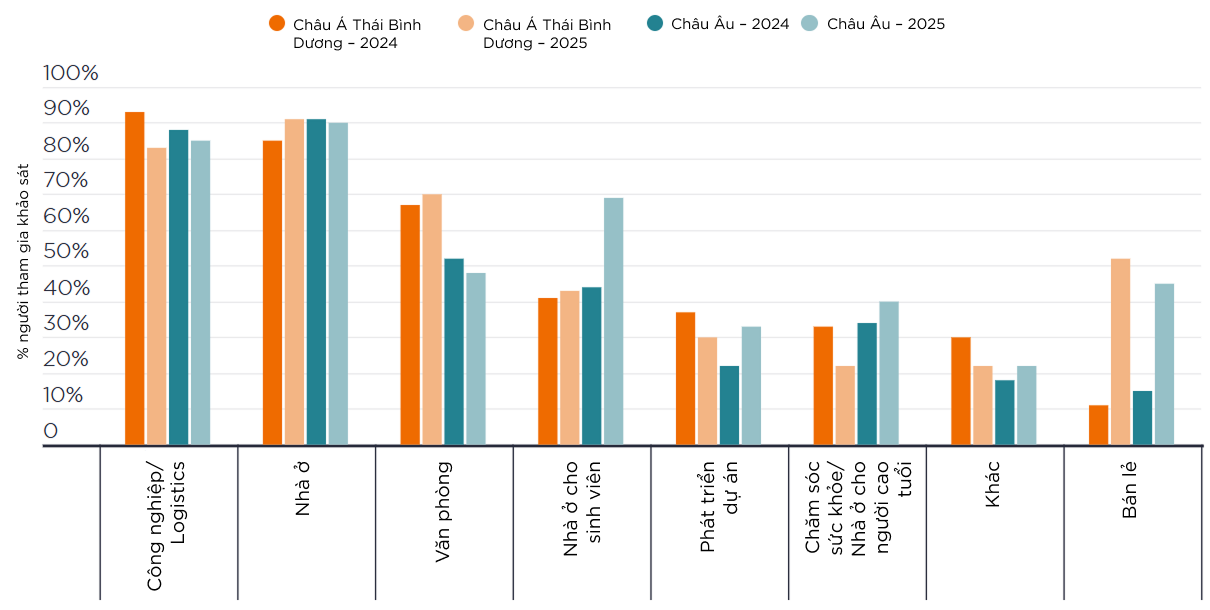

Preferred investment segments in Europe and Asia-Pacific, 2024–2025. Source: INREV/ANREV Investment Intentions Survey 2025

Ho Chi Minh City is leading this process in Vietnam. In the first quarter of 2025, the city’s total retail supply reached 1.6 million square meters, a 6% increase year-on-year, thanks to new projects like Centre Mall Vo Van Kiet in District 6. The impressive occupancy rate of 94% reflects the genuine demand from both tenants and consumers. Despite slight adjustments due to the entry of new projects with lower prices, the average ground-floor rent remained at VND 1.4 million per square meter per month, a 9% year-on-year increase.

Modern retail models continue to demonstrate their superiority. Malls like Thiso Mall Sala, Vincom Mega Mall Grand Park, and Parc Mall recorded occupancy rates above 70% immediately after opening. In contrast, street retail is increasingly overshadowed due to a lack of investment in experience, amenities, and professional operations—factors that are increasingly prioritized by consumers.

In Hanoi, ground-floor rents in the same period showed a strong year-on-year increase of 6%, with a remarkable 37% rise in the central area. The occupancy rate reached 86%, while new contracts indicated a shift away from F&B, which used to dominate, towards fashion, cosmetics, and convenience stores.

According to Savills, while capital used to be the “first wave” that propelled retail, it is now the retail brands themselves that are reshaping the market. The expansion demands of fashion, cosmetics, furniture, and F&B brands are leading the way, attracting investors back to the market. However, many investors remain cautious due to previous investments in underperforming retail assets.

Ms. Tran Pham Phuong Quyen, Senior Manager of Savills Retail Leasing, shared: “With many international brands considering the Southeast Asian market, Vietnam has the advantage of a young, dynamic population that embraces shopping trends and desires more experiences. Additionally, labor, construction, and warehouse costs are still lower than in many regional countries, enabling brands to optimize costs and achieve higher profit potential.”

A significant shift in investment thinking is occurring in the industry: retail is no longer solely rental real estate. As consumers demand more from their experiences and brands, retail real estate is now viewed as an operational asset—requiring a tight integration of operations, technology, tenant brands, and a deep understanding of customer behavior.

According to Ms. Quyen, the retail leasing market in the coming years will undergo a profound shift towards advisory services: “It’s not just about connecting leasing needs with available spaces anymore. Both tenants and landlords are turning to professional advisory firms with data, analytics, and technology tools to identify the most suitable spaces for each phase of their business.”

According to Savills experts, the retail industry has officially returned to the growth track in 2025, but not in the traditional way. In a market increasingly competitive in experience and operations, Vietnam, especially Ho Chi Minh City, has the advantage of a young population, dynamic consumer behavior, and reasonable operating costs, making it a strategic destination for international brands in the coming period.

“Investors need to ensure that their leaseable areas meet standards, build competent leasing and operating teams, and devise a well-thought-out communication plan to turn their projects into genuine regional destinations. Pursuing retail real estate is a long-term journey.”

“VN-Index to Surpass 1,500 Points This Year: VNDirect Names 3 Stock Groups to Attract Investments”

“VNDirect anticipates that the downward trend of the DXY index, coupled with the potential upgrade of the Vietnamese market by FTSE in September, will serve as positive catalysts for the stock market in 2025. This upgrade has the potential to attract increased foreign investment and boost the country’s economic outlook, making it an opportune time for investors to capitalize on the market’s growth potential.”

The Ultimate Audio Experience: Fender Audio, Tivoli, Linklike, and Tribit Arrive in Vietnam

“PHDT is proud to announce that it is now an official distributor of audio equipment from four renowned brands: Fender Audio, Tivoli, Linklike, and Tribit. With this expansion into the Vietnamese market, PHDT aims to bring high-quality audio products to music enthusiasts across the nation, offering an unparalleled listening experience.”

The VN-Index Surges: Will Investors Keep the Faith?

The VN-Index surges past the 1,300-point milestone, marking a robust week of recovery following the US tariff shock. However, the week’s end saw a corrective session, leaving investors questioning whether to continue investing or temporarily stay on the sidelines, securing their profits.