Despite predictions of a market correction and strong volatility at its highest level in over three years, the VN-Index continued its positive trajectory this week.

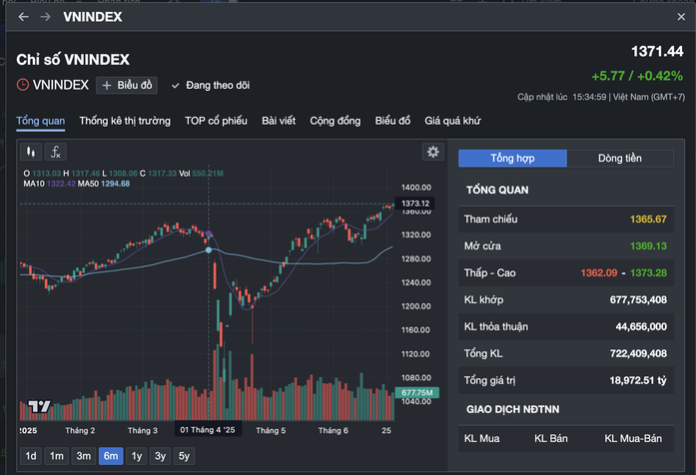

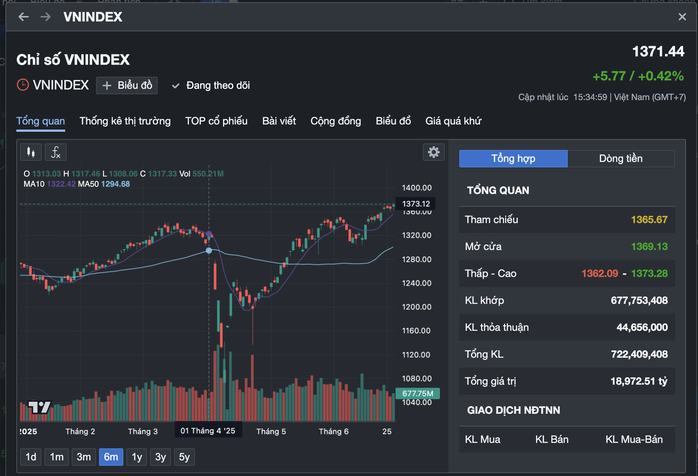

Closing the trading week of June 23-27, the VN-Index stood at 1,371.44 points, marking a new yearly high. Stocks witnessed positive price movements across various sectors, including retail, industrial parks, seafood, construction, technology, and real estate. In contrast, the oil and gas sector faced strong corrective pressure as oil prices plummeted following a ceasefire agreement in the Middle East.

In an interview with Báo Người Lao Động, investors expressed their surprise at the market’s performance this week, noting that despite deep intraday dips, the market quickly recovered. Some investors chose to take profits and await a market pullback to re-enter, but the market continued its upward trend.

VN-Index reaches a new yearly high

Mr. Nguyễn Thái Học, an analyst at Pinetree Securities, commented that the VN-Index’s two consecutive weeks of gains, breaking past the previous peak in late March, is a positive signal for the market.

According to Mr. Học, the main driver of the market’s improvement this week was speculation surrounding Vietnam’s potential agreement on tax reciprocity with the US, with tax rates lower than initially feared, estimated at around 15%, and possibly as low as 10% for some products.

However, he also noted that the market has not yet displayed a clear consensus in terms of money flow. Sector rotation has been prominent, with retail, technology, and telecommunications stocks leading the index this week.

The stock market is expected to be influenced by multiple factors next week

Mr. Học predicted that next week, the market could be significantly impacted by a confluence of factors, including the quarter-end NAV (net asset value) calculation at the start of the week and early indications of second-quarter financial results from major companies. With the market approaching the July 8 deadline for the postponement of tax reciprocity between Vietnam and the US, investor sentiment is likely to be cautious.

Meanwhile, analysts from SHS Securities suggested that the market currently holds optimistic expectations regarding the post-trade tax reciprocity negotiation levels and second-quarter financial results. This could present a short-term opportunity for various stock sectors to recover to pre-sell-off levels.

However, SHS advised that new purchases at this juncture should be based on a thorough analysis of fundamental factors and company valuations, with a focus on growth prospects in the second half of the year. The preferred strategy remains holding and awaiting a re-evaluation of stock fundamentals.

CSI Securities maintained its optimistic outlook on the market, forecasting that the VN-Index could target the resistance zone of 1,398 – 1,418 points in next week’s trading sessions. CSI recommended that investors maintain their current positions and exercise patience until the index approaches the aforementioned resistance zone before considering profit-taking.

Mr. Học anticipated that the latter half of next week would be particularly noteworthy, as information related to semi-annual financial results and trade negotiation progress is likely to be disclosed. However, he also warned of potential risks if the negotiation outcomes fall short of expectations. “Investors should remain cautious, especially when making new investment decisions,” he emphasized.

The Flow of Funds: What Does the Hesitant Money Trail Tell Us?

The VN-Index witnessed its second consecutive week of robust gains, surging past the 1370-point mark. The bulk of these gains were concentrated in the first two trading sessions, with the latter three sessions experiencing minimal fluctuations. Notably, excluding the high-volume trading session on June 24th, the average weekly trading volume was relatively low.

The First Wood Enterprise Reports Record Low Six-Month Profit, Slim Margins Persist

In the first half of 2025, GTA Wood Processing Joint Stock Company (HOSE: GTA) recorded VND 120 billion in revenue, but high expenses ate into profits, resulting in a meager pre-tax profit of just VND 3.2 billion – the lowest half-yearly figure in its history. GTA’s stock has plummeted, losing 45% of its value in the last two years, and its liquidity has all but frozen.

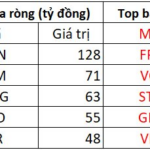

“Foreign Investors Sell-Off: Over $6.3 Million Net Sell in Blue-Chip Stock on June 27th Session”

Foreign investors continued their selling spree, offloading stocks worth over 80 billion VND in today’s trading session across the market.