Real Estate Businesses Gear Up to Ride the Wave of Provincial Mergers

As of July 1st, Binh Duong and Ba Ria-Vung Tau officially become part of Ho Chi Minh City, marking a pivotal moment in the comprehensive restructuring of urban spaces, infrastructure, and investment flows.

Seizing the opportunity presented by this merger, real estate developers with projects in these two markets have been making notable moves. Binh Duong, in particular, which boasts one of the most vibrant apartment markets in Southern Vietnam, is witnessing a flurry of activity as developers rush to capitalize on the anticipated surge in demand.

On June 28th, Bcons Group inaugurated the construction of Bcons Binh An Dong Tay, located on Thong Nhat Street in Binh An ward, Di An (now part of Ho Chi Minh City), offering over 1,800 affordable housing units. Soon after, the group will introduce the final products of the Green Diamond tower within the Bcons City project, also conveniently situated on Thong Nhat Street.

Likewise, in late July 2025, the TT AVIO project, a joint venture between Japanese companies Cosmos Initia, TT Capital, and Koterasu Group, will officially launch a new tower with 1,000 apartments, starting at VND 33.6 million per square meter.

Phu Dong Group is also seizing this moment to introduce their Phu Dong SkyOne project to the market. This development, featuring nearly 800 reasonably priced apartments, will kick off in July 2025.

The positive sentiment following the provincial mergers has infused a vibrant atmosphere into projects on the outskirts of Ho Chi Minh City. Illustrative image.

C-Holdings Group is gearing up to enter the market with their project, The Felix, in Thuan An City. Recently, the group’s chairman, Mr. Nguyen Quoc Cuong (Cường Đô la), garnered attention by hosting a live streaming session that secured over 500 bookings.

Another project in the pipeline is La Pura by Phat Dat, which is preparing to launch its next phase after successfully absorbing the first phase.

Not wanting to be left behind, Van Xuan Group is introducing its Happy One Central project, comprising nearly 1,300 apartments. The group anticipates riding the wave of the provincial mergers, expecting significant infrastructure and investment boons now that Binh Duong is part of Ho Chi Minh City.

The real estate scene in Ba Ria-Vung Tau is equally vibrant, with several enterprises continuously launching new projects or subsequent phases of existing ones. This region has witnessed a surge in real estate interest since the announcement of its merger with Ho Chi Minh City, with the most significant increases in Phu My (22%) and Xuyên Mộc (21%), followed by Ba Ria (16%) and Chau Duc (11%), according to Batdongsan.com.vn data.

Numerous developers have enthusiastically released their projects, infusing vigor into the Ba Ria-Vung Tau real estate market since the first quarter of 2025. Notable mentions include TDG Group’s The Maris Vung Tau project, which is about to launch its Polarism apartment subdivision. This 23-hectare project encompasses a resort, commercial, and entertainment complex.

In June 2025, Sun Group officially unveiled the Blanca Township in Vung Tau, spanning 96.6 hectares with a total investment of nearly VND 37 trillion.

Similarly, Goal Coast Holding is gearing up to enter the market with its Gold Coast Vung Tau project, a 1,300-hectare development featuring villas, shophouses, and terraced houses.

On June 21st, Five Star Group commenced the construction of two 5-star hotel and apartment complexes: Five Star Odyssey and Five Star Poseidon, with a combined investment of over VND 10 trillion.

Earlier, The Grand Ho Tram project in Xuyên Mộc, Ba Ria-Vung Tau, commenced the construction of a new 35-hectare subdivision. These moves by enterprises are seen as a swift response to the merger of Ba Ria-Vung Tau and Ho Chi Minh City.

Anticipating the Wave of Population Decentralization

Following the merger, the new Ho Chi Minh City will become the most populous city in Vietnam, with nearly 14 million residents, and the country’s largest economic hub.

Industry experts predict that post-merger, there will be a substantial shift in housing demand from Ho Chi Minh City to neighboring areas and industrial and port centers. The merger is expected to drive price increases and attract significant investment to the bordering regions, boosting the role of industrial real estate and residential properties. It will also redistribute the population, alleviate inner-city congestion, and foster the development of multi-center urban areas.

According to Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in Southern Vietnam, Ho Chi Minh City’s population density before the merger was 4,363 people per square kilometer, with 9.4 million inhabitants, straining its infrastructure and amenities. As a result, the trend of population decentralization to neighboring satellite areas has been robust from 2020 to 2025. This wave is expected to intensify as infrastructure development synchronizes across the merged regions.

Regarding anticipated real estate price increases in Binh Duong and Ba Ria-Vung Tau post-merger, Mr. Tran Khanh Quang, an experienced real estate investor, shared that Ho Chi Minh City’s apartment prices are already relatively high, while those in Binh Duong and Ba Ria-Vung Tau remain lower. These two areas will likely catch up with Ho Chi Minh City’s price levels and continue to rise. Specifically, real estate prices in Di An and Thuan An are expected to increase by 15-20% in the coming time. Phu My in Ba Ria-Vung Tau may see price hikes of 30-50%, while holiday properties in Ho Tram are projected to increase by 20-30%.

The wave of population decentralization is expected to gain further momentum post-merger as infrastructure development synchronizes across the merged regions. Source: Batdongsan.com.vn

Sharing this view, Ms. Giang Huynh, Director of Research at Savills Ho Chi Minh City, stated that the official merger of Binh Duong and Ba Ria-Vung Tau into Ho Chi Minh City would create a new, highly competitive economic and urban center, maximizing the natural, geographical, and infrastructural advantages of the three localities. The expanded land area will facilitate a population decentralization strategy and the development of satellite cities and modern new towns.

Given that real estate prices in Binh Duong and Ba Ria-Vung Tau are currently 20-30% lower than in Ho Chi Minh City, yet they share the same ecosystem, the price gap between these areas is expected to narrow after the merger. However, Savills representative emphasized that to sustain real estate value growth, a solid foundation of transportation, economic, and social infrastructure, along with efficient administrative procedures, is essential.

Experts also advise investors entering the market during this transitional phase to remain level-headed and avoid herd mentality. Areas with specific planning, ongoing development of key infrastructure, a comprehensive range of external utilities, and policies that attract residents are safer choices. These factors help mitigate financial risks, whether investing for actual residence or speculative purposes.

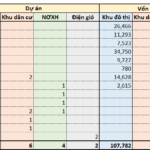

Investment Opportunities 21-27/06/2025: 24 Urban Areas Seek Investment of Nearly 107.8 Trillion VND

Week of June 21-27, 2025: A total of 14 provinces and cities sought investment for 36 projects, amounting to nearly VND 127 trillion. Among these, urban areas dominated with 24 projects and an investment of nearly VND 107.8 trillion, with the largest concentration in Ha Nam province.

Transforming Land Usage: A Hefty 300% Surge in Fees

The new land pricing policy has resulted in a significant increase in taxes for those wishing to change their land usage. With a 250-300% surge in taxes for converting agricultural land to residential use, many individuals are now facing financial challenges due to the substantial increase in land use charges. This new calculation method, which involves deducting the cost of agricultural land from the residential land price, has left many struggling to keep up with the rising costs.