The USD Index (DXY) – a measure of the greenback’s strength against a basket of six major currencies – closed the trading session on June 27 with a significant drop of 1.52 points, settling at 97.25.

The USD plummeted after reports surfaced that President Donald Trump is considering nominating a successor to Fed Chair Jerome Powell earlier than expected. This move has raised concerns about political interference in monetary policy and fueled expectations that the Fed may ease policy sooner to meet the White House’s desires.

With the political landscape in the US fraught with potential upheaval and the threat of rising inflation due to tariff policies, the US dollar’s status as a global safe-haven currency is weakening. International investors are approaching the greenback with caution, leading to a distinct downward pressure on its value.

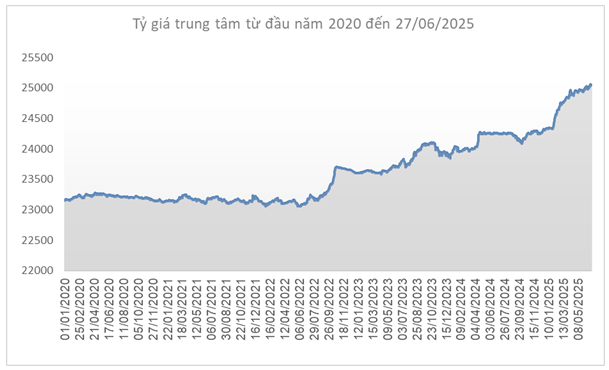

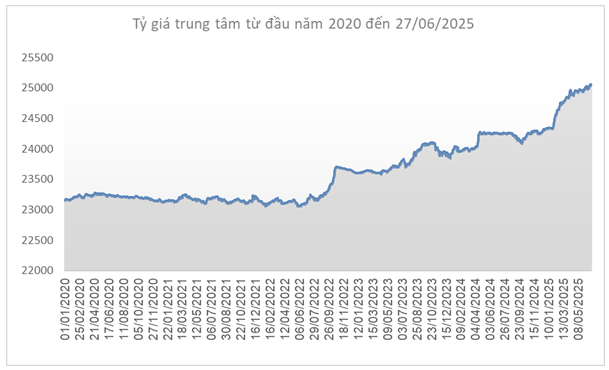

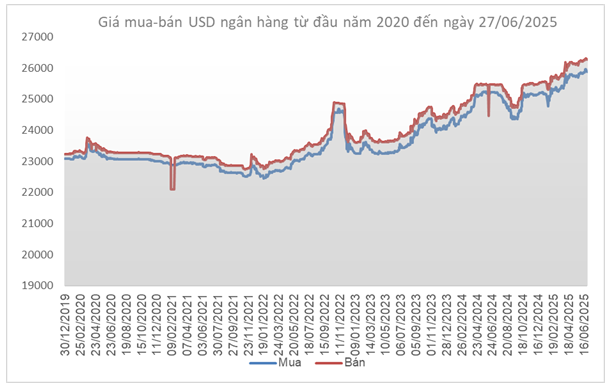

Source: SBV

|

In the domestic market, the State Bank of Vietnam set the daily reference exchange rate for June 27 at 25,048 VND per USD, a rise of 17 VND from the previous week. With a permitted fluctuation of ±5%, commercial banks listed USD/VND exchange rates ranging from 23,796 to 26,300.

The USD/VND reference rates at the State Bank of Vietnam’s Foreign Exchange Management Department also witnessed a sharp increase, climbing to 23,846– 26,258 (buying – selling), a rise of 16 and 18 VND, respectively, compared to the previous week.

Source: VCB

|

Vietcombank listed exchange rates for June 27 at 25,880– 26,270 VND per USD (buying – selling), a decrease of 12 VND in both directions.

Source: VietstockFinance

|

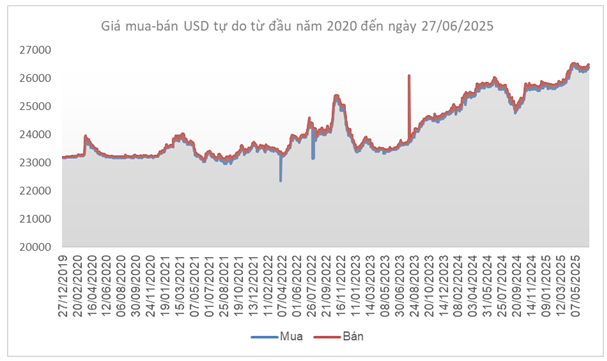

In the free market, USD rates surged by 85 VND for buyers and 75 VND for sellers, trading around 26,380 – 26,470 VND per USD (buying – selling).

– 17:58 29/06/2025

The Ultimate Guide to Forecasting Exchange Rates and Interest Rates

The skillful maneuvering of open market operations and credit support policies by the State Bank has maintained low-interest rates, ensuring liquidity and fostering growth amidst challenging global conditions.

The Greenback Slumps to a Three-and-a-Half-Year Low

The specter of Trump’s tariff policies is once again haunting investors as the July 9 deadline for the 90-day tariff truce approaches. With the clock ticking, markets are on edge as they anticipate the potential fallout from renewed trade tensions. As the temporary ceasefire draws to a close, all eyes are on the potential implications for global trade and economic growth.

Gold Prices Slip Below Key $3,300/oz Level as Dollar Rebounds

The safe-haven appeal of gold continued to diminish as the ceasefire between Israel and Iran held. There was no net buying or selling activity by the world’s largest gold ETF, SPDR Gold Trust, on Thursday, as it maintained its gold holdings at 953.4 tons.