Individual Investors in the Midst of an Information Maelstrom

In the digital age, individual investors face a daily deluge of information. It’s not just news from traditional media sources; investors are also inundated with a plethora of unofficial channels, including social media, forums, and instant online platforms. From financial bulletins and economic reports to status updates on X, Facebook, and stock market rumors—all contribute to a continuous 24/7 news cycle, leaving investors overwhelmed. Distinguishing valuable information from noise has become increasingly challenging. Amid this maelstrom, not everyone possesses the fortitude and skills to sift through effectively, leading to the potential for decisions based on misleading signals.

The consequence of being engulfed by this chaotic flow of news is the profound impact on investors’ psychology and behavior. When confronted with a rapid succession of positive and negative developments, individual investors often fall prey to herd mentality, experiencing extreme euphoria or panic within a short span of time. These psychological fluctuations trigger excessive reactions in the market, placing individual investors in a precarious situation: they seek information to guide their portfolio decisions, but the surplus and disorderly nature of the information itself becomes a risk.

Traditional Media: Roles and Drawbacks

Amid this information explosion, traditional media outlets—print newspapers, radio, television, and reputable online news sites—continue to play a vital role as beacons of information. Their primary advantage lies in the multi-layered verification process: reporters gather news, which is then scrutinized and fact-checked by editorial teams before publication. This rigorous procedure ensures that the information disseminated by traditional media typically boasts a higher level of reliability than that found on social media. For investors, in-depth analyses, macroeconomic data, and corporate reports from these sources serve as essential references for making investment choices. Undoubtedly, the value of traditional media lies in their ability to offer a comprehensive overview, backed by historical context, enabling investors to make informed decisions.

However, traditional media also has its drawbacks and limitations. Due to the multiple layers of verification, information may become diluted or delayed compared to real-time developments. While the stringent editorial process helps weed out false news, it can also result in “stale” news by the time it reaches the public. In today’s era of social media, where information spreads within minutes, traditional media sometimes lags behind. For instance, in the event of rumors or unexpected incidents, newspapers often await confirmation from authorities or businesses before publishing, creating a vacuum where unverified information on Facebook, X, Zalo, and Telegram thrives. This leads to the paradox of investors learning about events from social media before reading about them in traditional media, diminishing the latter’s role in urgent situations.

Regarding speed, the content of traditional media can also be influenced by factors beyond journalistic considerations. Each newspaper, television channel, or online platform has its editorial slant, occasionally swayed by political agendas or special interest groups. By the time information reaches investors, it may have been “sculpted” to align with specific viewpoints or the interests of certain stakeholders. Consequently, investors relying solely on traditional media may not receive timely warnings about potential risks.

The failure of traditional media to deliver timely and accurate investment information has occasionally created a trust deficit. When investors perceive a lack of clarity or timeliness in traditional media, they are compelled to seek alternative, more responsive sources. This vacuum has provided fertile ground for the emergence and prominence of new information channels in recent years.

New Information Sources: From Social Media to Podcast and Livestream

The advancement of the internet and mobile technology has unleashed an explosion of information sources beyond the realm of traditional media. Social media platforms (Facebook, X, LinkedIn, Reddit, etc.), podcast channels, livestreams on YouTube and TikTok, and online chat rooms have become information goldmines for astute investors. Their greatest strength lies in the speed of information dissemination and their diversity, offering a constant flow of timely insights from a multitude of perspectives. A single tweet from a CEO or politician can send shockwaves through global financial markets. Livestream sessions featuring bank executives or investment legends attract millions of viewers worldwide, as investors yearn for unfiltered statements. Simultaneously, podcasts hosted by independent experts and journalists provide fresh perspectives unconstrained by the confines of traditional journalism. In an age where “information is power,” these new sources empower individual investors by granting them direct access to industry leaders, policymakers, and real-time debates among specialists—all without waiting for a belated summary in traditional media.

However, like a double-edged sword, this vast reservoir of information carries significant risks regarding authenticity and reliability. On social media, anyone can assume the role of a “reporter,” disseminating unverified news. Misinformation or subjective opinions can masquerade as investment advice, easily deceiving inexperienced individuals. The echo chamber effect on platforms like Facebook and Reddit can entrap users in a cycle of biased opinions, reinforcing only what they want to hear. Consequently, if investors lack discernment, chasing these new sources may lead to an illusion of knowledge, resulting in erroneous decisions.

Nonetheless, the reference value of raw, unprocessed information from these channels cannot be denied. When utilized selectively and cautiously, they provide “live” data and practical insights that traditional media may overlook. Raw information, free from preconceived notions, can help investors comprehend the true nature of issues.

The rise of financial influencers on social media is also noteworthy. Numerous individuals on X and YouTube, ranging from economists to fund managers and self-taught investors, have established themselves as trusted “gatekeepers” of investment knowledge for younger generations. Their accurate predictions or astute analyses have garnered substantial followings. When these influencers voice opinions about the market or specific stocks, their influence can be immense, sometimes causing short-term shifts in asset prices.

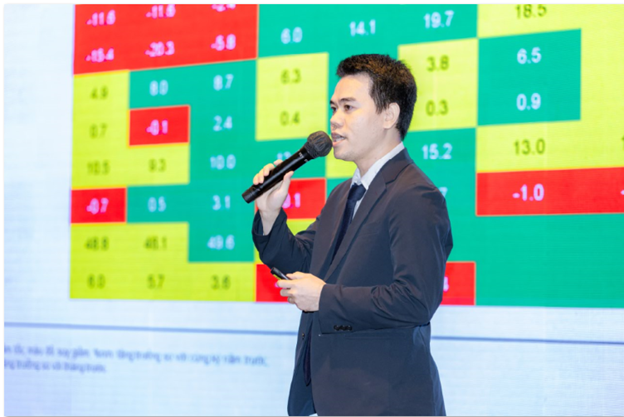

Receiving and Processing Multi-Dimensional Information in Stock Investment

Amid the current flood of multi-dimensional information, the most critical skill for investors is effectively absorbing and processing data.

|

In today’s multi-dimensional information landscape, the most vital skill for investors is effectively absorbing and processing data. This demands an open-minded yet discerning attitude, coupled with a concrete strategy for verifying and cross-referencing all information before making decisions.

Firstly, maintain an open attitude towards diverse information sources. Avoid extremes such as shunning social media due to fears of misinformation or blindly trusting traditional media. Each channel has its merits if utilized appropriately. Investors should harness multiple sources: reading newspapers for the big picture and verified data while monitoring social media for emerging trends. This openness ensures investors avoid bias and approach issues from multiple perspectives—a crucial factor in comprehensively assessing risks and opportunities.

Next, cross-verification is a survival tactic. When encountering significant news that influences investment choices, refrain from immediate belief; instead, seek confirmation from independent sources. This multi-dimensional verification filters out inaccurate or exaggerated information while reinforcing the reliability of accurate data. Remember, never act based on a single, potentially biased or unverified, source.

A useful strategy is to employ social media as an early warning system, followed by traditional media and primary sources as a “check.” Social media, with its speed, acts like a radar, swiftly detecting fluctuations: rumors about interest rate adjustments, unusual statements from politicians, or leaked images of a tech giant’s new production line—all break on X or Facebook first. Investors should leverage this advantage to swiftly grasp emerging developments. However, after the initial radar alert, the subsequent step of verification through traditional media and/or primary sources is indispensable. This two-step process—detection via social media and confirmation via traditional channels and/or primary sources—helps investors stay abreast without falling prey to fake news.

Additionally, hearing directly from those involved is another effective information-processing strategy. Instead of solely relying on journalists’ or influencers’ interpretations, investors should cultivate the habit of consulting primary data sources whenever possible (e.g., listening to speeches by politicians, policymakers, or business leaders). Primary information ensures investors comprehend the context and content accurately, avoiding instances of “Chinese whispers” or intentional distortions. Moreover, direct listening enables investors to assess the speaker’s reliability through their delivery, rather than depending on a third party’s interpretation.

Lastly, but importantly, cultivate a spirit of critical thinking and emotional discipline while consuming information. Regardless of the source’s credibility, investors should ask: “What does this information mean for my investment strategy? Does it alter fundamental assumptions, or is it merely temporary noise?” Maintaining a cool head, free from FOMO or fear, helps filter out much of the noise from social media and traditional media alike. Remember, the ultimate goal is to make prudent investment decisions based on profound understanding, not to chase daily headlines. Information is a means to an end, not the end itself.

In this era of multi-dimensional information, successful investors must equip themselves with a “filter” and a “compass” to navigate. The filter sifts out the noise, selecting only the essence, while the compass—comprised of personal knowledge and strategy—helps orient each piece of information in relation to one’s path. Traditional media and social media, when used in tandem, become a dynamic duo: social media provides agility, while traditional media offers depth and reliability. Combining these elements with independent thinking enables investors to stand firm amid information storms, avoid psychological traps, and make enlightened decisions in the ever-changing investment landscape.

The Kingpin: Unraveling the Web of a Large-Scale Cannabis Operation, Dealing in Digital Dollars

On June 22nd, the Quang Ninh Provincial Police, in collaboration with the C04 Drug Crime Investigation Bureau of the Ministry of Public Security, successfully dismantled a sophisticated drug trafficking ring, primarily dealing in cannabis. This illicit network operated through cyberspace, spanning from the southern to the northern regions of the country.

The Capital’s Beloved Cafe Rumored to Shut Down Due to “Huge Losses”: Owner Sets the Record Straight

A shocking anonymous post claimed that a renowned Hanoi cafe was closing down due to financial losses. This prompted the owner to quickly refute the allegations.