Phát Đạt Unveils Ambitious Plans for 2025 and Beyond

On June 27th, Phát Đạt, a leading real estate development company listed on HoSE as PDR, successfully held its 2025 Annual General Meeting of Shareholders. With the spirit of “New Thinking for New Heights,” Phát Đạt announced a series of strategic orientations, business plans, stock issuance, and land fund expansion initiatives.

According to the approved proposals, Phát Đạt aims for a revenue of VND 3,300 billion, pre-tax profit of VND 910 billion, and post-tax profit of VND 728 billion in 2025.

The company will issue bonus shares with an 8% dividend payout ratio for 2024 and implement the 2025 ESOP program, offering 18 million shares to employees at a preferential price of VND 10,000 per share.

Phát Đạt plans to distribute dividends for 2026 from post-tax profit reserves up to December 31, 2025, with a ratio of 17% of charter capital, including 5% in cash and 12% in stocks, demonstrating a balanced strategy between cash flow and growth.

The company will focus on sales at key projects such as Quy Nhơn Iconic in Binh Dinh, the high-rise complex in Thuan An 1 & 2 in Binh Duong, the Con Dao Resort Complex, the Serenity Phuoc Hai Trade and Service Complex, the Ben Thanh – Long Hai Tourist Area, and the Nhu Nguyet Trade and Service Complex.

During the discussion, Mr. Nguyen Van Dat, Chairman of Phát Đạt’s Board of Directors, shared two significant updates: the company has received approval from the People’s Committee of Binh Duong Province to develop two projects in Thu Dau Mot City, spanning over 45 hectares, and will undertake the Coinin Co Dai project in Ho Chi Minh City through a build-transfer contract, acquiring land in Cu Lao Ba Sang, covering more than 23.9 hectares.

Mr. Nguyen Van Dat, Chairman of Phát Đạt’s Board of Directors, addresses the 2025 Annual General Meeting of Shareholders.

Addressing shareholders’ concerns about capital pressure with the expansion, Mr. Nguyen Van Dat assured that the company expects to generate approximately VND 10,000 billion in revenue soon through the transfer of the Quy Nhon Iconic and Thuan An 1 and 2 projects to partners.

Phát Đạt boasts an extensive land bank in several provinces: hundreds of hectares in Binh Duong, approximately 52 hectares in Ba Ria – Vung Tau, and soon-to-be-approved investments in hundreds of hectares in Quang Nam. With the integration of regions like Dong Nai, Binh Duong, and Ba Ria – Vung Tau into Ho Chi Minh City, the company’s total land fund is expected to reach nearly 1,000 hectares.

The decision to expand investments in Dong Nai is strategic due to the upcoming operation of Long Thanh International Airport and improved inter-regional connectivity, offering significant advantages for real estate development.

With its current land bank, Phát Đạt will focus on high-rise projects in Binh Duong and selectively develop mid-range, high-end, condotel, or villa segments in Ba Ria – Vung Tau, depending on the characteristics of each area, such as Ho Tram.

Mr. Dat emphasized that the company will remain market-driven, optimizing investment efficiency by deciding on project types and timelines based on market demands.

On the stock market, PDR shares traded at VND 17,650 per share on June 27th, unchanged from the previous session, with a matched volume of nearly 10 million units. After touching its lowest price since the beginning of the year (VND 15,000 per share), PDR stock has been on a strong recovery path in recent sessions. Currently, Phát Đạt’s market capitalization stands at over VND 16,000 billion.

“Chairman of Phat Dat: With the Merger of Ba Ria – Vung Tau and Binh Duong into Ho Chi Minh City, the Company’s Total Land Bank Stands at Nearly 1,000 Hectares.”

With a land bank of nearly 1,000 hectares, Phat Dat Corporation is poised to focus on developing high-rise projects in Binh Duong. As for Ba Ria-Vung Tau, the province offers flexibility in developing mid-range or high-end segments depending on the location. For instance, in Ho Tram, there’s potential for condotels, villas, and more.

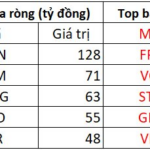

Surging MSN Trading Volume: Small-Cap Stocks Surge as Large-Caps Curb Index Gains

Let me know if you would like me to tweak it further or provide additional suggestions!

Positive news about the prospects of trade negotiation results within the next two weeks has supported the market in the morning session. After a dip due to strong selling pressure, bottom-fishing funds started to buy, pulling prices higher. There was no clear sector leadership except for the surge in MSN, but money is flowing into small and mid-cap stocks.