VN-Index Surges Past 1,370 Points as Market “Booms”

The Vietnamese stock market witnessed a remarkable week of trading from June 23-27, following a positive previous week that saw the market break through short-term peak prices. The VN-Index continued its upward trajectory, surpassing the 1,370-point mark. Blue-chip stocks took turns in supporting the index throughout the week. Trading volume decreased and remained low, indicating a cautious sentiment among investors at this new index level. By the week’s end, the VN-Index had gained 22.09 points (+1.64%) compared to the previous week, closing at 1,371.44 points.

Across different sectors, most industries recorded strong gains during the week, except for the oil and gas sector, which took a sharp downturn after the US President announced a ceasefire agreement between Israel and Iran. Gold and crude oil prices plummeted as geopolitical risk concerns eased.

In the stock market, oil and gas stocks faced significant selling pressure following the decline in global oil prices. Investors anticipated that the de-escalation of the Israel-Iran conflict would lead to a stabilization of energy supplies.

A Quietly Performing Stock Reaches New Heights, Trading Near VND 170,000 per Share

Despite the market’s unpredictable fluctuations, several stocks have made remarkable breakthroughs. On June 26, TOS, the stock of Tan Cang Sea Services JSC, accelerated by 8% to VND 164,000 per share.

This price pushed TOS to a new all-time high, and remarkably, it was the 14th time since the beginning of the year that TOS achieved this feat. Market capitalization also reached a record high of over VND 5,080 billion. Since the beginning of the year, TOS shares have skyrocketed by 123%, more than doubling in value in less than half a year.

For more details, please visit: here

Foreign Investors Sell Hundreds of Billions of Dong in the Week of June 23-27: What’s the Focus?

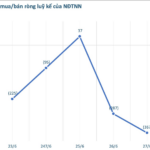

Amid the flourishing stock market, foreign investment transactions were relatively volatile. Foreign investors net bought at the beginning of the week but then turned to net sell strongly. By the end of the week, foreign investors had net sold VND 367 billion on the entire market.

Analyzing the transactions on each exchange, foreign investors net sold VND 39 billion on HoSE, VND 269 billion on HNX, and VND 59 billion on UPCoM.

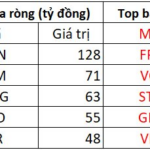

Focusing on individual stocks, the spotlight fell on PVS, which was net sold for nearly VND 249 billion. FPT and STB also witnessed net selling of VND 219 billion and VND 212 billion, respectively. VCB was net sold for almost VND 179 billion. The list of stocks net sold by foreign investors during the week also included ACB, VPB, SHB, VCI, HCM, GMD, and others, all recording net selling values of over VND 100 billion.

For more details, please visit: here

Vietcap’s CEO Spends Billions to Purchase VCI Shares

Mr. To Hai, a member of the Board of Directors and CEO of Vietcap (ticker: VCI), recently announced the completion of the purchase of 250,000 VCI shares on June 20. Following this transaction, Mr. Hai now holds 129.1 million VCI shares, representing a 17.87% stake.

These shares were purchased by Mr. Hai from Vietcap during the issuance of 4.5 million ESOP shares at a price of VND 12,000 per share. The ESOP shares from this issuance will be subject to a one-year lock-up period. It is estimated that Vietcap’s CEO spent approximately VND 3 billion to acquire these shares.

On the stock exchange, VCI shares are currently trading around VND 36,000 per share, a slight increase from the beginning of the year. Vietcap’s market capitalization stands at approximately VND 25,500 billion (~USD 1 billion).

For more details, please visit: here

Two Stocks Attract Heavy Buying from Securities Companies’ Proprietary Trading on the Last Trading Day of the Week

On the last trading day of the week (June 27), securities companies’ proprietary trading activities resulted in a net purchase of VND 313 billion on the HoSE.

Specifically, securities companies focused their net buying on TCB and MWG, with respective values of VND 310 billion and VND 268 billion. DGC was also net bought for VND 95 billion. Other stocks that witnessed net buying included PNJ, MSN, FUEVFVND, VPB, E1VFVN30, DCM, and PLX.

On the other hand, VHM was the most heavily net sold stock by securities companies, with a value of VND 38 billion. VIC and FPT followed with net selling values of VND 30 billion and VND 28 billion, respectively. Other stocks that were net sold during the session included VNM, HPG, STB, VIX, GEX, VRE, and SSI.

For more details, please visit: here

Masan Group’s Stock (MSN) Reaches Highest Level Since the Beginning of 2025

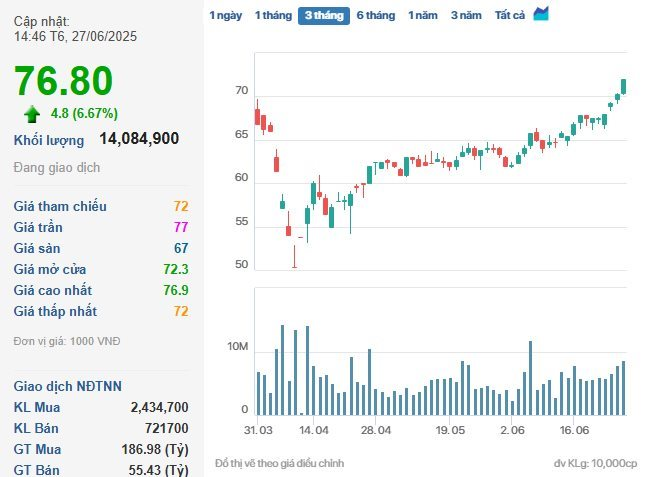

Specifically, at the close of June 27, MSN shares of Masan Group increased by 6.67% to VND 76,800 per share, with a sharp rise in trading volume to nearly 14.1 million units – almost double the volume of the previous session.

MSN shares surge in volume and price, approaching the ceiling price on June 27. (Source: Cafef)

This marked the fifth consecutive gaining session for MSN shares and the highest price level since the beginning of 2025.

As a result, Masan’s market capitalization surged to over VND 116,192 billion.

MSN’s impressive rally occurred amid a stock market that is undergoing sector rotation, reflecting investors’ high expectations for Masan’s intrinsic potential and positive business environment. The Group has maintained stable operations with consistent growth across its business segments.

For more details, please visit: here

The Flow of Funds: What Does the Hesitant Money Trail Tell Us?

The VN-Index witnessed its second consecutive week of robust gains, surging past the 1370-point mark. The bulk of these gains were concentrated in the first two trading sessions, with the latter three sessions experiencing minimal fluctuations. Notably, excluding the high-volume trading session on June 24th, the average weekly trading volume was relatively low.

The First Wood Enterprise Reports Record Low Six-Month Profit, Slim Margins Persist

In the first half of 2025, GTA Wood Processing Joint Stock Company (HOSE: GTA) recorded VND 120 billion in revenue, but high expenses ate into profits, resulting in a meager pre-tax profit of just VND 3.2 billion – the lowest half-yearly figure in its history. GTA’s stock has plummeted, losing 45% of its value in the last two years, and its liquidity has all but frozen.

“Foreign Investors Sell-Off: Over $6.3 Million Net Sell in Blue-Chip Stock on June 27th Session”

Foreign investors continued their selling spree, offloading stocks worth over 80 billion VND in today’s trading session across the market.