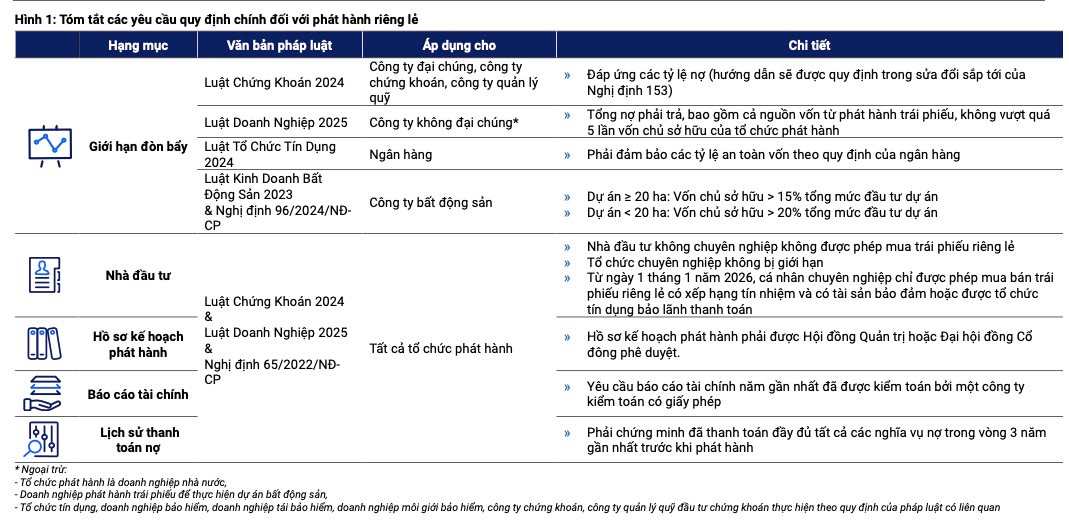

The National Assembly has recently passed the amended Enterprise Law 2025, introducing new regulations on leverage ratio limits for non-public companies issuing private placement bonds, effective from July 1, 2025.

According to VIS Rating, these issuing organizations must maintain a debt-to-equity ratio (including bonds to be issued) of no more than 5 times to be permitted to issue private placement bonds. This regulation aligns the legal framework for non-public companies with that of public companies under the Securities Law 2024.

VIS Rating expert’s take on the new regulation

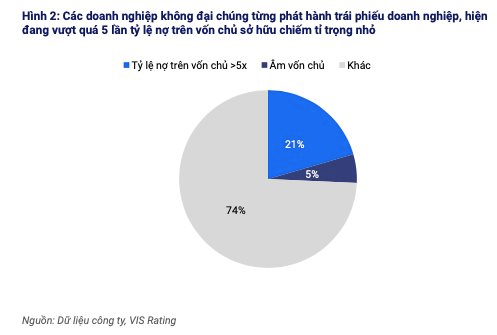

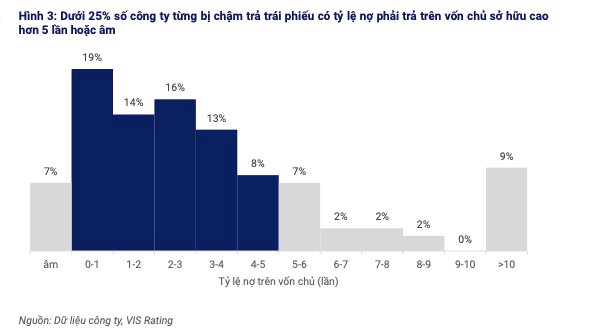

VIS Rating specialists believe that the new rule will have a negligible impact on private bond issuance activities. Their data on all non-public companies in Vietnam over the last three years reveals that only about 25% of firms had a debt-to-equity ratio exceeding 5 times or negative equity.

Breakdown of companies by debt-to-equity ratio

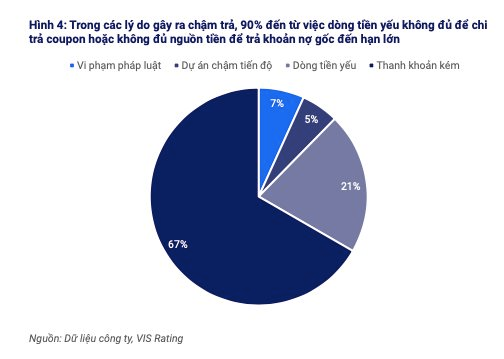

While high leverage is a significant credit risk for low-rated issuers, VIS Rating analysts found that out of 182 enterprises that defaulted on their bonds, excessive leverage was not the primary cause. Instead, weak cash flow and poor liquidity management were the main reasons. Less than a quarter of these defaulters had a debt-to-equity ratio above 5 times or negative equity, while the average ratio for the remaining three-quarters was just 2.8 times, roughly equal to the average of non-defaulting issuers.

Factors contributing to bond defaults

Despite moderate leverage, 90% of defaulting issuers failed to generate sufficient operating cash flow to service periodic interest payments or lacked liquidity to repay principal amounts upon maturity.

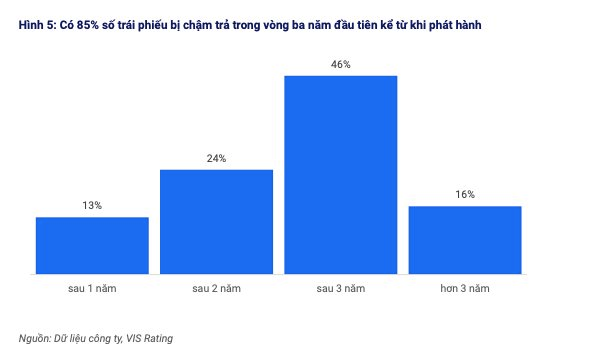

Breakdown of defaulted bonds by time to maturity

Nearly 40% of defaulted bonds had very short tenors of 1-3 years, often used for long-term projects that do not generate cash flow promptly. Without stable cash inflows, issuers become reliant on refinancing, i.e., using new debt to repay old debt. Consequently, 85% of default cases occurred within the first three years after issuance.

Challenges in bond repayment

Additionally, around 40% of defaulted bonds had collateral that was difficult to value or liquidate, such as receivables related to real estate projects, business cooperation contracts, and future project income. The lack of an effective debt restructuring mechanism and limitations in legal approaches further contribute to the high default rate. Overall, investors consider more than just financial leverage when purchasing corporate bonds.

A more comprehensive assessment is necessary, including the underlying motives for bond issuance, the issuer’s ability to generate sustainable cash flow, and the mitigation of repayment risks through high-value collateral or payment guarantees from reputable third parties. Equally important is for investors to evaluate not only credit risks at the issuer level but also specific risks within each debt instrument. These factors encompass payment priority, quality of collateral, and legal commitments.

The Emerging Phu Tho Province: A Visionary Escape with an 18-Hole Golf Course and a Lavish Resort Spanning 100 Hectares, Backed by a Robust Investment of Over VND 1,500 Billion

The provincial People’s Committee Party in Hòa Bình has approved the investment policy for the Độc Lập tourism, resort, and golf course complex in Độc Lập commune, Hòa Bình city.

The Reason Hoa Lu Abandoned the Dutch-Style Water Bridge Project

On June 28, the People’s Committee of Hoa Lu city, Ninh Binh province, officiated the groundbreaking ceremony for the construction of a bridge over the Trang An River. The project, with a total investment of over VND 179 billion, involves the building of a permanent concrete bridge at the intersection of Le Thai To and Trang An streets in Tan Thanh ward. This design replaces the previously proposed water bridge, marking a significant shift in the development plans for the area.

The Power of Words: Crafting Captivating Copy for Web Success

Unleashing the Potential of Nhơn Trạch 4 Power Plant: Synchronizing with the National Grid

On June 27th, at 1:55 p.m., the Nhon Trach 4 Power Plant, one of the first LNG-fired power plants in Vietnam, successfully synchronized with the national grid, initially delivering an impressive 50 MW of power. This significant milestone, a first for the power plant, marks a crucial step in the testing phase before commencing commercial operations.