As of the end of Q1/2025, the pre-tax profits of 27 banks on the stock exchange reached VND 82,380 billion, a nearly 14% increase compared to the same period in 2024. Among them, only five banks experienced a decline in profits, while five banks recorded growth below 10%. The rest witnessed double-digit growth, and some banks even reported profits several times higher than the previous year.

In the context of accelerating credit growth in Q2, as of June 18, 2025, credit had increased by 7.14%, double that of the previous year, and is expected to reach about 16% by the end of the year. The banking industry’s profits are expected to continue their positive trajectory in Q2/2025.

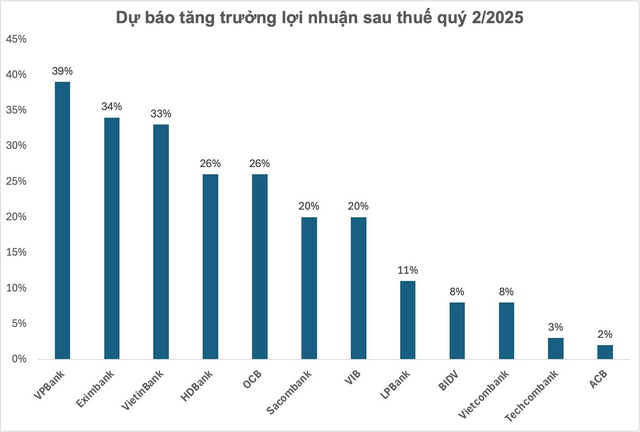

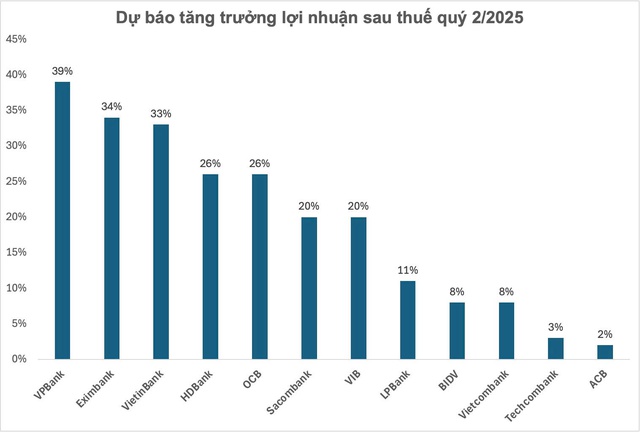

In a recent report, MBS forecasted a 14.7% year-on-year increase in the after-tax profits of listed banks for Q2/2025. MBS predicted that five banks would achieve profit growth of over 20% for Q2/2025: VPBank, Eximbank, VietinBank, HDBank, and OCB.

VPBank is expected by MBS to witness a 39% surge in profits in Q2 and a 26% increase for the full year 2025.

MBS estimates that VPBank’s credit growth could reach approximately 12% by the end of Q2, while NIM is projected at 5.9%, unchanged from the previous quarter but lower than the same period last year due to the high base effect.

Lending to corporate clients is expected to continue driving credit growth, mainly related to trade and construction activities. Lending to individual customers will primarily come from home loans, while margin lending and consumer credit will likely remain slow until negotiation results are announced.

Eximbank is forecasted to achieve a 34% surge in profit for Q2 and a 5% increase for the full year 2025.

MBS believes that Eximbank’s credit growth will accelerate significantly, reaching an estimated 13% by the end of the quarter, partly due to a very favorable increase of over 9% in Q1.

Similarly, NIM is expected to inch up to 2.5%, mainly due to a reduction in the cost of funds (COF) to 4.1%. Provision expenses for Q2 are projected at VND 200 billion, unchanged from the same period last year but up 66% from the previous quarter as non-performing loans and substandard loans show no signs of decreasing. While profits for the first half of the year are very positive, they only represent 34% of the relatively ambitious plan.

VietinBank is expected to record a 33% surge in profit for Q2 and a 13% increase for the full year. Credit as of the end of June is projected at around 10%, along with NIM expected to remain stable at 2.6%.

MBS believes that VietinBank’s credit will be boosted in two sectors: export trade and construction, as the 90-day negotiation and promotion of public investment are still relatively slow compared to the plan. Provision expenses are forecasted to reach approximately VND 8,000 billion, unchanged from the previous quarter.

HDBank is expected by MBS to achieve a 26% surge in profit for Q2 and a 28% increase for the full year 2025.

According to MBS, HDBank’s credit growth at the end of Q2 is projected at around 6%, mainly due to the low base in the previous quarter. The bank’s core SME customer segment is expected to be significantly impacted by tax and invoice declarations.

Meanwhile, NIM is forecasted to continue declining to 4.5% in Q2. Provision expenses are expected to decrease slightly to VND 1,000 billion, unchanged from the same period last year. Profit for the first six months is expected to reach 50% of the full-year plan and increase by 30.7% compared to the same period last year.

OCB is forecasted to achieve a 26% surge in profit for Q2 and a 9% increase for the full year 2025. MBS anticipates OCB’s credit growth to reach 7% by the end of Q2, with a quarter-on-quarter credit growth of about 4.5% in Q2, double that of Q1 due to the low base.

NIM is expected to recover slightly to 2.4% as the cost of funds decreases, and the bank will not be under significant pressure to increase mobilization, having already done so in Q1. Provision expenses for Q2 are projected at VND 450 billion, up 8% from the same period last year. Profit for the first six months continues to decline by 3.3% from the same period last year and completes only 38% of the full-year plan.

Source: Compiled by MBS

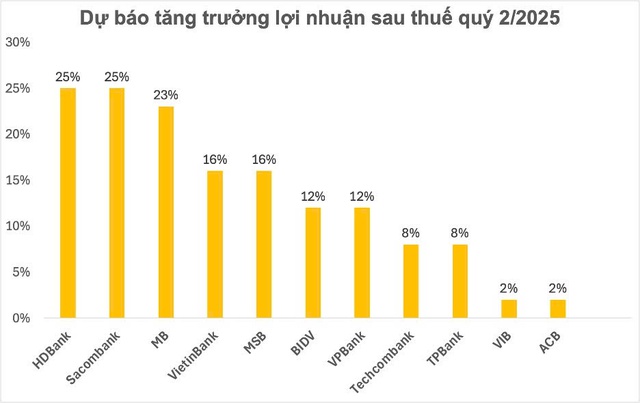

Most of the banks mentioned by MBS’s analyst team also overlap with the forecast from VCBS.

Among them, HDBank is expected by VCBS to have a higher credit growth outlook than the industry average, attributed to its focus on agricultural and rural lending, the recovery of the real estate market, and the acquisition of DongA Bank.

Profit is expected to maintain a positive growth rate, with Q2/2025 and full-year 2025 growth rates of 25% and 24%, respectively. Meanwhile, the pressure to narrow NIM in 2025 is expected to ease compared to the industry average.

Source: Compiled by VCBS

Along with HDBank, two other banks forecasted by VCBS to have profit growth of over 20% in Q2 are Sacombank and MB.

VCBS believes that Sacombank will record positive non-interest income, with total operating income estimated at VND 8,585 billion (up 20%) in Q2 and VND 34,955 billion (up 22%) for the full year 2025. Accordingly, pre-tax profit is expected to increase by the same rate of 25% in Q2 and for the full year. In addition, credit is expected to grow by 14%, and NIM is projected to remain at 3.7% in 2025.

Non-interest income is expected to improve due to fee income and the recovery of written-off bad debts. Regarding asset quality, with low provision pressure in 2025, VCBS experts expect Sacombank to accelerate the resolution of distressed assets and complete this process in 2025-2026.

MB is forecasted to achieve a 23% surge in profit, driven by strong credit growth of 27.8% in 2025, improved NIM, robust fee income, and enhanced asset quality.

Overall, VCBS believes that credit growth and bad debt control are the main drivers of bank profits. Additionally, NIM recovery and reduced provision pressure are also factors contributing to the positive profit performance of some banks in this Q2.

The Ultimate Guide to Forecasting Exchange Rates and Interest Rates

The skillful maneuvering of open market operations and credit support policies by the State Bank has maintained low-interest rates, ensuring liquidity and fostering growth amidst challenging global conditions.

“A Life Insurance Giant Holds Over 57 Million VietinBank Shares, Valued at Nearly VND 2.4 Trillion”

Introducing VietinBank: A Leading Financial Institution in Vietnam

The Vietnam Joint Stock Commercial Bank for Industry and Trade, widely known as VietinBank (CTG), has recently disclosed information regarding its shareholders. In a notable development, the bank has announced that one of its shareholders now holds over 1% of its chartered capital.

5 Banks Project Profit of Over 30,000 Billion VND in 2025

“In addition to the aforementioned top five banks, Agribank and VPBank are also aiming high with plans to achieve profits of approximately $1 billion each in 2025. These ambitious targets showcase the growth trajectory of Vietnam’s banking sector and the potential for significant financial gains in the coming years.”