Vietnam Airlines’ Consolidated Financial Report for 2024: Insights into Short-Term Borrowings and Lender Relationships

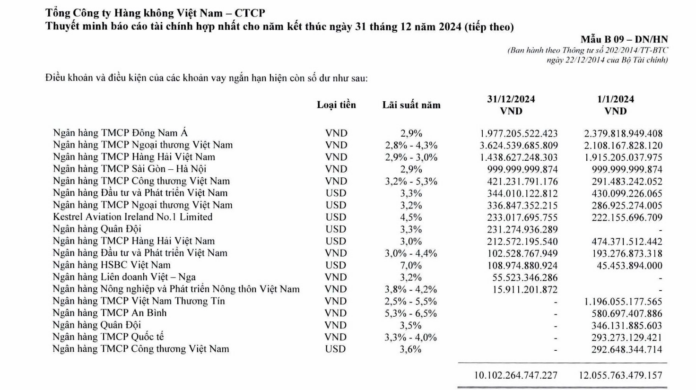

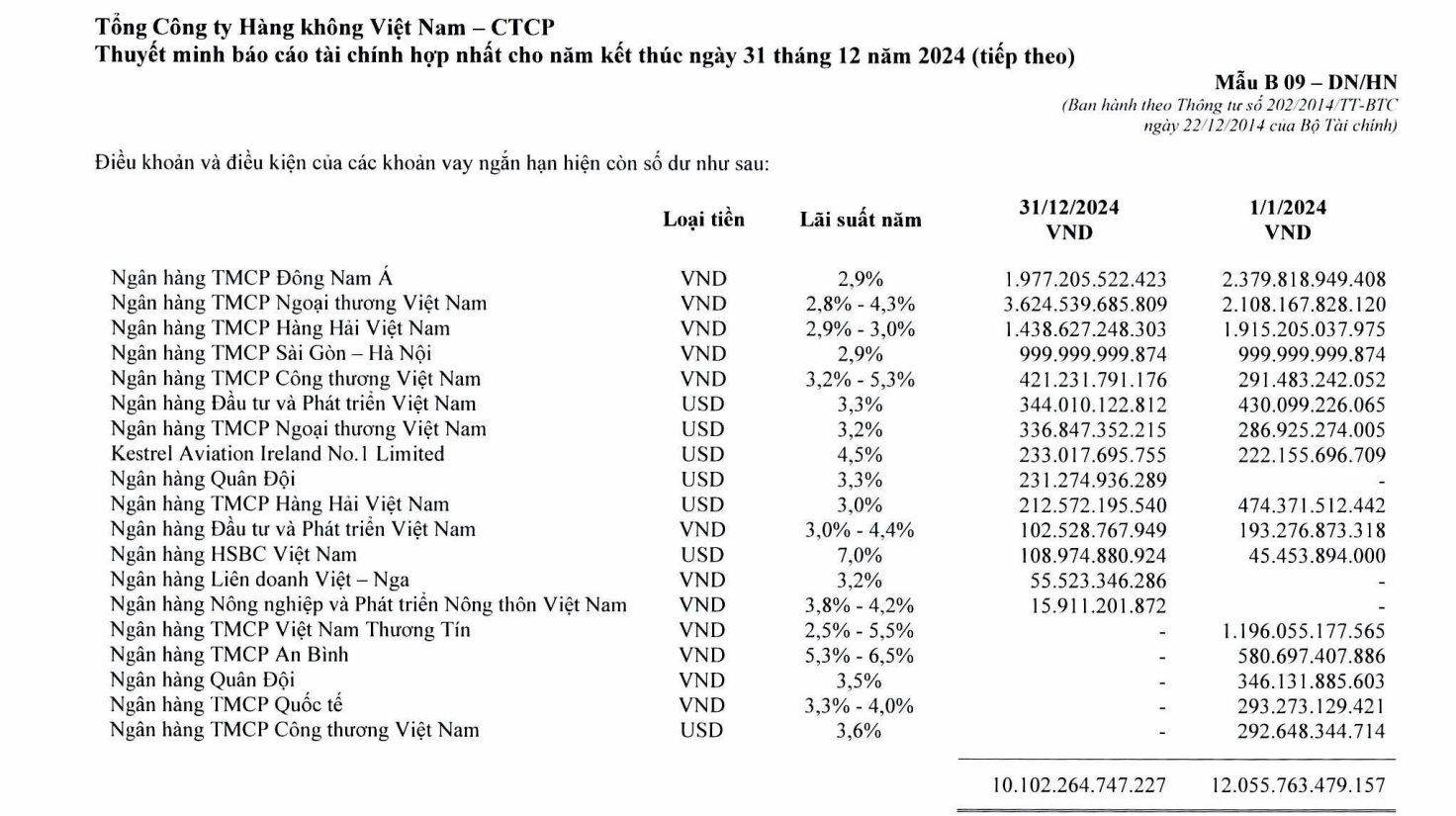

Vietnam Airlines’ (HoSE: HVN) consolidated financial report for 2024 offers insights into its short-term borrowings and lender relationships. As of the end of 2024, the national carrier recorded short-term loans totaling 10,102 billion VND, a decrease from the 12,056 billion VND at the beginning of the year.

Vietcombank remains the largest lender, with short-term loans amounting to 3,961 billion VND, an increase of approximately 1,566 billion VND year-on-year. Other significant lenders include SeABank with 1,977 billion VND, MSB with 1,439 billion VND, and SHB with nearly 1,000 billion VND.

Among the banks with credit relationships with Vietnam Airlines, HSBC Vietnam stands out with its USD-denominated loans, equivalent to approximately 109 billion VND, doubling from over 45 billion VND at the start of the year. The interest rate between the two parties is set at 7%.

This 7% interest rate is significantly higher than those offered by other banks, such as BIDV at 3.3%, Vietcombank at 3.2%, and MBBank at 3.3%.

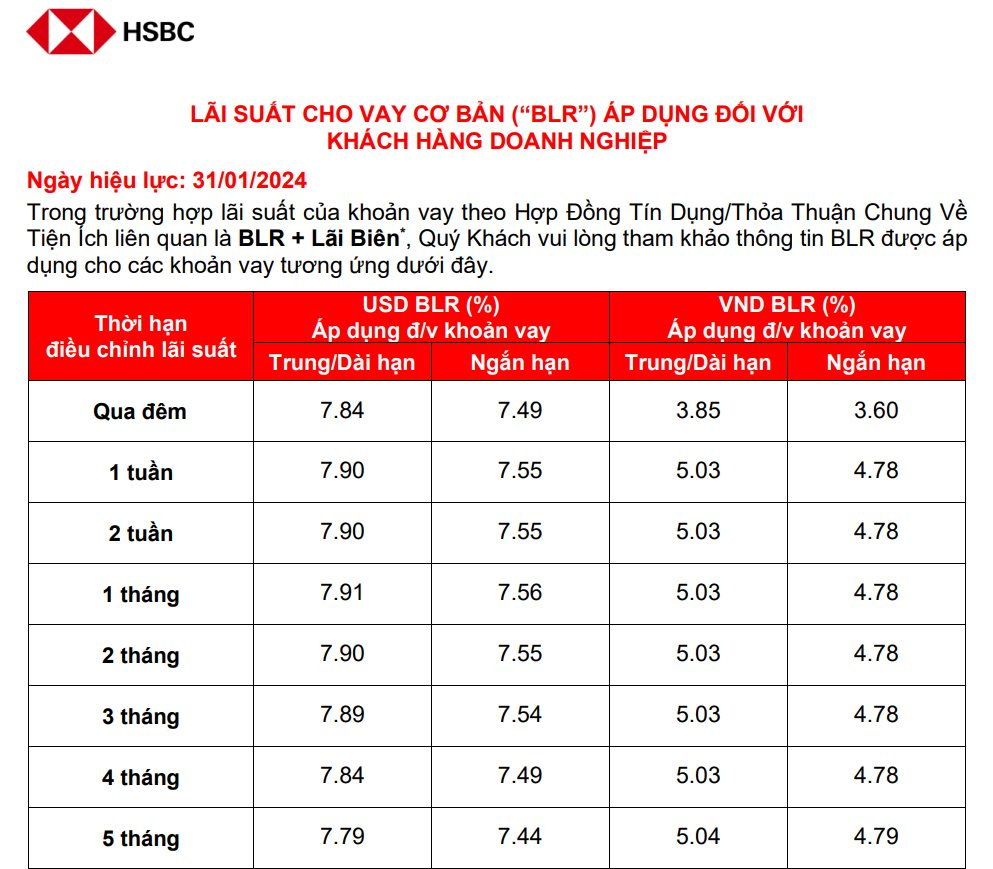

According to HSBC’s data, the bank offered USD loans with interest rates above 7% at the beginning of 2024. For example, short-term USD loans as of January 31, 2024, had interest rates ranging from 7.03% to 7.49% for overnight to 12-month tenors.

HSBC Vietnam’s summarized financial report for 2024 reveals a pre-tax profit of nearly 4,450 billion VND, a 31.7% decrease compared to the previous year. The foreign bank’s profit-after-tax stood at 3,541 billion VND.

As of the end of 2024, HSBC Vietnam’s total assets decreased by 16.9% to 136,434 billion VND, mainly due to a reduction in deposits and loans to other credit institutions, which fell from 74,539 billion VND to 43,296 billion VND.

The bank’s liabilities at the end of 2024 were 117,204 billion VND, down from 145,157 billion VND at the end of 2023. A significant portion of this amount comprises customer deposits, totaling 114,139 billion VND.

Additionally, HSBC Vietnam’s report highlights an impressive figure in terms of deposit mobilization and issuance of securities, reaching 4.81 million billion VND. The bank’s loan disbursements and loan collections amounted to 191,868 billion VND and 188,917 billion VND, respectively, surpassing its total assets.

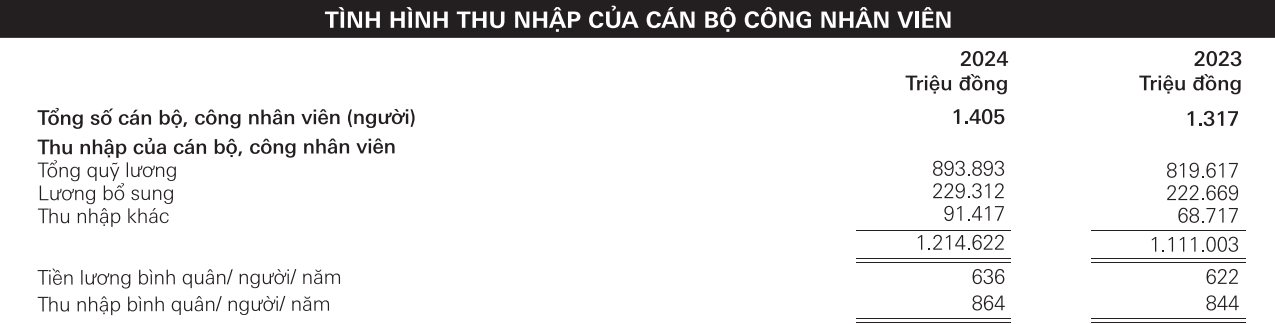

While HSBC Vietnam may be smaller in terms of financial figures, it excels in employee compensation. As of the end of 2024, HSBC Vietnam employed 1,405 staff, and the total salary, bonus, and other income for the year amounted to 1,215 billion VND.

The average income per HSBC Vietnam employee stands at 864 million VND per year, a 2.4% increase from 2023, far surpassing that of domestic banks.

Steady Steps Towards a Wider Horizon: Expanding Our Fleet and Network for a Brighter Future

As Vietnam’s flagship carrier and the leading airline in the country, Vietnam Airlines has embarked on a journey of resurgence and future-oriented expansion. With a robust fleet expansion and a host of new route explorations, the airline is taking off towards new horizons with renewed vigor and heightened aspirations.