On July 15, Viet Tri Paper Joint Stock Company (code: GVT) will finalize its shareholder list to distribute the remaining dividend for 2024 with a ratio of 33%, meaning that for each share owned, shareholders will receive VND 3,300.

With over 11.6 million shares in circulation, Viet Tri Paper will need to allocate approximately VND 38 billion for this dividend payment. The expected payment date is July 28, 2025.

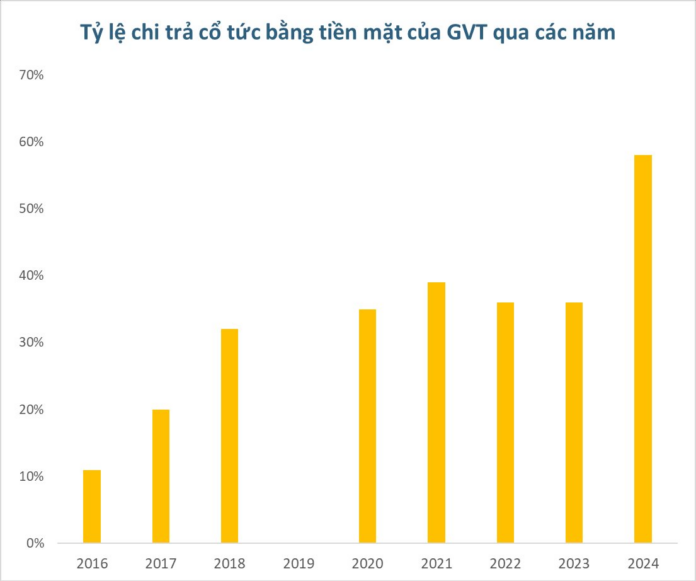

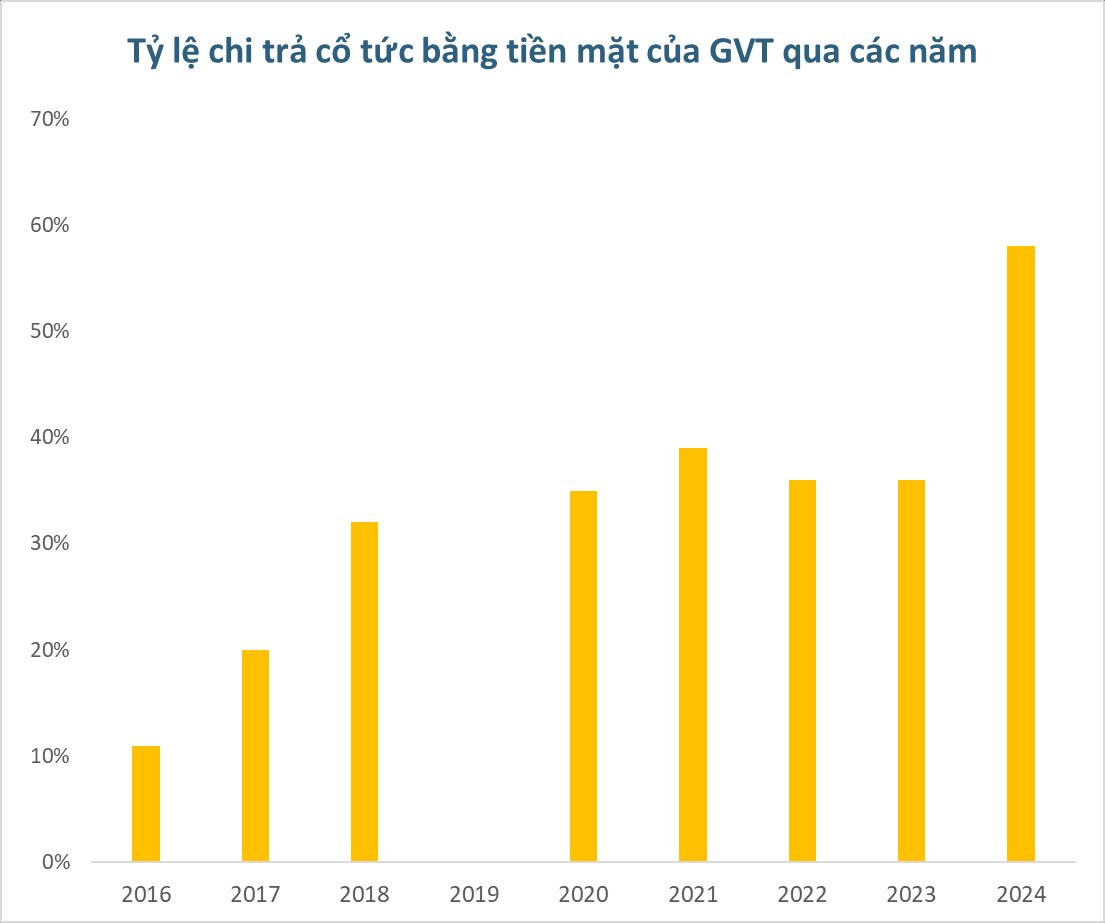

Previously, GVT had paid an interim cash dividend of 25% in January 2025. With this final installment, the total dividend ratio for the year reaches 58% – the highest in the company’s history and in line with the profit distribution plan approved at the annual general meeting of shareholders.

GVT has a tradition of paying high and consistent cash dividends over the years. Its shareholder structure includes the Vietnam Paper Corporation, holding nearly 3.4 million shares, equivalent to a 29% stake. Notably, Le Xuan Luong, a prominent investor with a penchant for stable and dividend-paying manufacturing companies, is also a major shareholder.

Viet Tri Paper, formerly known as Viet Tri Paper Mill, has been operating since 1961. The company’s main products include Duplex coated paper, Krafliner paper, printing and writing paper, cement bag paper, and corrugated paper, among others.

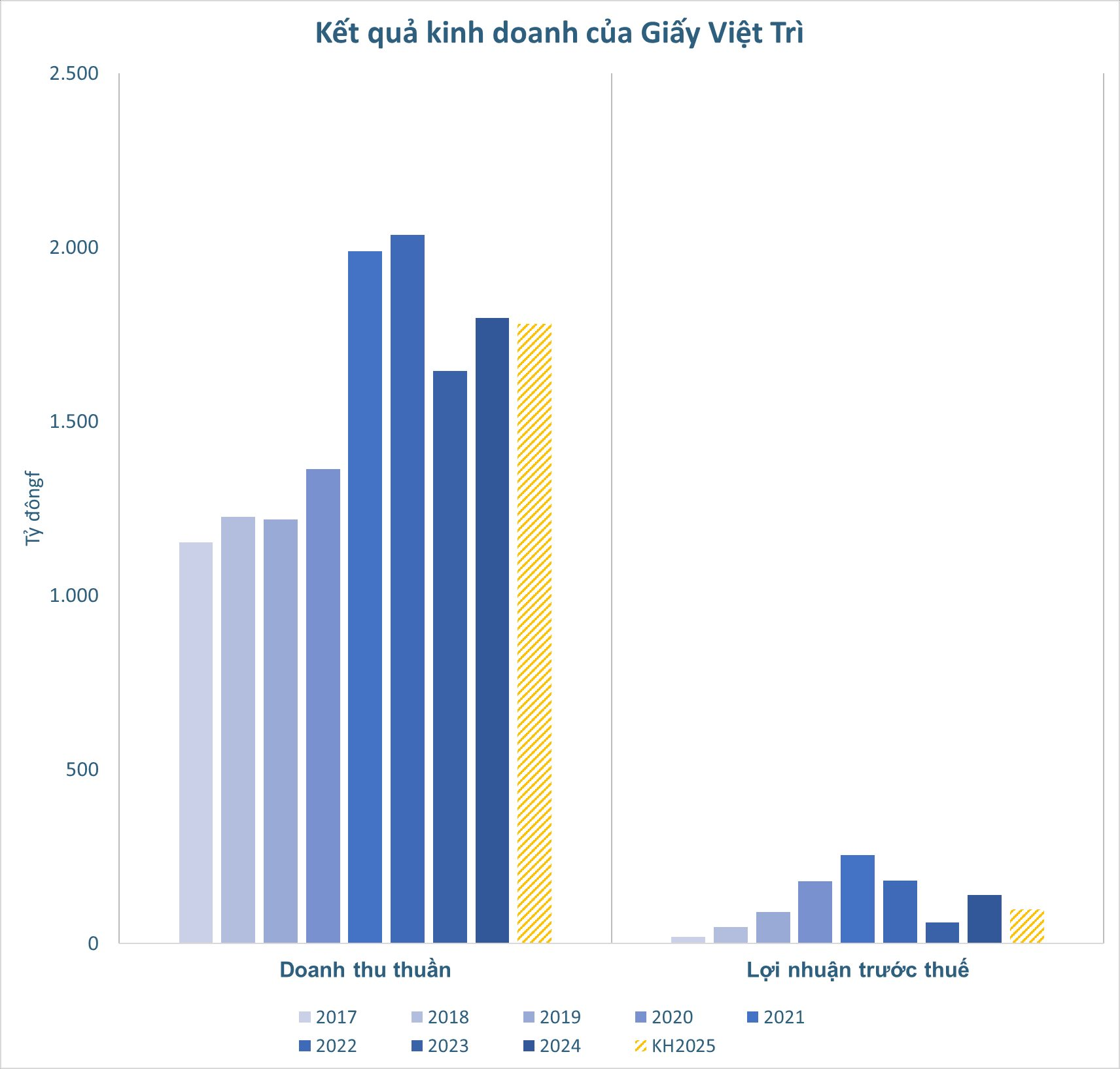

GVT’s business performance has been relatively stable. In 2024, its net revenue reached approximately VND 1,800 billion, a 9% increase year-over-year. Profit after tax witnessed a remarkable surge of 232%, amounting to VND 139 billion. For 2025, the company targets a production volume of over 160,000 tons, with net revenue and profit after tax expected to reach VND 1,780 billion and VND 98 billion, respectively. The planned dividend ratio for this year is above 35%.

In the stock market, GVT shares have been trading lacklusterly, often with low or no trading volume. The current market price stands at VND 78,000 per share.

“The Approval of the Listing of Nearly 312 Million TAL Shares of Taseco Land on HoSE”

The HoSE has approved the listing of 311.85 million TAL shares of Taseco Land, amounting to a total face value of VND 3,118.5 billion.

“MWG Announces Nearly VND 1,500 Billion Cash Dividend Payout”

The Mobile World Investment Corporation (HOSE: MWG) has announced a cash dividend payout of 10% (VND 1,000 per share), with a record date of July 24th. This marks a significant increase from the previous two years’ dividend rate of 5%.