Boosting Voluntary Social Insurance Support

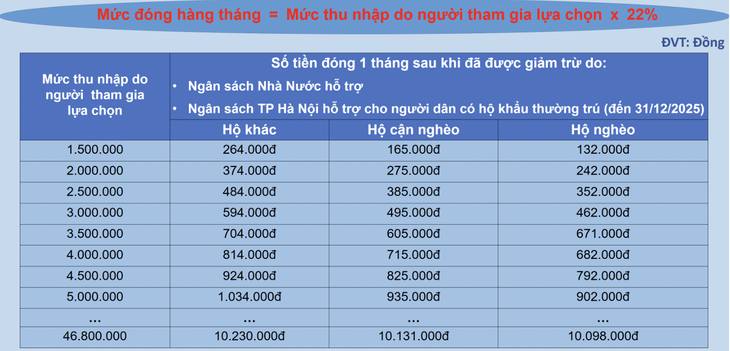

According to Decree No. 159/2025/ND-CP, which took effect on July 1st, and elaborates on the Law on Social Insurance regarding voluntary social insurance, the state will support participants’ contributions as a percentage of the rural poverty line.

Voluntary Social Insurance Contribution Levels in Hanoi – Image: Social Insurance Area 1

Specifically: 50% for participants from poor households, those living in island or special districts; 40% for near-poor households; 30% for ethnic minority participants; and 20% for other participants.

If a participant falls into multiple eligible categories, they will receive the highest applicable support level.

The maximum support period is 10 years (120 months), depending on the actual participation time of each individual in voluntary social insurance.

The decree also encourages agencies, organizations, and individuals to provide additional support to participants. In addition to the central support, the provincial/municipal People’s Committees can decide on supplementary support levels, depending on the local budget and socio-economic development conditions.

Eligible participants will pay their contribution share to the social insurance agency or authorized collection organization. The social insurance agency will periodically consolidate the information and send it to the financial agency to transfer the support funds from the budget to the social insurance fund.

From July 1st, the voluntary social insurance contribution rate will be 22% of the income basis for pension and survivor benefits. Participants can choose to contribute periodically or in a lump sum.

Contribution methods include monthly, quarterly, semi-annual, annual, or multi-year contributions (not exceeding 5 years at a time). For one-time contributions, participants can pay for the missing years (not exceeding 10 years).

Also, from this date, in addition to the retirement pension, voluntary social insurance participants will be entitled to new regimes and benefits. These include maternity benefits of VND 2 million per child for pregnancies of 22 weeks or more, but resulting in fetal death. The condition is that the participant has contributed to social insurance for at least 6 months in the 12 months before giving birth.

They will also receive a free health insurance card (with up to 95% coverage for medical examination and treatment costs) and a funeral allowance for their relatives equivalent to 10 times the base salary (after participating for 5 years or more), i.e., VND 23.4 million.

According to Vietnam Social Insurance, the number of social insurance participants as of the end of May reached approximately 19.5 million, an increase of 12% compared to the same period in 2024. Of these, over 17.4 million were compulsory participants (an increase of nearly 9%) and more than 2.1 million were voluntary participants (an increase of about 46%).

How Many Paternity Leave Days Are Granted to Male Workers in Vietnam Starting July 1st?

As of July 1st, 2025, the new Social Insurance Law comes into effect, bringing with it a host of new employee-friendly policies. One of the most notable changes is the extended paternity leave for husbands, a progressive step towards supporting new families.

The Big Pay Out: Announcing the July 2025 Schedule for Hanoi’s Social Insurance Payouts, Totaling 4,000 Billion VND in Pension and Benefit Payments.

The operational structure of Hanoi’s government will not impact the social insurance payment schedule. From the 1st of July onwards, the city will implement a two-tier administration system, ensuring seamless and efficient governance. This strategic reorganization aims to enhance the city’s management and service delivery without causing any disruptions to the existing social security framework.