As of July 1st, 2025, the Value-Added Tax Law No. 48/2024/QH15, issued by the National Assembly on November 26th, 2024, officially takes effect.

According to the new regulations, certain activities in the securities sector that were previously tax-exempt will now be subject to a 10% VAT rate. As a result, many securities companies have announced adjustments to their service fee schedules to comply with these changes.

Securities SHS was among the first to update investors about the application of VAT on select services from July 1st, 2025, in accordance with the new Law. The taxable services include securities custody, transfer, withdrawal, derivatives clearing, and margin asset management.

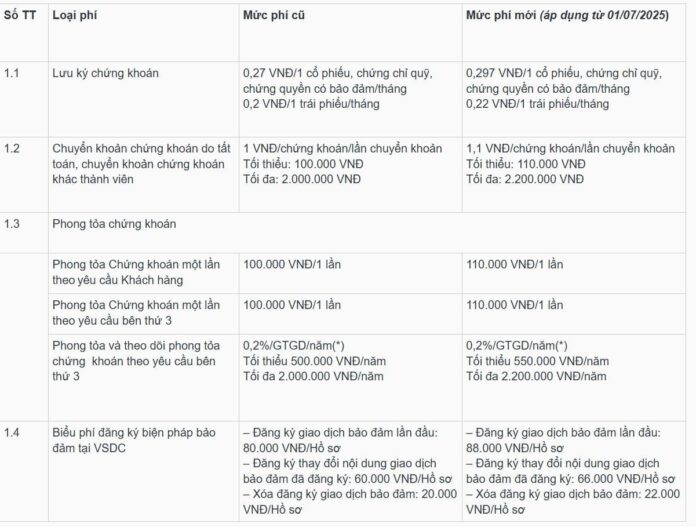

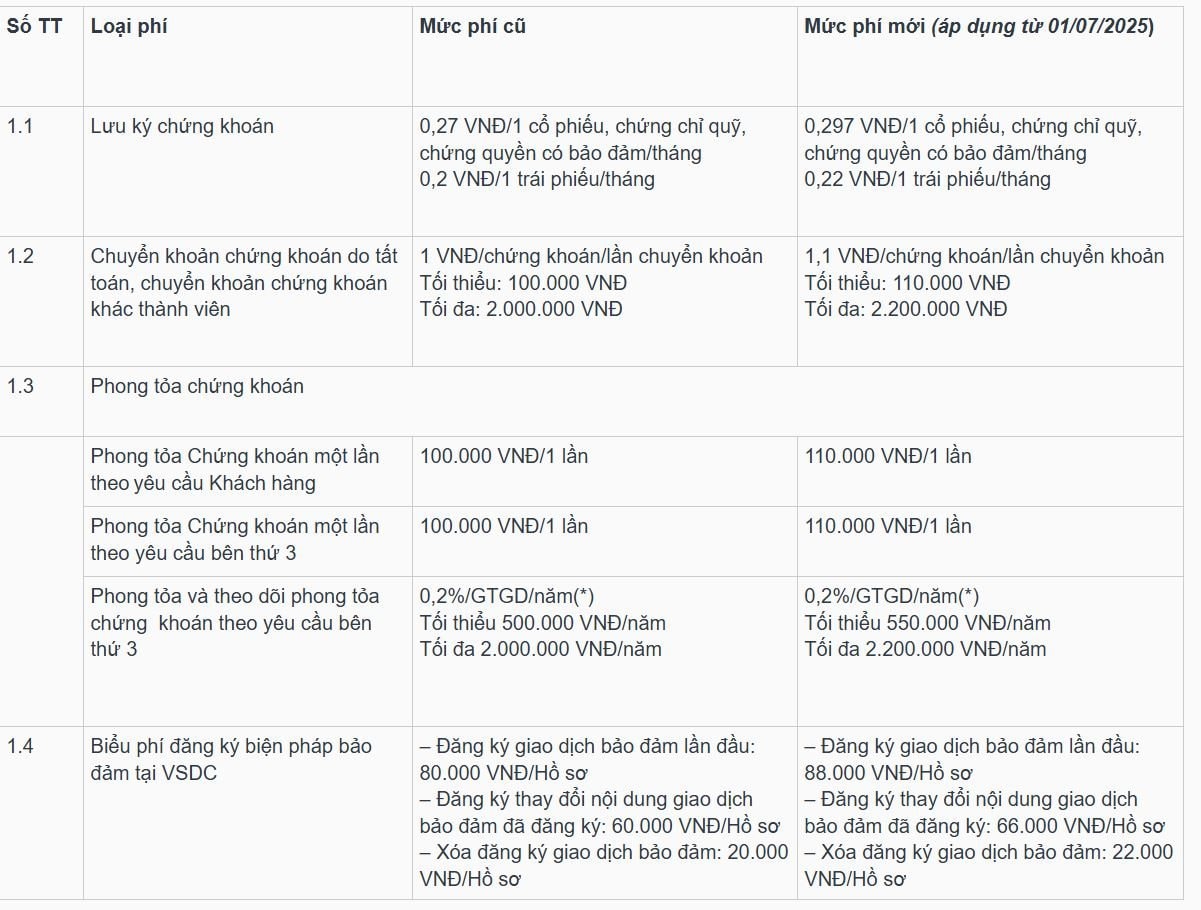

Correspondingly, the fees have been adjusted to account for the 10% tax rate. Specifically, the fee for stock, fund certificate, and warrant custody has increased from 0.27 dongs to 0.297 dongs per share per month; the withdrawal fee has risen from 0.2% to 0.22% of the value of securities; and the transfer fee for the transferring party has gone up from 0.25% to 0.275%.

Other services, such as transfer fee for the purchasing party, on-demand securities transfer, clearing, and margin asset management, have also been adjusted upward to include VAT.

Fees that are not subject to taxation, such as inheritance file processing, account closure, and SMS fees, remain unchanged.

Vietnam Joint Stock Commercial Bank for Industry and Trade Securities Company (VCBS) will collect an additional 10% VAT on fees for securities custody, margin asset management for securities derivatives, clearing of derivatives positions, securities transfer, and securities blocking at VSD from customers.

Similarly, Dragon Capital Securities Joint Stock Company (VDSC) has also announced corresponding increases in line with the 10% tax rate for certain fees.

VNDIRECT’s announcement of fee increases from July 1st, 2025

Taxes and Fees in Securities Trading

Securities Trading Fee: This is a fee paid when buying and selling stocks successfully. It is charged by securities companies based on a percentage of the daily transaction value. Investors pay this fee for both buying and selling. This fee accounts for the majority of the taxes and fees that investors need to pay in securities trading.

Income Tax on Stock Sales: When transferring stocks, investors must pay an income tax of 0.1% of the stock sale value. This tax is only levied on the seller, not the buyer.

Securities Custody Fee: When purchasing and owning stocks, an organization will act as a custodian, holding those stocks in trust. Custody also certifies your ownership of shares in a company. In Vietnam, the State and the Vietnam Securities Depository Center are responsible for this task. Under the previous regulations, the securities custody fee was 0.27 dongs per share per month.

Income Tax on Cash Dividends: Cash dividends refer to the profits distributed by a company to its shareholders after a year of profitable operations. As these dividends are a source of income for investors, they are taxable. According to regulations, a 5% tax is levied on the value of cash dividends.

Other Taxes and Fees in Securities Trading: These include Ownership Transfer Fee, Advisory Fee, Deposit Fee, Withdrawal Fee, Securities Transfer Fee, Re-issuance Fee of Share Ownership Certificate, Securities Blocking Fee, Securities Account Opening Fee, Confirmation Fee of Securities Account Balance, Securities Account Maintenance Fee, Securities Transaction Statement Fee, and more.

“PM Requests JBIC to Facilitate Financial Restructuring for the Nghi Son Refinery and Petrochemical Project”

The Nghi Son Refinery and Petrochemical Complex Project (NSRP) is undergoing a comprehensive restructuring by the Government of Vietnam. As the leading financier, JBIC is urged to continue taking a central role in addressing challenges and paving the way for Phase 2. The Prime Minister calls for a spirit of transparent cooperation, effectiveness, and shared risk management to guide this endeavor.

“More Individuals to Receive Free Health Insurance Cards from July 1st”

The amended Health Insurance Law, effective from July 1st, increases the number of groups eligible for full state-funded coverage to 20. This change significantly lightens the financial burden on citizens by ensuring that a larger portion of the population has their healthcare expenses fully covered by the government.

“The End of an Era: What Happens to Your Money When This Type of ATM Card is Phased Out on July 1st?”

As of July 1st, 2025, a particular type of ATM card will no longer be accepted across all banks. This raises an important question: what will happen to the funds in your account if you don’t make the necessary transitions by the given deadline?