Considering FTS’s closing stock price of VND 37,200 per share on June 27, it is estimated that CEO Nguyen Diep Tung could have pocketed approximately VND 26 billion, while reducing his holdings from nearly 6.2 million shares (1.78%) to almost 5.5 million shares (1.58%).

Interestingly, this stock sale occurred just days after FPTS’ executives purchased over 161,000 shares out of nearly 10 million shares offered through the 2025 employee stock ownership plan (ESOP).

Mr. Nguyen Diep Tung – CEO of FPTS

|

The 2025 ESOP issuance concluded on June 25 with the participation of 60 personnel holding significant roles within the FPTS organization. Several leaders who bought substantial amounts of shares include Chairman of the Board and Vice President Nguyen Van Dung, who purchased nearly 530,000 shares, Vice President Nguyen Thi Thu Huong with almost 535,000 shares, Ho Chi Minh City branch director Tuong Nu Thu Lan with over 348,000 shares, and Securities Services Division deputy director Nguyen Thi Hong Linh, who bought more than 302,000 shares.

The nearly 10 million ESOP shares from 2025 are expected to be transferred in the second or third quarter of 2025, with half of them becoming freely transferable after one year from the issuance end date and the remaining half after two years.

With an issuance price of VND 10,000 per share, FPTS’ executive team secured a considerable discount, paying less than 27% of the current market price. Recently, FTS’s market price has shown signs of recovery following a sharp drop in early April due to tariff-related shocks.

| FTS Stock Rebounds After Tariff Shock |

Not long before, in May 2025, FPTS simultaneously implemented two plans: a 5% cash dividend for 2024 (VND 500 per share), amounting to nearly VND 153 billion paid out on June 12, and a 10:1 stock bonus, resulting in nearly 30.6 million new shares.

With the completion of the stock bonus and ESOP programs, the company’s chartered capital has increased to nearly VND 3,465 billion, a roughly 13% rise.

The topic of capital increase was a hot issue at FPTS’ 2025 Annual General Meeting of Shareholders, where shareholders questioned the company’s decision to not engage in aggressive capital hikes like many other securities companies in the market. In response, CEO Nguyen Diep Tung asserted that capital increases must be accompanied by efficient capital utilization plans, and without concrete strategies, capital raising may not be a prudent option.

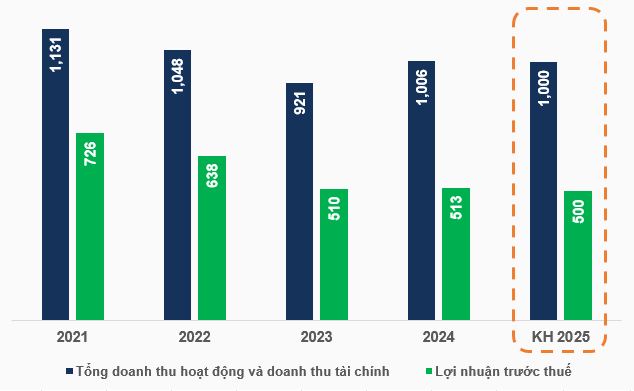

For the 2025 business plan, FPTS aims for VND 1,000 billion in revenue from business and financial activities, a slight decrease from the 2024 performance, and VND 500 billion in pre-tax profits, representing a 2.5% decline. This profit target reflects FPTS’ cautious approach, as the 2025 plan’s projected profit is the lowest compared to the years 2021-2024.

According to the CEO, the company’s plan takes into account the market conditions for the year, including the impact of zero-fee policies adopted by securities companies, which will reduce brokerage revenue, as well as decreased margin lending rates.

|

FPTS adopts a cautious approach for its 2025 business plan

Unit: Billion VND

Source: VietstockFinance

|

– 10:05 30/06/2025

“FPTS Insiders Plan to Offload a Massive 700,000 FTS Shares: What Does This Mean for Investors?”

Mr. Nguyen Diep Tung, a member of the Board of Directors and CEO of FPTS, has registered to sell 708,676 FTS shares to meet his personal financial needs.