European Businesses: Optimism Amidst Unforeseen Challenges

BCI Index Reflects Resilience and Long-term Confidence of European Businesses in Vietnam

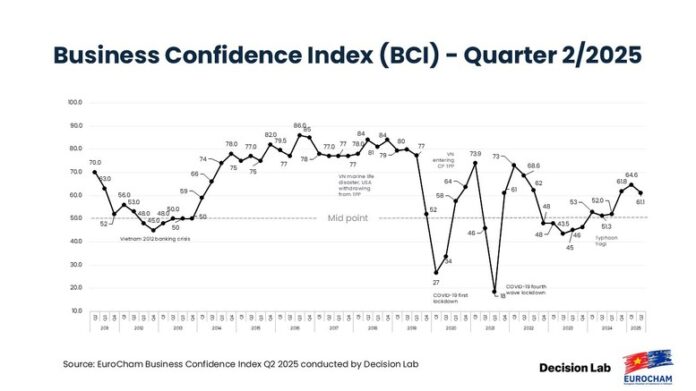

The Business Climate Index (BCI), published by the European Chamber of Commerce in Vietnam (EuroCham) on June 30, 2025, stands at 61.1, a slight dip from the previous quarter. However, the overall trend indicates the resilience and long-term confidence of European businesses in Vietnam, despite a volatile global context.

According to Bruno Jaspaert, Chairman of EuroCham, nearly 72% of European business leaders are willing to recommend Vietnam as an investment destination. This figure showcases a steadfast belief in Vietnam’s investment environment.

The report also reveals that most businesses have maintained financial stability, despite international trade being dominated by risks such as US countervailing duties, supply chain tensions, and geopolitical fluctuations. Only 15% of businesses reported negative financial impacts, while 70% saw no clear impact, and 5% turned a profit.

One aspect that businesses consider especially important in today’s trading environment is the Certificate of Origin (C/O). It is not just a tool for accessing preferential tariffs but also a demonstration of compliance and credibility in the global supply chain.

The BCI survey found that up to 56% of businesses, mainly large corporations, have submitted monthly C/O documents. Of these, 5% received their C/O within 24 hours, while 12% experienced delays of more than a week.

Previously, from May 5, 2025, the Ministry of Industry and Trade officially took over the C/O issuance process and promoted digital transformation. This move was positively evaluated by the business community as it reduces red tape and enhances transparency.

“Digital transformation is a strategic step in positioning Vietnam as a trusted trading partner. The Certificate of Origin is a symbol of trust and credibility in target markets,” emphasized Mr. Jaspaert.

Businesses Call for Transparent and Stable Policies

The BCI report for Q2 shows a cautiously optimistic trend. 78% of businesses expect business conditions to improve over the next five years, a 7% increase from Q1. However, in the short term, confidence in economic stability for Q3 2025 has dipped to 50%. According to Thue Quist Thomasen, CEO of Decision Lab, this is not a pessimistic sign but reflects a cautious attitude amidst global fluctuations.

39% of businesses remain neutral, 43% give positive assessments, and only 11% predict a gloomy outlook. Stable economic growth, a young population, and a wide network of trade agreements continue to bolster faith in Vietnam’s long-term appeal.

While Vietnam has made progress in macroeconomic reforms, European businesses still face challenges in implementation. Red tape is identified as the primary obstacle by 63% of businesses, followed by inconsistent law enforcement (44%), complex customs procedures (34%), and work permit procedures (33%).

Notably, the lack of an appropriate mechanism for foreign legal representatives in VNeID account registration is a technical issue that needs to be addressed promptly.

“Reform should not merely focus on reducing paperwork. There is a need to establish a transparent and predictable legal framework, along with effective coordination between relevant authorities,” shared the EuroCham Chairman.

EVFTA: Achievements and Remaining Gaps

Five years into its implementation, the Vietnam-EU Free Trade Agreement (EVFTA) has yielded positive results. 66% of businesses surveyed in the BCI report are engaged in trade or supply chains related to EVFTA.

According to Mr. Jaspaert, 98.2% of businesses are aware of EVFTA, and nearly half report medium to high business benefits. Larger corporations often see more explicit advantages, especially in the EU-to-Vietnam direction. Meanwhile, small and medium-sized enterprises play a pivotal role in promoting two-way trade.

The proportion of businesses identifying tariff preferences as a prominent benefit surged from 29% (Q2 2024) to 61% (Q2 2025). Vietnam-EU trade turnover has increased by 40% since 2020. Among the 21% of businesses able to quantify profits, the average increase stood at 8.7%, with some reaching 25%.

Alongside the advantages, EuroCham also candidly pointed out remaining barriers to fully harnessing EVFTA. 37% of businesses cited customs valuation as the most significant challenge due to differences in goods classification between Vietnam and the EU. Unclear legal issues and limited communication with local authorities also hinder the full utilization of the agreement.

Businesses proposed solutions, including simplifying import procedures, increasing digital technology applications, allowing for self-certification of origin, and providing more consistent customs implementation guidance.

In conclusion, the BCI Q2/2025 reaffirms Vietnam’s position as a top investment destination for European investors. However, maintaining this trust requires continuous reform and substantive responses to recommendations from businesses.

“European businesses know exactly what they need: streamlined procedures, harmonized regulations, convenient work permit issuance, tax refunds, and transparent customs procedures. With strong reform commitments, Vietnam can become the strategic investment hub of the region,” emphasized the EuroCham Chairman.