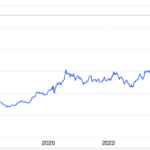

Gold Prices Dip for a Second Straight Week

After a week of geopolitical tensions not flaring up as anticipated, economic data continues to cool, and speculative buying power for gold seems to have waned. Gold prices dipped below the $3,300 per ounce mark.

Independent precious metals analyst Jesse Colombo, author of the Bubble Bubble report, believes that with the US-China trade framework finalized and a ceasefire agreement between Israel and Iran in place, investors are rushing back to riskier assets and pulling funds from safe-haven investments. This market sentiment could further pressure gold prices downwards in the coming week.

“Overall, gold is turning negative, heading towards its second consecutive weekly loss. If it closes the week below $3,300 per ounce, prices could retreat to $3,250 per ounce and even the psychological level of $3,200 per ounce. Conversely, if it climbs back above $3,300 per ounce, gold could recover to the $3,330 – $3,360 per ounce range,” he added.

Senior commodities broker at RJO Futures, Daniel Pavilonis, also opined that the gold market is witnessing a significant shift as the factors that once supported the precious metal’s price are gradually weakening.

Gold prices could dip for a second straight week. (Illustrative image: Minh Đức)

Pavilonis believes that geopolitical issues and tariffs will continue to ease, even as expectations of Federal Reserve interest rate cuts and concerns about the agency’s independence increase.

“I think many of the drivers of gold demand in recent times will start to subside, and we could see lower oil prices. This indicates that gold’s safe-haven appeal is diminishing as global tensions cool down,” Pavilonis assessed.

The expert noted that gold prices are currently range-bound, and there is a shift in preference towards other metals. Investor appetite has changed, and they are seeking profits in other assets with higher growth potential.

“The same forces that drive money into and out of the US dollar are the reasons for money flowing into and out of gold as a safe haven. Things are becoming more normal, and money will flow less into gold and more into the dollar. The most significant driver of gold’s recent rally was the potential escalation of conflict between Israel and Iran,” he analyzed.

This week, out of 17 analysts polled by Kitco, six, or 35%, predicted that gold prices would rise next week, nine, or 53%, forecast a price drop, and the remaining two, or 12%, expected prices to trade sideways.

Meanwhile, of the 231 retail investors surveyed, 119, or 51.5%, expected prices to climb, 63 (27.2%) predicted a decline, and the remaining 49 (21.3%) anticipated a sideways market.

Domestic Gold Prices Drop Slightly

Given the movement in global gold prices, experts believe that domestic gold prices in Vietnam could continue to fall but not significantly.

Nguyen Quang Huy, CEO of Finance – Banking (Nguyen Trai University), stated that while global gold prices fluctuate, whether domestic gold prices drop to the VND 100 million per tael mark or not depends on multiple factors and is not solely influenced by global prices.

In reality, there have been times when global gold prices dropped sharply, but domestic prices only decreased slightly or remained unchanged, and sometimes even increased. The fact that domestic gold prices are currently VND 14 million per tael higher than global prices illustrates this divergence.

Domestic gold prices are dropping at a slower pace. (Illustrative image: Minh Đức)

“The consumption habits of Vietnamese and other Asians, which include hoarding, accumulating, and saving gold as a defensive strategy, mean that even without high demand, a significant amount of money in the population is still being channeled into gold during times of price volatility,” said Huy.

Offering advice to domestic gold investors at this juncture, expert Tran Duy Phuong suggested that those who bought gold for asset accumulation purposes need not worry about selling at this time. Over time, gold prices will increase.

For those who invested in gold, the current price range is ideal for selling and taking profits.

“To determine the right time to sell gold, investors need to plan their expected profit margins and should be content with achieving their planned margins rather than regretting not selling at a higher price,” Phuong said.

He gave an example: “If we buy gold at VND 100 million per tael and set a profit target of VND 10 million per tael, then when the gold price reaches VND 110 million or VND 118 million per tael, as it is now, the profit target has been achieved or even exceeded, so investors should sell to lock in profits.”

“Don’t hold on to regrets about not selling at a higher price, as that can be very risky in a volatile context,” he analyzed.

The expert also advised that gold investors need to be cautious and thoroughly research the market to ensure they buy gold at the lowest possible price and sell at the highest possible price or their desired profit margin.

Sharing this view, economic expert Nguyen Tri Hieu suggested that investors with idle money should not focus solely on gold but should diversify their portfolios into other channels such as stocks, real estate, and bank deposits.

Conversely, for those with gold reserves who want to sell to lock in profits, they can calculate whether the current profit margin meets their set goals.

“If you invest in gold to make a profit, you need to set an annual profit target. This way, you can calculate the gold price at which you want to sell. When your profit target is achieved, you can sell to lock in profits,” Hieu advised.

The Price of Gold Continues to Fall: Experts Warn of Further Drops After Breaching Key Support Level

The global gold price continues its downward spiral, dipping below the $3,300 per ounce mark. This decline has had a ripple effect on domestic gold prices, which have also witnessed a significant drop.

Gold Ring and SJC Gold Prices Take a Sharp Downturn

The gold ring and SJC gold prices have taken a downturn, falling by almost one million VND per tael after a recent surge.