Vietnamese manufacturers continued to face weak demand in June, particularly in the export sector, as survey respondents cited US tariffs as a key factor behind a sharp drop in new orders from abroad. With new orders falling, companies reduced employment, purchasing activity, and inventory levels. However, output in the manufacturing sector continued to rise marginally, while business confidence improved.

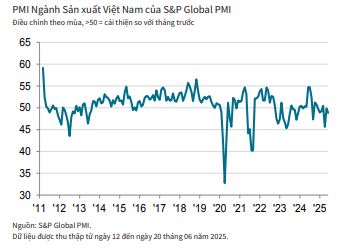

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index™ (PMI®) fell to 48.9 in June from 49.8 in May, signaling a slight deterioration in business conditions for the third consecutive month.

The key factor behind the sector’s worsening performance was a third successive monthly decline in new orders. New orders fell modestly in June, but at a faster pace than in May.

The drop in demand was particularly pronounced in export markets, as new orders from abroad decreased far more sharply than total new orders. In fact, the rate of reduction in new export orders was one of the fastest since September 2021, matching that seen in May 2023. Several respondents mentioned US tariffs as the reason for the decline in new export orders.

The fall in total new orders led to decreases in employment, purchasing activity, and inventory levels in June.

Employment fell for the ninth month running, and at a substantial and accelerated pace. Companies were able to reduce backlogs of work nonetheless, and at a strong rate.

Purchasing activity dipped slightly in June, following a similar rise in May, and fell for the third time in the past four months.

Both pre-production and finished goods inventories were lowered further at the end of the second quarter, with the rate of depletion in the former being the sharpest for nine months and in the latter for five months.

Despite weak demand, manufacturers continued to raise output in June, marking the second consecutive monthly rise, although only marginal and slower than in May.

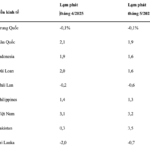

Input costs rose in June after falling for the first time in nearly two years in May, but only slightly and at a rate that was weaker than the survey average. Where input costs rose, survey respondents mentioned shortages of raw materials and the depreciation of the dong against the US dollar as causes.

Supply shortages also contributed to longer delivery times from vendors, while poor weather and transportation delays were among the factors leading to longer lead times. Vendor performance deteriorated sharply, and to the greatest extent since last February.

The rise in input costs led manufacturers to raise their selling prices, thereby ending a five-month sequence of reduction. However, the rate of inflation was only marginal. Finally, business confidence continued to recover from April’s 44-month low.

Hopes of a more stable market and reduced trade tensions were among the factors supporting optimism, although sentiment remained below the survey average.

Andrew Harker, Economics Director at S&P Global Market Intelligence:

“June saw a further weakening of international demand for Vietnamese manufactured goods as the impact of tariffs intensified. The sharp drop in exports contributed to a further fall in total new orders, leading companies to cut back on employment and purchasing activity.

A positive from the latest PMI survey was that companies continued to raise output, but this is unlikely to be sustained without an improvement in demand. The first half of 2025 has been characterized by volatility and uncertainty, especially regarding trade.

Business confidence has recovered to some extent in recent months, but positive sentiment is largely reliant on hopes of a more stable picture emerging in the coming months. We will have to wait and see if this actually comes to pass.”

– 07:55 01/07/2025

“CEO of KBC: Resolution 68 Provides a Breath of Fresh Air for Struggling Businesses”

“The birth of Decree 68 has unleashed and empowered large domestic private investors, including KBC,” said Ms. Nguyen Thi Thu Huong, CEO and Member of the Board of Management of KBC. “Previously, KBC was somewhat constrained, but now we have been infused with a boost of ‘oxygen’ to continue expanding our investments and taking on even larger projects.”

The Golden Rush: How Vietnam is Striking Gold and Rising as a Global Mining Powerhouse

China has significantly ramped up its imports of this particular commodity from Vietnam, witnessing a remarkable surge of 90% compared to the same period in 2024.