Trading activity slowed significantly in the afternoon session, with liquidity down 17% from the morning. Despite this, the market remained resilient, with stock prices inching higher, resulting in a cautious upward trend.

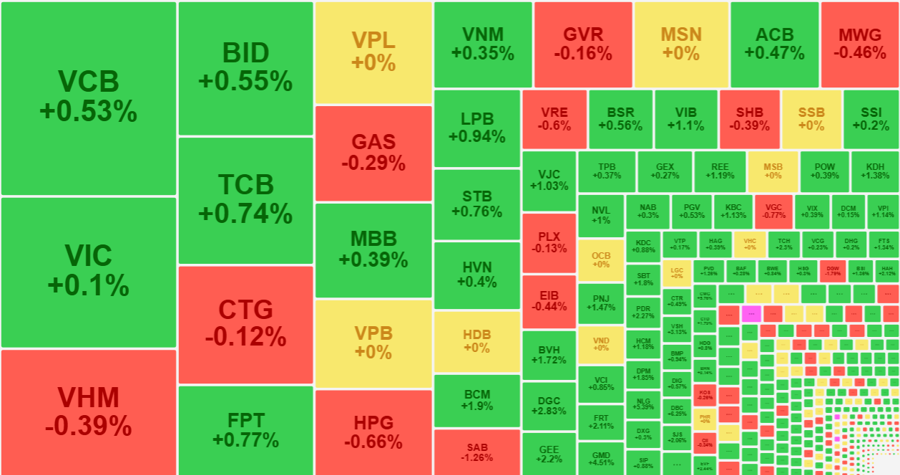

The VN-Index closed 4.63 points higher, or 0.34%, a slight decrease from the morning session (up 5.21 points). The breadth did not improve much, with 216 gainers and 92 losers. The price level remained similar, with 109 stocks closing above the reference price by more than 1% (compared to 95 in the morning).

Overall, the market fluctuated steadily, and even when buying power was not strong, sellers refrained from dumping their holdings. This positive situation reflects the market’s tendency to consolidate stably after breaking through the peak rather than being in a distribution phase.

This stability is attributed to the well-performing blue-chip stocks. Statistics show that out of this group, 10 stocks improved from their morning closing prices, while 15 declined. However, the price change range in both directions was very narrow. The only improving group was BCM, which gained 1.26%, while the declining group included SSI, which fell by only 1%. The narrow price movement range did not trigger a boom signal for the index, but it continued to rise slowly.

The VN30-Index closed 0.11% higher, underperforming the morning session (up 0.37%) due to some weakened pillars. TCB fell by approximately 0.87% from its morning closing price, still gaining a slight 0.74% from the reference price. VIC also dropped by 0.42%, rising by a mere 0.1%. FPT gave back 0.67% but managed a 0.77% increase. In reality, these fluctuations had little impact on the VN-Index due to the minimal price changes.

Among mid-cap and small-cap stocks, price performance improved much more noticeably than blue-chips. In the morning, the HoSE floor had about 40 stocks rising over 2%, and in the afternoon, this number reached 60. Several stocks in this group witnessed excellent liquidity in the “hundred billion” range, including ANV, DBC, NLG, GMD, HDC, DGC, CSV, EVF, TCH, PDR, HAH, and FRT. This lengthy list indicates that despite the overall market liquidity decline, there is still sufficient capital flowing into specific stocks, resulting in impressive price performance. Investors are focusing on particular stocks, and as long as the VN-Index is maintained by blue-chips, regardless of the magnitude of the increase, there are opportunities for capital activity.

The representative index of the mid-cap group closed 1.1% higher than the reference price, outperforming the morning session. While the total matched order value on the HoSE floor decreased by 6% compared to the previous day, the mid-cap group increased by 13%, and the VN30 decreased by almost 10%. Small-cap stocks also saw a 9% increase in trading. This shift in capital flow to mid-cap and small-cap stocks can explain the VN-Index’s sideways upward movement in recent days. Despite the strong performance of many mid-cap and small-cap stocks, their ability to lead the index is very limited. For instance, DGC’s 2.83% increase, GMD’s 4.51%, NLG’s 5.39%, and GEE’s 2.2% rise only contributed less than one point (0.86 points) to the index. In contrast, VCB’s almost insignificant 0.53% gain brought nearly 0.6 points. The weakened TCB and FPT, which were the strongest pillars in the morning session, were a significant disadvantage for the VN-Index in the afternoon.

HoSE floor liquidity in the afternoon session decreased by 17% from the morning, reaching 7,459 billion VND, while VN30 decreased by 38.1% to 3,340 billion VND. Such a substantial decline in liquidity among blue-chips without a significant negative impact on prices is a positive outcome. Despite large investors reducing their trading intensity in this group, they did not sell much.

Foreign investors continued to invest evenly in the afternoon, with net value increasing by approximately 389.7 billion VND on the HoSE floor. MSN witnessed impressive additional purchases, with net buying of about 69.5 billion VND in the morning and 149.9 billion VND at the end of the session. NLG and DBC, which were heavily bought in the morning, also performed well in the afternoon, with net buying of 128.7 billion VND and 105 billion VND, respectively. VND, MWG, and HDC, which were not actively bought in the morning, saw net buying of 99.5 billion, 50.7 billion, and 41.2 billion VND, respectively, in the afternoon. On the selling side, HPG stood out with net selling of -87.1 billion, followed by VHM (-58.5 billion), BID (-35.3 billion), KDH (-32.6 billion), SAB (-29.5 billion), and ACB (-29.3 billion).

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)