Colusa – Miliket Joint Stock Food Company (stock code: CMN) has just announced the minutes of its 2025 Annual General Meeting of Shareholders. The meeting was held on June 20, 2025. The company owns the famous “two shrimp” instant noodle brand in Vietnam.

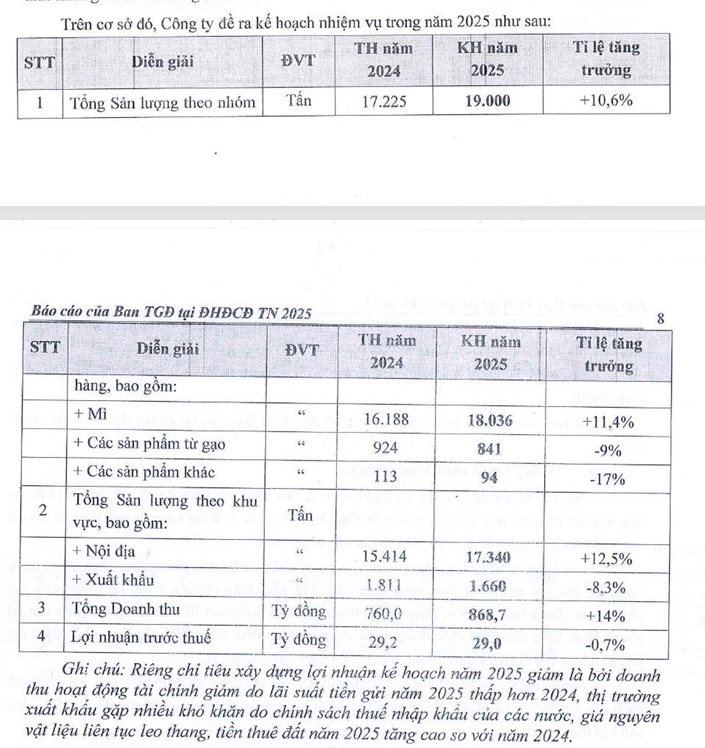

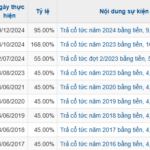

At the meeting, the company’s leaders passed several important issues. In 2024, Miliket achieved a revenue of VND 760 billion and a pre-tax profit of VND 29.2 billion, completing 99% and 108% of its targets, respectively. The company’s total output for 2024 was VND 17,225 billion, completing 91% of its plan.

Cash dividend payout of 13%

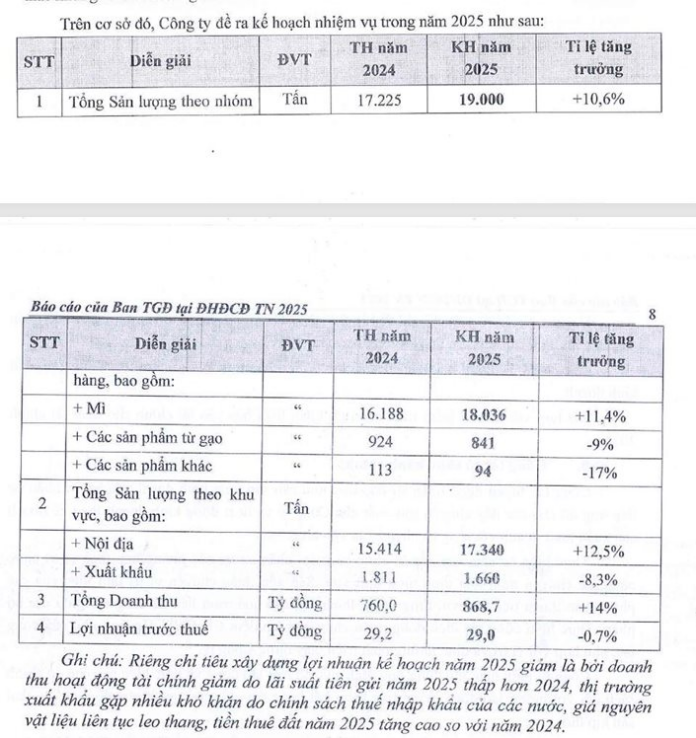

The meeting approved a 2024 dividend payout of 13% in cash, equivalent to VND 1,300 per share, half of the planned 26%. With this payout ratio, the company expects to spend VND 6.24 billion on this dividend payment.

In previous years, Miliket maintained a dividend of VND 2,600 per share for two consecutive years, 2022 and 2023, and regularly paid dividends ranging from 17-33% since its listing on UPCoM in 2017.

Explaining the decrease in dividends, the management board stated that they needed to retain profits to invest in machinery repairs, meet increasing export orders, and prepare for a new factory plan. According to Ms. Luu Thi Tuyet Mai, Chairwoman of CMN, this payout ratio is still higher than bank deposit interest rates in the context of fierce domestic market competition.

2025 Business Plan

For 2025, the company sets a target of VND 868.7 billion in total revenue, a 14% increase from 2024. Pre-tax profit is projected to decrease slightly by 0.7%, reaching VND 29 billion. The company’s output target for 2025 is set at 19,000 tons, representing a 10.6% growth.

Restructuring and Phasing Out Traditional Products

In 2025, the company’s management predicts geopolitical instability and unpredictable developments worldwide, significantly impacting export and import activities due to increased sea freight costs, trade protectionism, exchange rates, and technical trade barriers.

In response to this situation, the company has continuously improved product quality and introduced new products that cater to consumer preferences. They have also completed the SAP Business One enterprise management software implementation to manage the company’s production and business activities. Additionally, they plan to deploy sales management software solutions across the company’s sales system.

Miliket aims to focus on developing modern sales channels to enhance the position of Colusa-Miliket products in the market. Simultaneously, the company is reviewing its domestic sales strategy to reposition the brand. They are also expanding their export markets, with a particular emphasis on directly introducing Colusa-Miliket products to the global market.

Furthermore, the company is finalizing the pre-feasibility study report for the investment project to relocate the southern factory, and a report will be submitted to the General Meeting of Shareholders.

General Director Tran Hoang Ngan shared that the company is implementing a series of changes to improve operational efficiency. They have restructured their personnel, invested in additional production equipment for the processing area in the North, and plan to discontinue the production of Mi Ky, a characteristic but financially unviable product.

The Miliket brand was once the “king” of instant noodles in Vietnam, known for its distinctive kraft paper packaging featuring two red shrimp. While the company used to hold a 20% market share in the domestic instant noodle market, it now accounts for only about 2%. This situation has prompted the company to enter a comprehensive restructuring phase.

Gemadept Confirms Record Dividend Payout of Over 840 Billion VND for 2024

Gemadept is about to dish out an impressive 840.4 billion VND as dividends for its shareholders for the year 2024. The company has announced a generous 20% payout ratio, with the record date set for July 10, 2025, and payments to be made on July 17, 2025.

“MAC Plaza Shareholders Approve Cash Dividends, Halving Last Year’s Record High”

Joint Stock Company Equipment (UPCoM: MA1), the proud owners of MAC Plaza – a bustling commercial center located at 10 Tran Phu, Ha Dong, Hanoi – has just announced a thrilling opportunity for shareholders. The company has declared a generous cash dividend for the year 2024, offering a substantial 15% dividend rate, equivalent to VND 1,500 per share. Mark your calendars, as the ex-dividend date falls on July 7th, and the anticipated payment date is scheduled for July 21st.

What’s Going On: Three Securities Firm Leaders Simultaneously Resign

“In a move that precedes the annual general meeting of this securities company, scheduled for June 27th, significant developments are underway.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)