The VN-Index closed the 26th trading week of 2025 at 1,371.44 points, a 1.64% increase from the previous week, with a slight decrease in liquidity (-1.5%).

The average matched order value on the HOSE reached 18,239 billion VND in week 26, 7.8% lower than the 5-week average. In terms of market capitalization, liquidity decreased for both large and small caps, while their price performance was mixed. Specifically, the large-cap VN30 index recorded an impressive 2.84% gain, while the small-cap VNSML index slightly declined by 0.24%.

On the other hand, the mid-cap segment displayed positive signals with improvements in both points and liquidity.

By sector, liquidity decreased in Banking, Real Estate, Steel, Chemicals, Oil & Gas, and Information Technology; among these, only Banking and Oil & Gas sectors witnessed point decreases. Conversely, Securities, Construction, Agriculture & Seafood, Food & Beverage, Retail, Electrical Equipment, and Textiles simultaneously enhanced their points and liquidity, indicating positive money flow signals.

Across the three exchanges, the average trading value per session in week 26 reached 23,942 billion VND, with the average matched order value per session at 20,344 billion VND, a 1% decrease from the previous week and a 7.5% drop compared to the 5-week average.

Foreign investors net sold 41.9 billion VND, with a net sell of 481.5 billion VND in matched orders. Their main net buy sectors were Basic Resources and Financial Services. The top net bought stocks by foreign investors included VND, SSI, HPG, VHM, CTG, MWG, MSN, CTR, DBC, and DGW.

On the sell side, their main sector was Banking. The top net sold stocks were FPT, STB, VCB, ACB, VPB, VCI, HCM, GMD, and VRE.

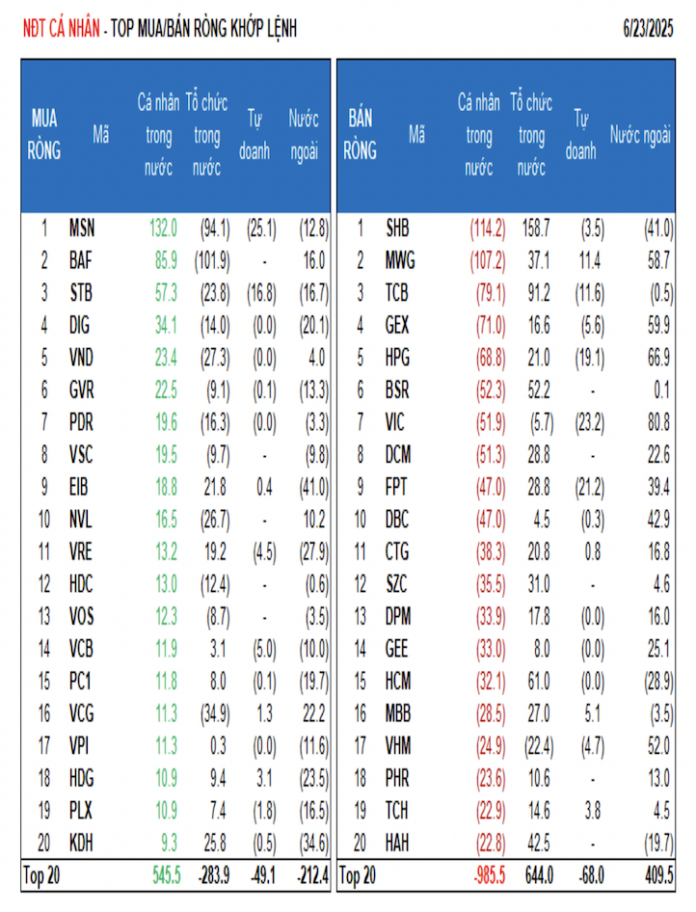

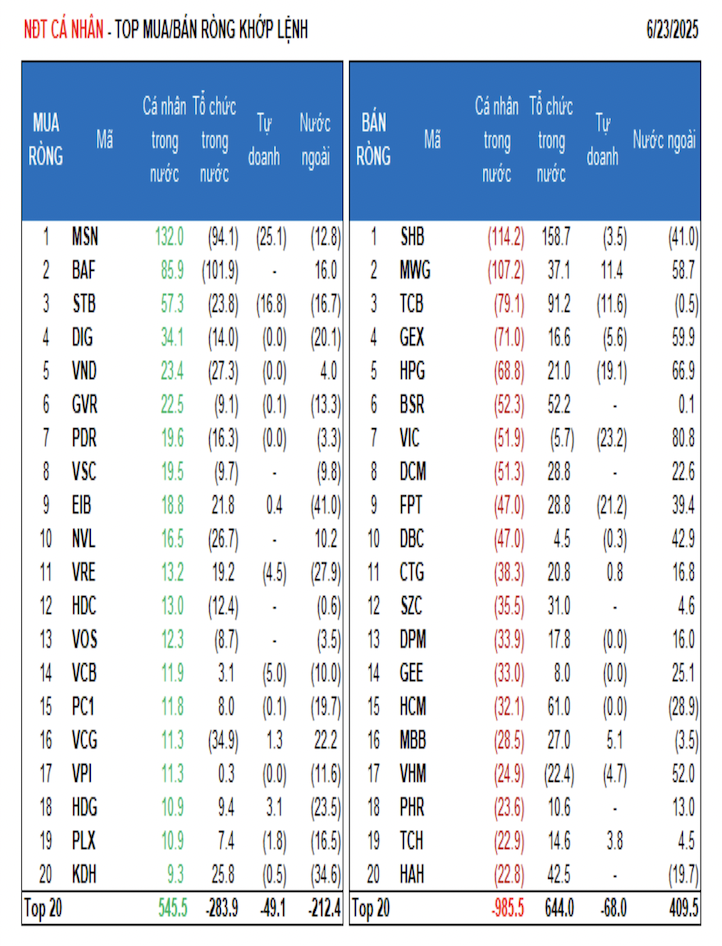

Individual investors net bought 845.2 billion VND, with a net sell of 229.8 billion VND in matched orders. In terms of matched orders, they net bought 7 out of 18 sectors, mainly in the Food & Beverage sector. Their top net bought stocks were MSN, STB, VPB, VIX, VNM, DIG, VHM, FPT, GMD, and EIB.

On the net sell side, they net sold 11 out of 18 sectors, mainly in the Industrial Goods & Services and Basic Resources sectors. The top net sold stocks included GEX, TCB, CTG, HPG, VND, KBC, MBB, SSI, and HAH.

Proprietary trading net bought 2,296.0 billion VND, with a net sell of 1,082.8 billion VND in matched orders. In terms of matched orders, proprietary trading net bought 5 out of 18 sectors. The Industrial Goods & Services and Personal & Household Goods sectors were their top net bought sectors.

Their top net bought stocks this week included ACB, GEX, MBB, PNJ, E1VFVN30, FUEVFVND, HDG, VPB, VHC, and SZC. Their top net sold sector was Real Estate. The top net sold stocks were HPG, TCB, MWG, VIC, STB, FPT, VHM, VIX, VNM, and SSI.

Domestic institutional investors net sold 3,099.3 billion VND, with a net buy of 1,794 billion VND in matched orders. In terms of matched orders, domestic institutions net sold 6 out of 18 sectors, with the highest value in the Food & Beverage sector. Their top net sold stocks were MSN, VHM, SS1, VND, BAF, DIG, VCG, ACB, CTR, and FTS. Their top net bought sector was Banking. The top net bought stocks were TCB, GEX, SHB, FPT, DXG, KBC, VIC, HAH, VCB, and HCM.

The money flow allocation ratio increased for Securities, Construction, Agriculture & Seafood, Food & Beverage, and Retail, while it decreased for Banking, Real Estate, Steel, Information Technology, and Oil & Gas.

Liquidity decreased in Banking, Real Estate, Steel, Chemicals, Oil & Gas, and Information Technology; among these, only Banking and Oil & Gas sectors witnessed point decreases. Conversely, Securities, Construction, Agriculture & Seafood, Food & Beverage, Retail, Electrical Equipment, and Textiles simultaneously enhanced their points and liquidity, indicating positive money flow signals.

For the Food & Beverage sector, the money flow allocation ratio improved for the third consecutive week, mainly due to the contribution of MSN stock, which saw impressive gains in both liquidity (+50% in matched order value) and stock price (+13.8%). Over a longer time frame (1 month), the money flow ratio into this sector has just emerged from a 10-month low, suggesting further recovery potential. Notably, the positive price performance of MSN is significantly supported by strong net buying from foreign investors, marking their fourth consecutive week of net buying.

Oil & Gas and Chemicals: The easing of geopolitical tensions in the Middle East weakened money flow into the Oil & Gas and Chemicals sectors, leading to a downward adjustment in stock prices within these groups.

Securities: The money flow allocation ratio recovered this week, similar to the previous week’s performance in the Banking sector. However, over a 1-month period, money flow into the Securities sector remains on a downward trend, indicating that the current recovery signal is relatively fragile and prone to reversal.

In terms of market capitalization, liquidity decreased for both large and small caps, while their price performance was mixed. Conversely, the mid-cap segment displayed positive signals with improvements in both points and liquidity.

During week 26, the money flow allocation ratio for the large-cap VN30 index reached 46.6%, down from 48.5% in week 25, as the average trading value per session (matched orders only) slightly decreased by 469 billion VND (-5.2%). Similarly, the small-cap segment witnessed a decrease in the average trading value per session by 199 billion VND (-11.2%), causing a slight drop in the money flow ratio to 8.6%.

In contrast, the money flow allocation ratio for the mid-cap VNMID index increased significantly in week 26, reaching 41.2% (compared to 36.8% in week 25).

Regarding price performance, the large-cap VN30 index recorded an impressive 2.84% gain, while the small-cap VNSML index slightly declined by 0.24%. On the other hand, the mid-cap segment showed positive signals with improvements in both points (+0.89%) and liquidity.