DBC Shares Surge as Dabaco Vietnam Group’s Profits Soar

After a period of stagnation, shares of Dabaco Vietnam Group (DBC) have surged since the beginning of June. Over the past month, DBC’s market price has risen 24% to reach a new peak of 34,000 VND per share, pushing the company’s market capitalization to a record high of nearly 11,400 billion VND.

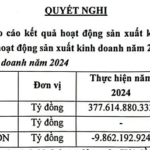

In a recent meeting with investors, Dabaco’s leadership attributed this success to sustained high pork prices, which have remained at 68,000 VND per kg in the North. As a result, the company expects to post an impressive profit after tax of around 500 billion VND for the second quarter, matching their performance in the first quarter. If estimates hold true, Dabaco’s profit after tax for the second quarter will be 3.5 times higher than the same period last year.

For the full year 2025, Dabaco has set ambitious targets, aiming for revenue of 28,759 billion VND and profit after tax of 1,007 billion VND. Looking further ahead, the company has even bolder aspirations, targeting revenue of 38,000-40,000 billion VND by 2030, representing a 150% increase compared to 2024. To achieve this, Dabaco plans to grow its profits by at least 7% annually.

Given their positive performance, Dabaco’s management is considering distributing dividends in the near future based on their strong results in the first half of the year. They attribute this success to sustained high pork prices, which they believe will remain around 60,000 VND per kg during the 2025/26 period due to the slow pace of herd rebuilding. In a recent report, KBSV assumed average pork prices of 68,000/62,000 VND during this period.

Riding on this favorable situation, Dabaco is expanding its sow herd, which currently stands at an estimated 58,000 animals. The company has set its sights on growing this number to 80,000 sows by 2028, a 70% increase compared to the end of 2024.

Phase 2 of the Oil Press Factory

Regarding the Group’s Phase 2 Oil Press Factory, with a crushing capacity of 1,000 tons of soybeans per day—double that of Phase 1—Dabaco’s leadership expects to double their revenue from this segment. Moreover, they anticipate improved profit margins thanks to modern technology enhancing the conversion rate.

In parallel, the company plans to invest in a pipeline connecting to the Can Tan Chi Port project to optimize transportation costs for soybean raw materials.

Vaccine Segment

On the vaccine front, Dabaco’s leadership shared that their Philippine partner is currently field-testing their products to demonstrate their effectiveness. Additionally, Dabaco is providing training to their partner’s personnel to ensure compliance with vaccination procedures.

Lac Ve Industrial Cluster and Real Estate Projects

Dabaco has received approval for their Lac Ve Industrial Cluster project, spanning 45 hectares, with completion expected in the 2027/28 period. Separately, the company has submitted proposals to relevant authorities for the development of a high-rise building complex for commerce, offices, hotels, and residential use on their 12.3-hectare headquarters site, in line with the approved planning for Bac Ninh province. The company’s management is optimistic about receiving approval for this project soon.

PVI Infrastructure Investment Fund Invests $7 Million to Become Major Shareholder in SGT

The Ho Chi Minh Stock Exchange (HoSE) witnessed a unique trading session on June 20th. A notable 10 million SGT shares changed hands, amounting to a substantial VND 170 billion in value. This intense trading activity resulted in a share price of VND 17,000, reflecting a 3% decline from the previous closing price of VND 17,600.

“Untapped Prime Property: Ocean Group’s Visionary Project in Hanoi”

With prime projects located in Hanoi and Ho Chi Minh City, the leadership at OGC is focused on overcoming legal hurdles. They are actively collaborating with authorities and partners to streamline procedures and bring these projects to fruition.

“MWG Announces Nearly VND 1,500 Billion Cash Dividend Payout”

The Mobile World Investment Corporation (HOSE: MWG) has announced a cash dividend payout of 10% (VND 1,000 per share), with a record date of July 24th. This marks a significant increase from the previous two years’ dividend rate of 5%.