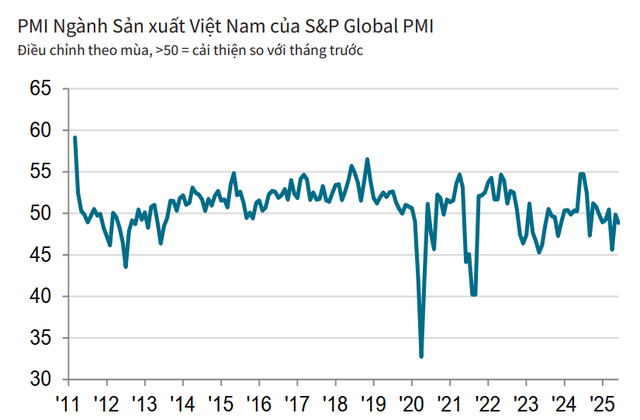

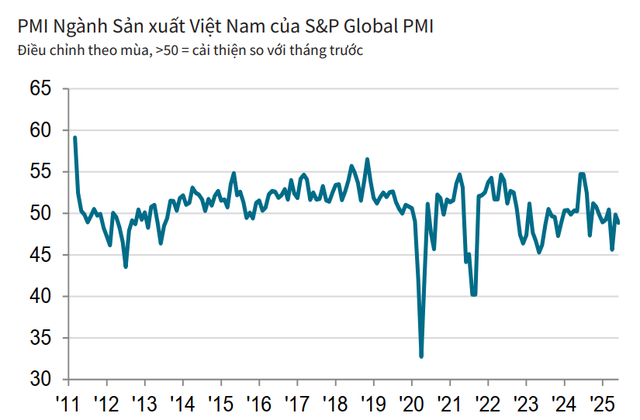

Vietnam’s manufacturing sector witnessed a decline in the Purchasing Managers’ Index (PMI) to 48.9 in June from 49.8 in May. This marks the third consecutive month of the PMI dipping below the 50-point mark, signaling a mild deterioration in business conditions during the first half of the year.

S&P Global experts attribute this overall decline in the health of the manufacturing sector to a decrease in new orders. Specifically, while new orders slightly decreased in June, the rate of decline accelerated compared to May.

The drop in demand was particularly pronounced in export markets as new orders from abroad fell far more sharply than total new orders. In fact, the rate of decline in new export orders matched that of May 2023.

“Some survey respondents mentioned US tariffs as the reason for the fall in new export orders,” the report noted.

This decline in total new orders led to reductions in employment, buying activity, and inventories in June. Employment decreased for the ninth straight month, with a far sharper drop than in the previous month. S&P Global specialists predict that companies may continue to substantially reduce backlogs of work. After a slight increase the prior month, buying activity faced a downturn. Meanwhile, stocks of both purchases and finished goods fell more sharply at the end of the second quarter.

Despite weak demand, manufacturers continued to increase output in June. Regarding input costs, the report revealed a slight increase in input prices during the month. This rise in input costs prompted manufacturers to raise their output charges. The reasons for this were attributed to material shortages and the depreciation of the Vietnamese dong against the US dollar.

The scarcity of supply also contributed to longer delivery times from suppliers, and bad weather and transportation delays were among the factors lengthening lead times. Vendor performance deteriorated significantly, witnessing the sharpest decline since February.

Lastly, business confidence continued to recover from April’s 44-month low. Hopes for a more stable market and reduced trade tensions were among the factors supporting the optimistic outlook, although confidence remained below the historical average for the index.

“June saw a weakening in international demand for Vietnamese manufactured goods as the impact of tariffs intensified. A sharp drop in exports contributed to a further decrease in total new orders, leading companies to cut back on employment and buying activity,” commented Andrew Harker, Economics Director at S&P Global Market Intelligence, on Vietnam’s June PMI results.

However, a positive aspect of this PMI survey, according to the expert, was the continued increase in output by companies.

“But this is unlikely to be sustainable if demand does not improve. While business confidence has recovered to some extent in recent months, the positive sentiment is largely based on hopes of a more stable picture emerging in the coming months. We’ll have to wait and see if this actually comes to pass,” assessed Andrew.

“KIS Research: April Macro View – Economic Resilience Amid Looming Challenges”

“Vietnam’s macroeconomic landscape remained positive in April, according to KIS Securities. However, early signs of a slowdown are emerging amid concerns over global tariffs. The country’s economic momentum is showing tentative signs of softening, with potential headwinds on the horizon.”

“Vietnam’s Manufacturing Sector Loses Momentum in Late 2024”

The Vietnamese manufacturing sector faced headwinds in the final month of 2024, as the Purchasing Managers’ Index (PMI) dipped from 50.8 in November to 49.8 in December, slipping below the 50-point threshold for the first time in three months. This indicates a mild deterioration in business conditions, presenting a challenging landscape for the industry as the year drew to a close.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)