|

Photo: FT montage/Getty

|

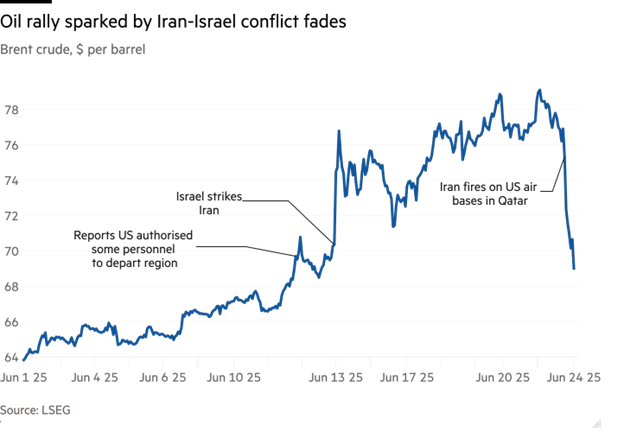

On June 23, as Iran launched missiles at a US airbase in Qatar, oil traders reacted with remarkable speed, not by buying but by selling.

Just seven minutes after the first missile was fired, around 5:30 pm London time, Brent crude, the international benchmark, started to plummet. It took just 20 minutes for the decline to reach 3%. By 7:30 pm, oil prices had dropped 7.2% to $71.48 a barrel, the biggest intraday fall in almost three years.

The sell-off in a market that usually spikes at the first sign of geopolitical turmoil took many by surprise. Even as civilians scrambled for cover and television channels broadcast images of missiles tearing through the sky, traders quickly realized that the attacks would defuse, rather than escalate, tensions between the US, Israel, and Iran.

“This was a staged scenario; we knew the base was empty. I knew from June 18 that the base had been evacuated,” said Jorge Montepeque, an oil analyst at Onyx Capital Group, in a text message soon after the attack began on June 23. “We’ve seen this movie before.”

Since the conflict between Israel and Iran erupted, oil traders have been closely monitoring social media and open-source intelligence to analyze the situation. “Everyone is in the same boat; we’re all following Twitter accounts, open-source intelligence, and any information that can help us understand the dynamics,” said an executive at a large oil trading company.

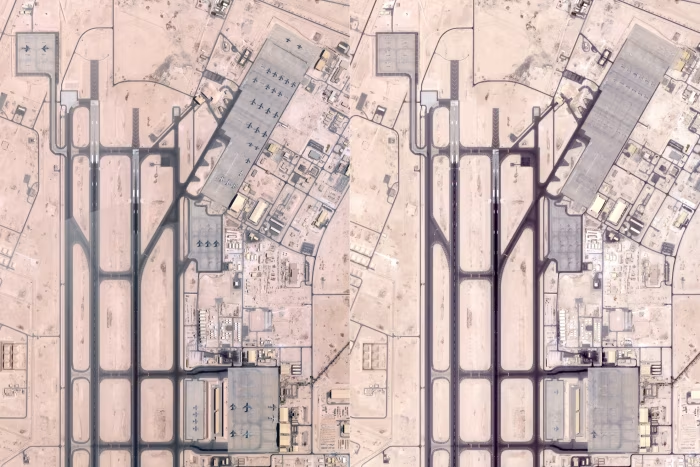

For example, traders have been analyzing satellite images of Al Udeid airbase in Qatar, home to 10,000 US troops. Satellite images showed the US had withdrawn planes from Al Udeid just days before launching airstrikes on Iran’s nuclear facilities over the previous weekend, as well as before Tehran’s retaliation on June 23.

|

Satellite images suggest the US may have withdrawn planes from Al Udeid airbase in Qatar between June 5 and 19. Photo: Planet Labs/AFP/Getty Images

|

This led traders to two conclusions: the missile launches were largely symbolic, and after retaliating to the US airstrikes on its nuclear facilities, Iran was unlikely to escalate further by attacking oil infrastructure, the region’s most vulnerable asset.

Oil flows from the region continued uninterrupted during the clashes, and Iran even increased its exports as it was unable to process as much crude domestically, according to energy consulting firm Rystad.

This highlights another peculiarity of the oil market: traders are often adept at maintaining oil flows even as major disruptions send other industries running for cover.

The market’s reaction on June 23 also repeated a pattern from a week earlier, when crude prices initially jumped as much as 5.5% after Israeli strikes on Iranian gas and fuel depots, but those gains were quickly erased as signs emerged that Tehran wanted to negotiate peace.

Both events showed that since the fighting erupted, traders have focused on a key question: will Iran increase or decrease the risk of threatening tankers passing through the Strait of Hormuz, a vital 33-kilometer-wide waterway connecting Gulf oil producers to global markets?

“Everyone is focused on the possibility of an attack on the Strait. Once it became clear that wasn’t going to happen, the risk premium immediately disappeared,” said Amrita Sen, founder of Energy Aspects, a market analysis firm.

A senior oil trading company executive also said that in recent years, a pattern has emerged where geopolitical shock-driven price spikes quickly fizzle out. “This is not a situation like Ukraine and Russia, where we have to reroute trade for a long time. This is a case where the market is just waiting to sell off whenever there’s a spike,” the executive said.

Montepeque agreed, saying that selling off on major shocks has become the norm. “If you read the market right, you’ve already got a favorable position, you’re making good money, and you want to cash in,” he said.

Although the market had anticipated the outbreak of war, with oil prices rising ahead of Israel’s initial strike, the broader context made traders hesitant to bet heavily on further price increases. The global oil market is currently flush with supply, as the OPEC+ alliance has ramped up production in recent months. US shale oil producers have also maintained output at record levels.

Helima Croft, strategist at RBC, suggested that the White House likely decided against using the Strategic Petroleum Reserve even as the energy market experienced significant volatility in recent weeks because officials “feel confident that they have plenty of other supply levers to pull if there is a severe disruption.”

Short-Lived Oil Price Spike Due to Iran-Israel Conflict

Many analysts predict that by the end of the year, the global oil supply will be excessive, putting further downward pressure on prices. “Everyone thinks oil will go back to $50 or $60,” Sen said. “Once the risk is gone, people go back to looking at the fundamentals.”

A temporary ceasefire between Iran and Israel, mediated by former US President Donald Trump, triggered another sell-off on June 24, pushing Brent crude down 6.1% to just over $67 a barrel, lower than it was before the conflict began.

“People felt that Iran didn’t have many options left, and closing the Strait would only hurt China, their only major ally,” said an oil trader. “Israel didn’t have many options either, the nuclear threat had subsided, and any further escalation from them would be hard to justify.”

Analysts suggested that the price volatility in the market was amplified by option positions, a derivative that becomes more valuable when oil prices move sharply around a certain level.

Before the Iran-Israel conflict erupted, the oil market was already under pressure from excessive supply and weak demand, leading some producers to buy put options, which pay off if prices fall.

Traders manage these positions by buying futures contracts, a key tool in oil trading and the basis for global oil price benchmarks.

“When Brent falls, the likelihood of brokers having to pay out on the options increases. So, they have to sell more futures,” said Ilia Bouchouev, former president of US commodity trading firm Koch Global Partners. He added that this selling contributed to the sharp drop in oil prices on June 23.

“There was a mad rush to the top and a mad rush to the bottom,” said Al Munro, a broker at Marex.

Quan An (FT)

Secure Your Energy Supply: 5 Tasks to Ensure a Constant Flow of Fuel.

“Vietnam’s Minister of Industry and Trade, Nguyen Hong Dien, has instructed the industry to closely monitor market dynamics and be proactive in devising strategies to ensure a stable supply of gasoline for both production and consumption. The directive emphasizes the importance of maintaining reasonable price levels that align with global market trends.”

The First Day of Lunar New Year: Bac Giang Residents Stunned as Lychee Prices Plummet to 3,000 VND per Kilogram

The price of Bac Giang lychees unexpectedly dropped to 3,000 VND per kg at the purchasing points in Kim Street (Luc Ngan district, Bac Giang province) on the morning of June 25, disappointing many locals.

The Energy Markets on June 18: Oil Prices Surge Over 4%, Sugar Falls 3%

The global oil market witnessed a significant surge on June 17th, with prices soaring by over 4% as tensions between Iran and Israel showed no signs of abating. This escalation has had a ripple effect on commodities, with gold prices experiencing a slight uptick, while sugar prices took a hit, dropping by approximately 3%.