The Urban Development Corporation of Kinh Bac – JSC (KBC: KBC, HoSE) has just announced that the PVI Infrastructure Investment Fund (PIF), managed by PVI Fund Management Joint Stock Company, has become a major shareholder, holding 5% or more of the company’s shares.

Specifically, on June 24, 2025, PIF purchased 50 million KBC shares in the company’s private placement, thereby increasing its ownership from 0% to 5.31% and officially becoming a major shareholder.

With the private placement price of VND 23,900 per share, it is estimated that PIF spent approximately VND 1,195 billion to purchase the aforementioned number of shares.

Illustrative image

The report also shows that PVI Fund Management also holds 1.25 million KBC shares, equivalent to a holding ratio of 0.13%.

Thus, the total number of KBC shares held by PIF and related parties amounts to 51.25 million, equivalent to a 5.44% ownership stake in Kinh Bac.

In another development, Kinh Bac has recently approved the use of proceeds from the private placement.

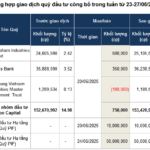

The company stated that since the amount raised was VND 4,162.1 billion, lower than the initially expected amount of VND 6,250 billion, the Board of Directors decided to allocate the funds as follows:

Source: KBC

Firstly, Kinh Bac will use VND 1,462.5 billion to repay principal and interest to Saigon – Hai Phong Industrial Zone Joint Stock Company according to contract number 01/2023/HDV/SHP-KBC dated October 25, 2023.

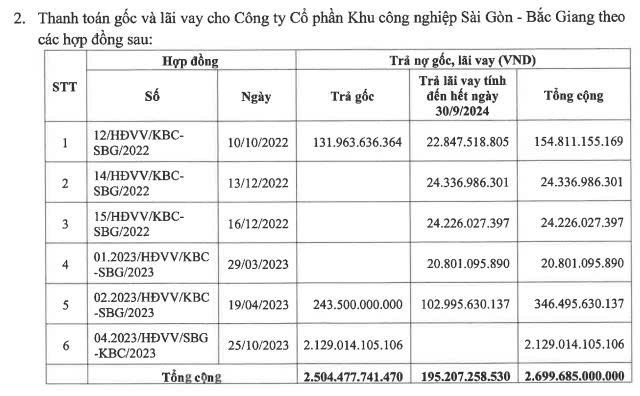

Next, KBC will use VND 2,699.7 billion to repay principal and interest to Saigon – Bac Giang Industrial Zone Joint Stock Company under 6 detailed contracts as follows:

Thus, the total amount used by Kinh Bac to repay the above debts is VND 4,162.1 billion. This is the amount that the company has just raised from the private placement that ended on June 24.

Accordingly, KBC successfully distributed 174.15 million shares, representing 69.66% of the 250 million shares registered for sale.

Of these, 102.9 million shares were distributed to 6 investors (including 4 individual investors and 2 institutional investors) between 9:00 am on June 20, 2025, and 4:00 pm on June 23, 2025. And 71.25 million shares were distributed to 4 investors on June 24.

The remaining 75.85 million shares that were not sold will be canceled. The offering price was VND 23,900 per share. There were a total of 9 investors participating in this offering.

Upon completion of the offering, KBC increased its outstanding shares to 941.75 million, equivalent to a charter capital of VND 9,417.5 billion.

PVI Infrastructure Investment Fund Invests $7 Million to Become Major Shareholder in SGT

The Ho Chi Minh Stock Exchange (HoSE) witnessed a unique trading session on June 20th. A notable 10 million SGT shares changed hands, amounting to a substantial VND 170 billion in value. This intense trading activity resulted in a share price of VND 17,000, reflecting a 3% decline from the previous closing price of VND 17,600.

“PVI Infrastructure Investment Fund Becomes Major Shareholder in Saigontel”

The PVI Infrastructure Investment Fund has bolstered its stake in SGT by acquiring 10 million shares, elevating its ownership to 6.67% and solidifying its position as a major shareholder of Saigontel.