A review of the first-quarter rubber price context for 2025 reveals that rubber prices globally remained at a high level. Specifically, RSS3 prices stayed above 60 million VND per ton, TSR20 hovered around 50 million VND per ton, and Latex fluctuated above 40 million VND per ton. This development reflects the prolonged supply-demand imbalance since the second half of 2024, with global supply consistently lower than actual consumption needs.

Until early April 2025, the rubber industry witnessed a significant downward adjustment due to news about tariffs between the United States and China, the world’s largest rubber consumer. This caused a noticeable downward trend in global rubber prices, especially for RSS3 and TSR20.

In the period following the US announcement on April 2 to impose a 46% countervailing duty on Vietnam, rubber stock prices plummeted. GVR of the Vietnam Rubber Industry Group fell sharply from 36,000 VND per share to 23,700 VND per share, a decrease of 33%, with many consecutive floor sessions.

Similarly, DPR of Dong Phu Rubber dropped from the 53,000 VND per share range to over 37,000 VND per share, a 30% decrease with many floor-sweeping sessions. PHR of Phuoc Hoa Rubber also saw a drastic reduction from 68,000 VND per share to 42,000 VND per share, a corresponding 38% drop.

However, along with the market’s recovery, rubber stocks rebounded.

Regarding the outlook for the rubber sector, Rong Viet Securities believes that negative information related to US tariffs will only create short-term pressure on the global rubber supply chain.

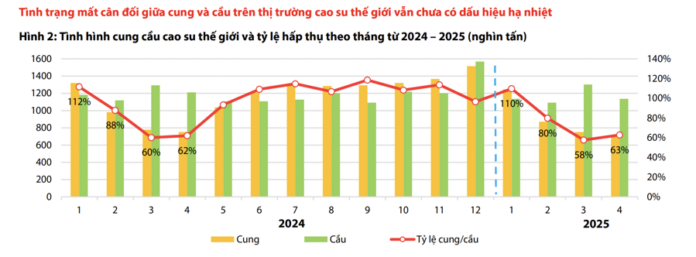

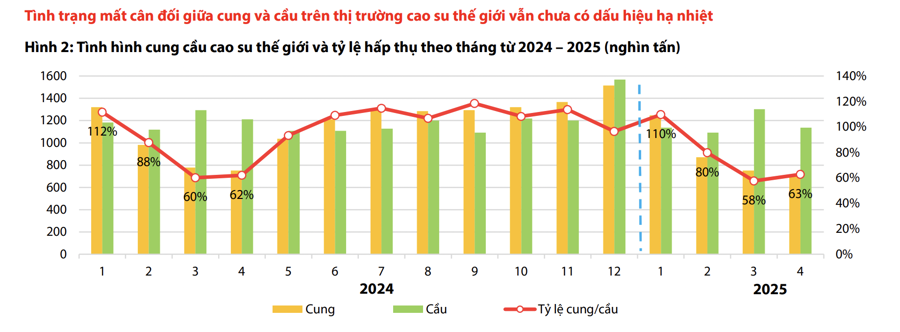

Looking at the global rubber supply-demand picture in the first four months of 2025, the supply-demand absorption ratio this year has decreased compared to 2024. While demand remains the same, this year’s supply has slightly decreased, indicating a continuing supply shortage combined with seasonal factors.

According to ANRPC estimates as of April 2025, the total global rubber supply for the whole of 2025 is expected to be deficient by about 673,000 tons. Accordingly, countries are projected to reduce natural rubber production in 2025 compared to the previous year, including Indonesia (-10%), Malaysia (-4.5%), and Vietnam (-1.6%).

Additionally, important output indicators for the natural rubber industry (such as tires) showed positive trends: The import volume of tires in the US in the first quarter of 2025 reached 70.7 million units, up 3.36% over the same period last year. Tire exports from China in the fourth quarter of 2025 reached 3.03 million tons, up 6.3% year-on-year, compared to 2.85 million tons in the same period in 2024.

Overall, with the global rubber supply still forecasted to be deficient while consumption remains stable and output products like tires show positive growth, VDSC expects rubber prices to likely recover in the second half of 2025.

Therefore, VDSC believes that the decrease in rubber prices this quarter will only have a limited impact on DPR’s average selling price for the full year 2025. Moreover, as trade tensions between the US and China ease, global rubber prices are showing signs of recovery after a sharp decline due to psychological factors. This provides a basis for expecting stability in rubber prices in the remaining quarters of the year.

“With rubber prices continuing to recover from the short-term impact of tariffs, along with the anticipated persistent supply shortage and stable demand, we believe that rubber prices are likely to recover further and remain at a high level in the second half of 2025,” VDSC emphasized.

“Global Markets Rally: Oil Prices Surge and Iron Ore Rebounds”

“Oil prices surged nearly 3% on June 19 as the Israel-Iran conflict escalated, creating a ripple effect across global markets. This development overshadowed a relatively quiet day for other assets, with gold trading sideways, the dollar dipping to a weekly low, iron ore snapping a five-day losing streak, and Indian rice prices climbing on improved demand.”

Oil Takes a Breather, Gold Shines Bright: A Week’s Peak, While Indian Rice Hits 2-Year Low

The oil price slipped slightly on Thursday, 12th June 2025, as the market monitored the Middle East tensions. Gold prices soared to a one-week high due to geopolitical tensions and expectations of a Fed rate cut.