In a surprising move, the company’s leadership had emphasized the goal of building Vietrip’s fleet as a key contributor to revenue back in April.

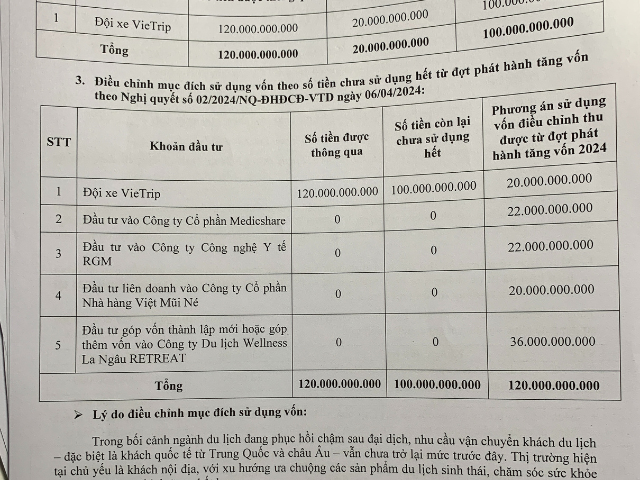

According to the newly approved plan, Vietourist will reallocate 100 billion VND out of the 120 billion VND raised from the recent public offering in the first quarter. Only 20 billion VND will be used to purchase five coaches, while the remaining funds will be invested in the following entities: CTCP Medicshare (22 billion VND), CTCP Medical Technology RGM (22 billion VND), CTCP Viet Restaurant Mui Ne (20 billion VND), and La Ngau Retreat Company (36 billion VND).

Mr. Nguyen Dinh Hoa, Vice Chairman of Vietourist’s Board of Directors, attributed this decision to the changing consumer trends post-pandemic, with an increasing focus on health and nature-oriented experiences. Instead of pure tourism, the model of tourism combined with healthcare and physical recovery is becoming a popular choice.

According to Mr. Hoa, Vietourist will develop a healthcare tourism ecosystem integrating therapy, meditation, yoga, mineral bathing, and nature-oriented accommodation. The first two projects in this strategy are the La Ngau resort in Binh Thuan and the Viet Mui Ne restaurant.

Vietourist Holdings surprises with a shift in capital usage – Photo: Tu Kinh

|

Additionally, Vietourist is venturing into the healthcare sector by investing in Medicshare and RGM, two companies specializing in rehabilitation, musculoskeletal issues, and stem cell technology. This move is aligned with the growing global trend of medical tourism, estimated at around $7 billion annually.

“One advantage Vietnam has is the increasing number of overseas Vietnamese returning for medical treatment. While in Europe or America, doctor appointments can take weeks, in Vietnam, patients can access healthcare services almost immediately and at significantly lower costs,” Mr. Hoa analyzed, “In the past, many people had to go to Germany for stem cell treatment, but now the trend has shifted to Singapore, Thailand, and Japan.”

The Vice Chairman also shared that their market tests indicated a growing preference among Vietnamese for domestic treatment, especially in stem cell therapy. Moreover, the company has started to attract international guests seeking healthcare services in Vietnam.

While acknowledging the potential of this industry, the leadership admitted that challenges exist and a cautious approach is necessary. In the initial phase, Vietourist plans to hold 10-20% of the shares in the healthcare entities and about 40-50% in the La Ngau project to maintain control.

“For these investments, we had extensive discussions to identify the right direction. We have caught on to the global ‘trend’ of green tourism, especially health tourism,” Mr. Hoa added.

When asked about the risks of expanding into biotechnology and healthcare, which differ from traditional tourism, the leadership recognized these sectors’ potential but emphasized the need for a cautious and gradual approach without rushing into it.

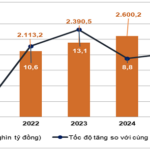

For the year 2025, Vietourist aims to achieve a revenue target of 250 billion VND, a 38% increase from the previous year, and an expected pre-tax profit of 7.5 billion VND. However, the Board admitted that the results for the first half of the year fell short of expectations due to the low season. The company hopes to record 2/3 of the revenue in the third quarter, the peak summer holiday season.

“We believe we will achieve more than 50% of the profit plan after the peak season,” said Mr. Tran Van Tuan, Chairman of the Board of Directors.

In the long term, if the healthcare and resort projects progress as planned, Vietourist expects the new fields to contribute 20-30% of revenue in the next five years, potentially increasing to 60-70% after 2030.

Vietourist’s shift in investment focus towards restaurants, healthcare, and resorts – Photo: Tu Kinh

|

Large shareholder emerges, confident in prospects

A notable presence at the meeting was Mr. Cao Hoang Anh, who revealed that he had purchased nearly 2 million VTD shares in the past month, equivalent to nearly 8.3% of the charter capital. He also represented nearly 6 million shares at the meeting.

“I am the one who bought back most of the shares that some of you sold recently,” said the shareholder.

Mr. Hoang Anh mentioned that he had received an offer to buy 10 million shares at 18,000 VND per share from an organization, double the current market price. He also assessed that Vietnam’s tourism industry is advantageous as the number of international visitors returning to the country is increasing, especially with the political tensions between Thailand and Cambodia. Regarding the domestic market, he expected that major holidays such as April 30 and September 02 would further attract international tourists.

“Perhaps many people have not fully grasped the potential of Vietnam’s tourism market. In Phan Thiet, even before the peak season, the occupancy rate at resorts is already high,” he illustrated, “The fixed costs of resorts remain almost unchanged, so when occupancy rates increase, profit margins improve significantly, and this will bring noticeable effects in the future.”

“I have full confidence in Mr. Tuan (Chairman of the Board of Directors) and have authorized him to manage the entire portion of my shares. I personally commit to continue buying and not selling, and I will accompany Vietourist in the long term,” Mr. Hoang Anh assured.

Mr. Cao Hoang Anh speaking at the meeting on June 29 – Photo: Tu Kinh

|

Tu Kinh

– 13:29 30/07/2025

The Pearl of the Orient Shines Bright: Ho Chi Minh City and Phu Quoc in Asia-Pacific’s Luxury Travel Hotlist

The inclusion of Ho Chi Minh City and Phu Quoc in the 2025 Asia-Pacific luxury travel rankings is not just a source of pride but also a testament to the renewed vigor of Vietnam’s tourism industry.

The Rise of Vietnam’s Middle Class: Asia’s Fastest-Growing Consumer Market and the Golden Era of a $34 Billion Industry

The thriving middle class, coupled with positive macroeconomic growth indicators, has propelled Vietnam into a golden era for the travel and hospitality industry.