The market turned green on the outside but red on the inside today, which is not unusual. Profit-taking has been shortening the duration of the recent uptrend as investors focus on preserving gains ahead of the upcoming final countervailing duty.

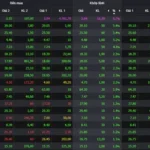

Looking at the daily advancing/declining stock ratio, the advantage shifts constantly. Yesterday, the VNI had a ratio of 2.35/1, but today it dropped to 0.6/1. The previous week also saw rotating ratios day by day. This is also the period when the VNI slowly crawled up without any significant breakthroughs. The propped-up index has facilitated short-term speculation and constant shifts in cash flow.

The rebound towards the end of today’s session was strongly influenced by the large-cap stocks VIC and VHM, while VCB played a role only in the morning session and then traded sideways for the rest of the day. Although the movement of other stocks can be attributed to expectations from financial results, the broader market context remains a crucial factor. As long as the VNI crawls upwards, confidence remains. However, a significant shift in the index caused by the large-caps could quickly change the market sentiment.

We have entered July, and the date of July 9th is approaching. Currently, information antennae are working at full capacity, but this is not the main concern. The large cash flow in the market will react and reveal signals. The threshold of matching orders below 20k billion/day continuously shows a lack of special action. The derivatives market is still heavily discounted. Daily stock fluctuations are merely repetitive and individual transactions.

Unifying risk assessments at this point is challenging, but looking at the stocks affected by the countervailing duty story, caution is returning. Two unclear issues are the tax threshold for comparing competitive advantages and the specific tax rates for each industry. Of course, the market always has scenarios for the final tax outcome, but these predictions are not yet certain or sufficient to redistribute portfolios. If you accept the risk, you can bet big; if you choose safety, maintain a balanced portfolio allocation and temporarily “avoid” stocks within the risk circle.

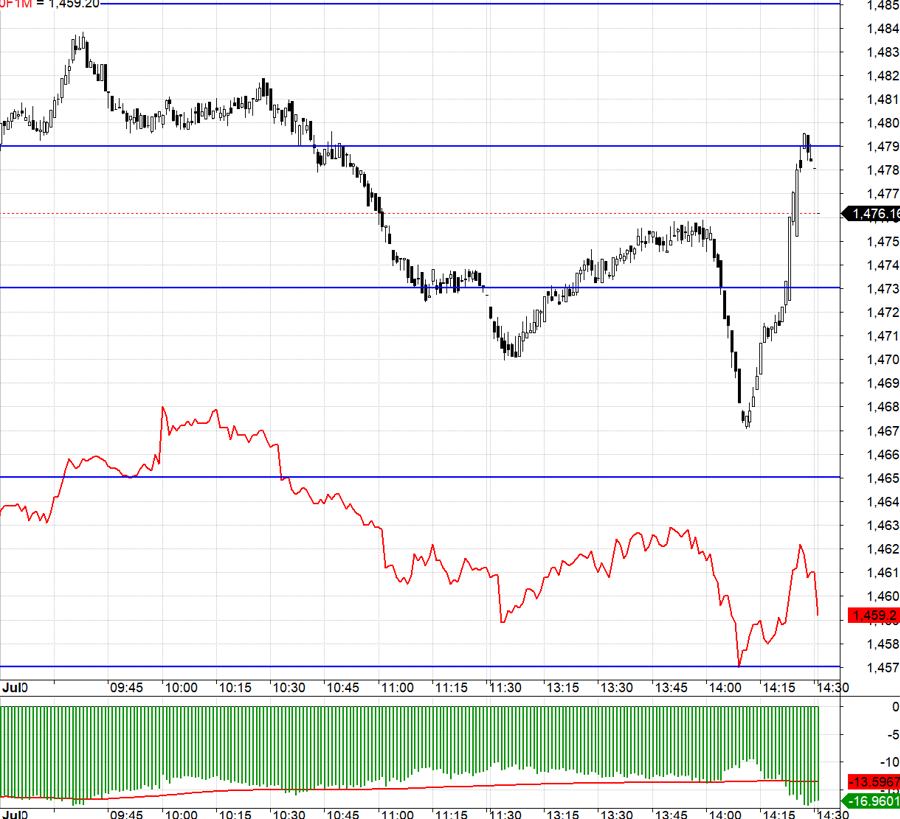

The derivatives market is still challenging to trade during these days of wide spreads, making it risky for both long and short positions. Today’s intraday trend for VN30 was mainly downward, but the 14-16-point discount basis was too risky, even though shorts technically made profits. The futures contracts continue to lean towards hedging against a significant decline since the VNI and VN30 peaked six sessions ago. In reality, VIC and VHM are still retesting the peak uncertainly and are likely to adjust. Other large-caps cannot compensate for their potential decline. Information about taxes could be the deciding factor and a significant boost.

VN30 closed today at 1476.16. Tomorrow’s nearest resistance levels are 1478, 1487, 1493, 1500, 1508, and 1514. Supports are at 1473, 1466, 1460, 1450, and 1442.

“Stock Market Blog” reflects the personal opinions of the investor and does not represent the views of VnEconomy. The opinions, assessments, and writing style are solely those of the investor, and VnEconomy respects the author’s perspective. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives presented in this blog.

“Securities Firms Hike Fees Starting Tomorrow”

As June draws to a close, the VN-Index soars to new heights, reaching a remarkable 1,376 points in today’s session. The market is painted in a sea of green, particularly for mid-cap and small-cap stocks. A new chapter begins tomorrow, July 1st, as multiple brokerage firms are set to increase their service charges.

“Massive Windfall for Savvy Investors: A Whopping $1.8 Billion Haul in a Week”

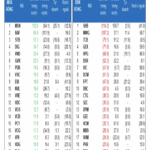

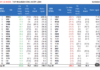

The domestic institutional investors recorded a net sell-off of VND 3,099.3 billion, while their net buying value on matched orders was VND 1,794 billion.

The Alluring Art of Refining: Estimating the Bank Stock Sell-Off by ETFs in the Upcoming Reconstitution

The latest estimates from BSC indicate that ETFs have offloaded all their shares in BVH and made significant sales in other stocks. The data reveals that up to 10.79 million VIB shares, 7.9 million ACB shares, 4.9 million VRE shares, 1.7 million OCB shares, and 4.9 million HDB shares were also sold by ETFs.