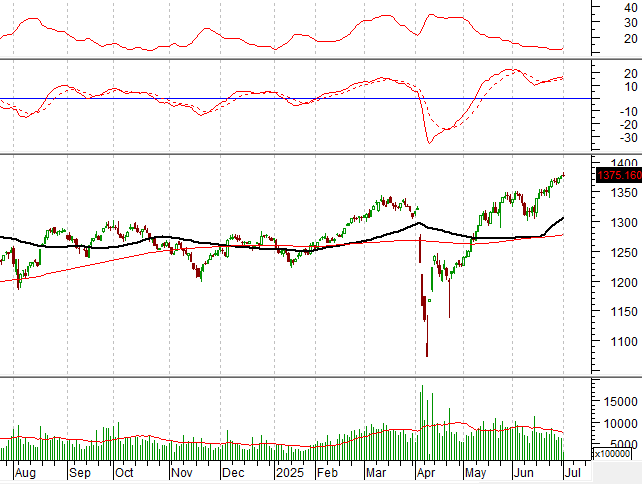

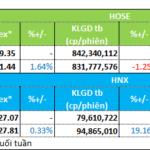

Technical Signals for VN-Index

During the trading session on the morning of July 1, 2025, the VN-Index declined, forming an Inverted Hammer candlestick pattern, indicating a rather pessimistic sentiment among investors.

Additionally, the Stochastic Oscillator indicator signaled a sell-off in the overbought territory, suggesting that the risk of a short-term correction is emerging if the indicator falls below this level in the upcoming sessions.

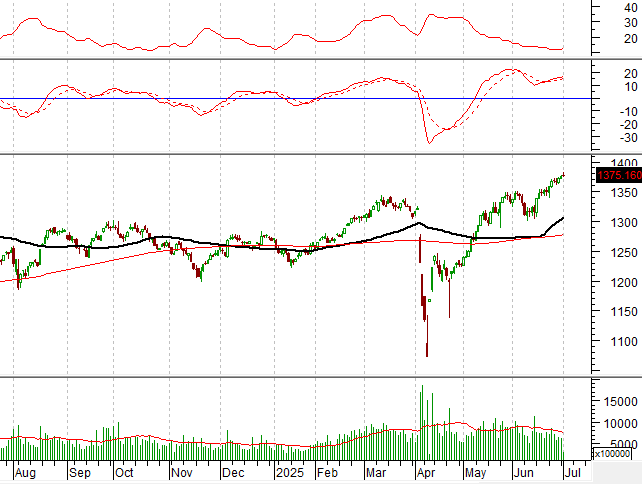

Technical Signals for HNX-Index

In the trading session on the morning of July 1, 2025, the HNX-Index witnessed a slight decline, forming a small-bodied bearish candlestick pattern accompanied by a mild dip in the morning session, reflecting investors’ cautious attitude.

Furthermore, the MACD indicator continues to weaken and move towards the zero level after providing a sell signal as the price retests the Middle line of the Bollinger Bands indicator.

The 50% Fibonacci retracement level (corresponding to the 219-220 area) is expected to act as a support zone in the near future if a corrective phase unfolds.

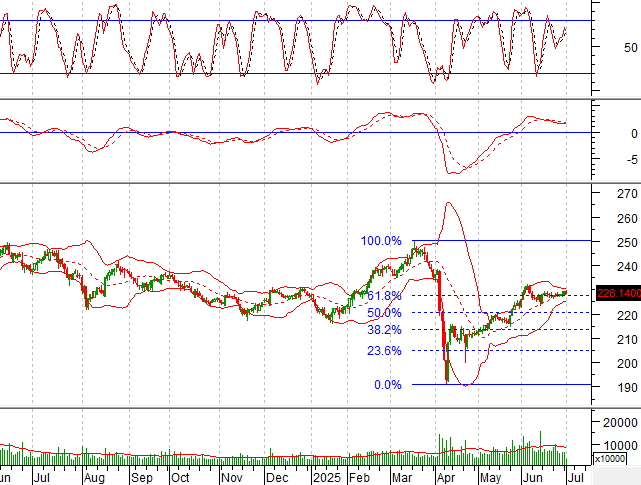

DXG – Real Estate Group Joint Stock Company

On the morning of July 1, 2025, DXG stock price declined, accompanied by a decrease in trading volume, indicating investors’ cautious sentiment.

Additionally, the price tends to reverse and retest the lower edge (corresponding to the 16,300-16,400 zone) of the short-term ascending price channel (Bullish Price Channel) while the MACD has issued a sell signal during the session. If the price breaks down below this zone, a bearish scenario may unfold.

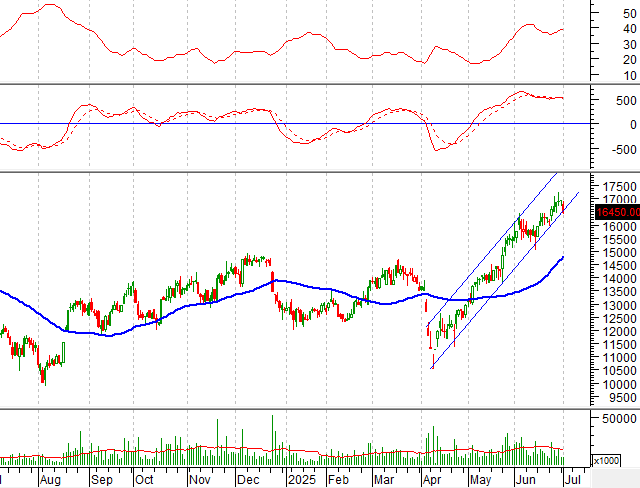

VCG – Vietnam Export-Import and Construction Corporation

In the trading session on the morning of July 1, 2025, the VCG stock price opened with a significant surge, accompanied by a trading volume surpassing the 20-session average, reflecting investors’ optimistic sentiment.

Additionally, the price is retesting the previous peak attained in September 2023 (corresponding to the 23,000-23,400 zone) while the MACD indicator inclines upward after delivering a buy signal. Should the price surpass this zone, the prevailing uptrend will be further reinforced.

Technical Analysis Department, Vietstock Consulting

– 12:26 01/07/2025

“The “Super Pillar” VCB Fails to Save the Market”

The morning’s robust selling pressure sent stock prices tumbling in the latter half of the session. Initially, the number of stocks rising outnumbered those falling by a ratio of 3:2 when the VN-Index peaked. However, by the end of the morning session, this trend had reversed, with declining stocks outpacing advancing ones by a ratio of 2:1.

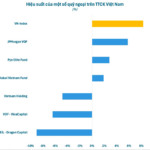

The Little Engine That Could: Small-Cap Stocks Chugging Along Nicely

The optimistic sentiment continues to bolster the market’s slow but steady ascent, despite lackluster performances from leading stocks. While the blue-chips struggled to keep pace with the indices, the small and mid-cap stocks witnessed notable price advancements. Trading liquidity on the two exchanges witnessed a 10% increase, indicating a potential shift in investor appetite.