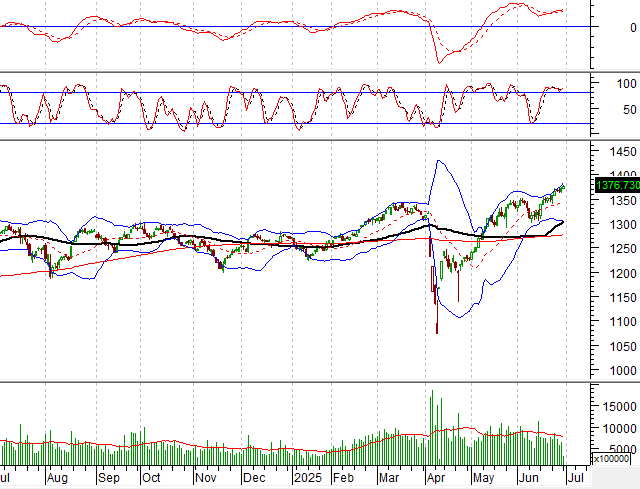

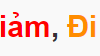

Technical Signals for VN-Index

During the trading session on the morning of June 30, 2025, the VN-Index opened higher, accompanied by improved trading volume in the morning session, indicating a rather optimistic investor sentiment.

In addition, the index remained close to the upper band of the Bollinger Bands while the MACD indicator continued to rise after giving a buy signal. This suggests that the current uptrend is being further reinforced.

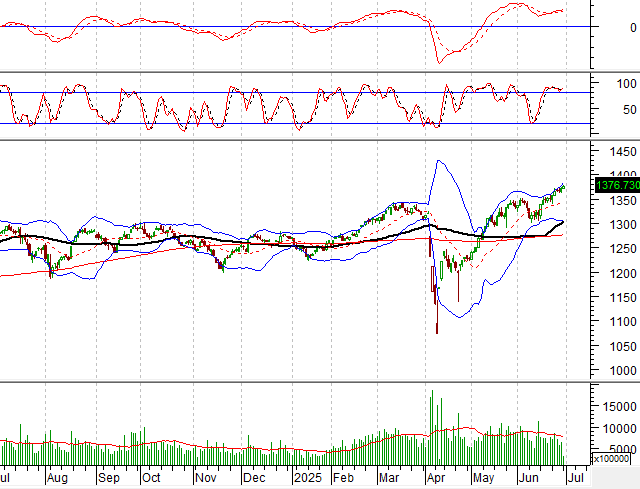

Technical Signals for HNX-Index

In the trading session on the morning of June 30, 2025, the HNX-Index rose slightly, forming a small candle body with improved volume in the morning session, indicating investors’ hesitation.

Moreover, the index has been fluctuating around the 61.8% Fibonacci retracement level (corresponding to 227-228) while the gap between the MACD and the signal line is narrowing. If this indicator gives a buy signal again in the coming sessions, the optimistic outlook may return.

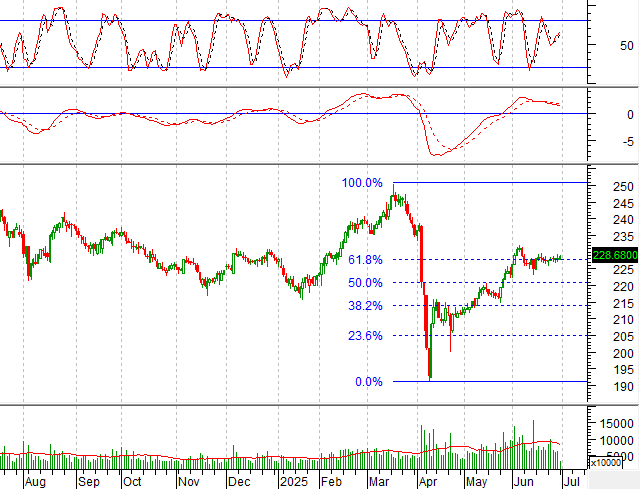

ANV – Vietnam Fisheries Corporation

On the morning of June 30, 2025, ANV’s stock price surged, forming a White Marubozu candlestick pattern with trading volume exceeding the 20-session average, indicating active trading by investors.

Additionally, the price is retesting the old peak from December 2024 (corresponding to the 20,500-21,000 region) while the MACD line continues to widen and rise after giving a buy signal.

If the price successfully breaks above this resistance level in the future, the optimistic outlook for the stock is likely to continue.

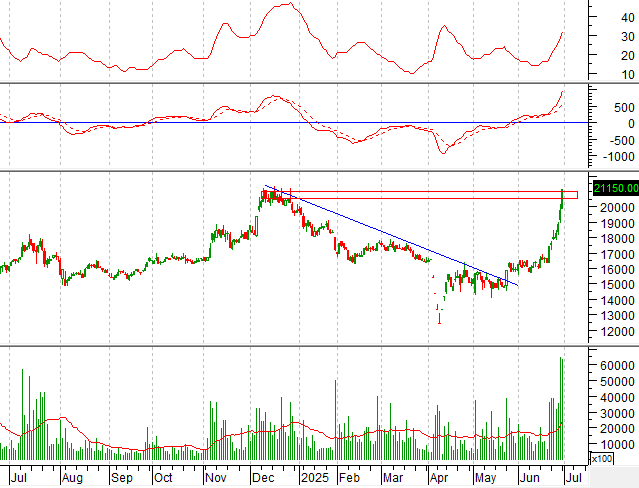

GMD – Gemadept Corporation

In the trading session on the morning of June 30, 2025, GMD’s stock price rose sharply, accompanied by trading volume exceeding the 20-session average, indicating optimistic investor sentiment.

Furthermore, the Stochastic Oscillator indicator has given a buy signal and exited the oversold region, further supporting the short-term recovery momentum.

The gap between the 100-day SMA and the 50-day SMA is also narrowing. If a golden cross appears in the future, the stock’s recovery will be further reinforced.

Technical Analysis Department, Vietstock Consulting

– 12:37, June 30, 2025

“The “Super Pillar” VCB Fails to Save the Market”

The morning’s robust selling pressure sent stock prices tumbling in the latter half of the session. Initially, the number of stocks rising outnumbered those falling by a ratio of 3:2 when the VN-Index peaked. However, by the end of the morning session, this trend had reversed, with declining stocks outpacing advancing ones by a ratio of 2:1.