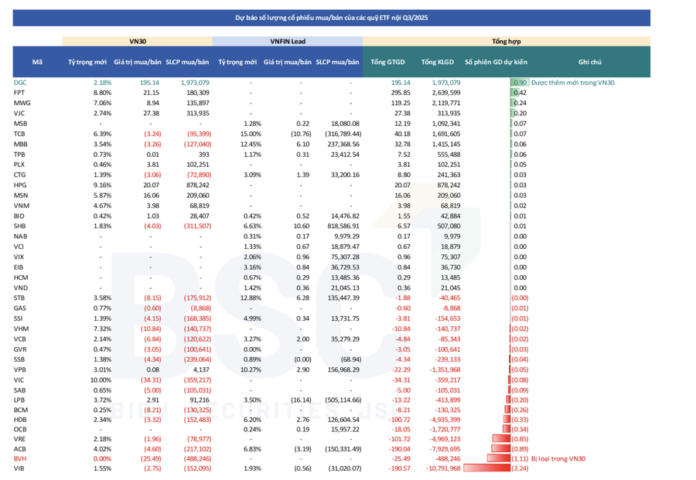

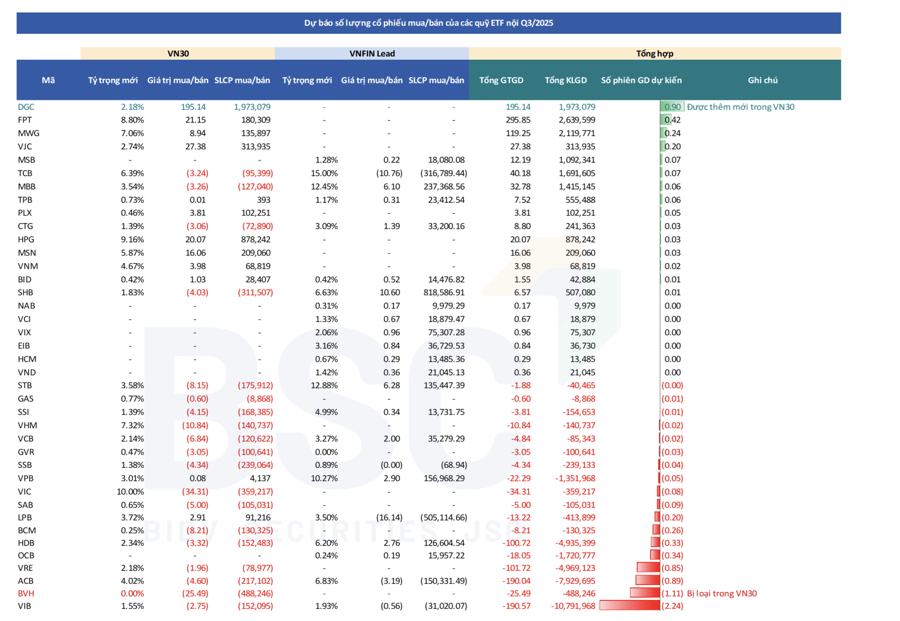

On July 16, 2025, and July 21, 2025, the VN30 and VNFINLead indices will announce their constituents for the third quarter of 2025. The ETFs tracking these indices will complete their portfolio restructuring on August 1, 2025.

Based on data as of June 27, 2025, BSC predicts notable changes in the constituents of these indices. For the VN30 index (tracked by 4 ETFs: E1VFVN30, FUEKIV30, FUEMAV30, and FUESSV30), DGC is expected to be added, while BVH will be removed due to failing to meet the criteria for trading volume and value. It’s important to note that BSR is not eligible for inclusion as it hasn’t met the minimum trading period of six months.

For the Q1/2026 review, the predictions are for reference only as the review data will be locked on December 31, 2025. Market performance in the last six months of the year will be crucial.

Scenario 1: ACV is listed on HOSE after September 2025. In this case, ACV will only be considered for VN30 inclusion from the July 2026 review. Potential changes for the Q1/2026 review could include:

VPL is likely to be added to the index. If VPL is included, TPB (currently the stock with the lowest adjusted free-float market cap) may be removed. If BSR improves its average trading capitalization, it could also be included, leading to the potential removal of DGC.

Scenario 2: ACV is listed on HOSE during July-September 2025. ACV and VPL are also likely to be added to the VN30 index. Similarly, if BSR shows significant improvement in trading capitalization, it will be a strong candidate for inclusion. The addition of new stocks will result in the removal of existing ones. The stocks likely to be removed in this scenario are TPB, DGC, and SHB.

For the VNFINLEAD index (tracked by 1 ETF: FUESSVFL), there will be no changes in this review. LPB may be removed from the index for failing to meet the criteria for turnover ratio. If LPB is removed, BSC predicts a sale of -941,289 shares, equivalent to 0.45 trading sessions.

Overall, BSC estimates that the ETFs will buy a maximum of 1.9 million DGC shares, 2.6 million additional FPT shares, and 2.1 million MWG shares. Conversely, they will sell all BVH shares and a maximum of 10.79 million VIB shares, 7.9 million ACB shares, 4.9 million VRE shares, 1.7 million OCB shares, and 4.9 million HDB shares.

The Ultimate Guide to Stock Market Investing: Navigating the Tumultuous Tides

Today’s trading session (June 25th) saw VHM continue its upward trajectory, albeit at a slower pace compared to the previous session. While the momentum behind the rally showed signs of easing, profit-taking pressure at the peak levels remained relatively subdued. The VN-Index once again failed to breach the 1,370-point mark.

The Stock Market Observer: Capital Remains on the Sidelines

The strength of MSN, along with the rebound of VIC and VHM, gave VNI a slightly more pronounced gain compared to the previous two sessions. While turnover showed some improvement, it was not entirely evident, and excluding the largest transactions, the rest even declined.