“Hyosung Vina Chemical Ventures into the Bond Market with its First Issuance”

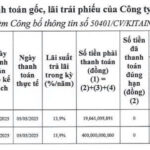

The bond with the code HOS12501 was raised on June 24, 2025, with a 12-month term, maturing on June 24, 2026. This is a 3-No bond (non-convertible, without warrants, and unsecured), registered and deposited by Shinhan Vietnam Securities JSC.

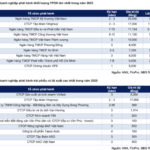

According to the Hanoi Stock Exchange (HNX), this is the first bond issued by Hyosung Vina Chemicals. The company was established in 2018 under the Hyosung Group and is headquartered in Ba Ria-Vung Tau Province. Its main business is the production of ethylene, propylene, polypropylene, hydrogen, and by-products such as steam and inert gas…

As of the update on June 20, the company had a chartered capital of nearly VND 19,205 billion. Hyosung Chemical Corporation (headquartered in South Korea) holds 51%, and Hyosung Vina 1st Co., Ltd. (South Korea) owns the remaining 49%. Mr. Kim Jong Ki (South Korea) is the Director and legal representative.

On its website, the company introduces the Hyosung Group, which started operating its first plant in Vietnam in 2007 with a total investment of $4 billion. The Group has five entities in four provinces and cities in Vietnam. Their diverse business portfolio includes fibers (spandex, nylon), tire cord, ATMs, and petrochemicals.

In late 2021, Hyosung Vina Chemicals inaugurated its PP production plant and underground LPG storage facility in Cai Mep Industrial Park (Tan Phuoc Ward, Phu My Town). The project has a total investment of $1.3 billion, including Polypropylene Plants 1 and 2 with a capacity of 300,000 tons/year each; a dedicated port capable of receiving 60,000-ton vessels; a Propylene and Ethylene plant with an annual capacity of 600,000 tons; and an underground LPG warehouse (located at a depth of 110-200 meters below sea level, nearly 5km long) with a capacity of 240,000 tons.

The PP production plant and underground LPG storage facility project by Hyosung Vina Chemicals, a subsidiary of the Hyosung Group (South Korea), with a total investment of $1.3 billion.

|

– 2:29 PM, July 1, 2025

The Great Treasury Bond Rush: Why Banks are Scrambling to Buy Back Bonds Early.

Since the end of last year, it has become a prevalent trend for banks to buy back bonds before maturity. This move is largely attributed to the ample liquidity in the system and the banks’ aim to enhance their capital safety net. The redemption of high-interest-bearing bonds is seen as a strategic move by many, given the current economic climate.

The Ultimate Bond: F88’s Third Issue of the Year

On June 12, F88 successfully issued bonds with the code F8812503, valued at VND 50 billion with a term of 18 months. This is the third batch of bonds issued by the company since the beginning of the year.