East Anh’s land prices remain high despite the cooling off of the feverish market

According to surveys, land prices in Dong Anh district have stabilized but remain high. Notably, the number of interested investors has also decreased significantly. In areas that used to be hot spots such as Dong Hoi, Dong Tru, Le Phap, Tien Duong, and Vinh Ngoc, the once bustling scene of people rushing to view land is no more.

However, land prices in Dong Anh show no signs of declining.

For example, a 90 sq m corner lot in the Mai Hien resettlement area (Mai Lam commune) with a 30 m wide frontage is being offered for sale at VND 210 million/sq m, equivalent to nearly VND 19 billion/lot. Meanwhile, a 110 sq m lot on Vuon Dao Street (Dong Anh town) is offered at VND 235 million/sq m, totaling nearly VND 26 billion.

Land prices in Dong Anh remain high despite the cooling off of the market. (Illustrative image: Znews)

Reports from PropertyGuru Vietnam also show that land prices in Dong Anh are stable compared to the peak of the land fever.

Specifically, land in Dong Tru, Le Phap, Tien Duong, and Uy No… with beautiful and advantageous locations, and potential for business, are still offered at VND 197-250 million/sq m. Land near the Vinhomes Co Loa project, with a business frontage in Trung Thon village, is priced at VND 250-260 million/sq m. Due to the advantageous location, many landowners here are determined to “hoard” their land and wait for the area’s development in the coming time instead of selling.

Land in Phuong Trach is priced at VND 200-230 million/sq m. Similarly, the offered price of land on Xuan Canh street has not changed compared to the feverish period, still fluctuating at VND 130-150 million/sq m.

Similarly, land prices in the northwestern region of Le Phap fluctuate between VND 90-115 million/sq m. Land in Tien Duong, located in an alley, is priced at VND 80-110 million/sq m.

Land in Nguyen Khe is still offered for sale at VND 80-100 million/sq m for business-potential plots. Land in small alleys, located deep in the villages of Van Noi and Bac Hong, is priced at VND 54-59 million/sq m. Land in an alley in Xuan Canh is priced at VND 86-100 million/sq m.

According to brokers, the reason for the difficulty in lowering land prices in Dong Anh is that, according to the planned development, this area is expected to include the entire administrative boundary of 3 districts: Dong Anh, Soc Son, and Me Linh.

Infrastructure is also strongly and synchronously invested in, especially the newly constructed Tu Lien Bridge, along with a series of real estate projects of large corporations pouring into this area. Therefore, the Dong Anh land market is expected to soon regain growth in the last months of the year when demand and capital flow tend to increase.

Be cautious when investing

Mr. Le Dinh Chung, General Director of SGO Homes Real Estate Consulting and Development Joint Stock Company, commented that in reality, Dong Anh land is an area with continuous fluctuations. The “land fever” used to be fueled by leverage factors such as planning information, transport infrastructure, super projects, and the “price pumping” of speculators and brokers to make a profit. Therefore, people should not invest in a trend or listen to rumors.

According to Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, the land price level in the outskirts of Hanoi has increased continuously in recent years, causing many investors and buyers to have a waiting and observing mentality before making decisions.

In addition, after the information about the merger, speculators tend to look for “hunting” opportunities in the provinces instead of focusing on land near the capital as before.

Therefore, although Dong Anh still maintains its position as the “focal point of attention” of the Hanoi land market, actual transactions are quite slow, reflecting a clear cautious mentality from investors. In the short term, the market may continue to strongly differentiate, and only those land products with complete legal procedures, beautiful locations, and reasonable prices will have good liquidity. If investors do not have experience and do not choose carefully when investing, they can easily lose.

Mr. Pham Duc Toan – General Director of EZ Vietnam Real Estate Investment and Development Joint Stock Company, also assessed that land prices have increased rapidly recently due to scarce supply and speculative price manipulation. Many investors have relied on the “heat” from mega-projects to push up land prices in the surrounding areas.

Mr. Toan advised investors to pay special attention to liquidity when deciding to buy land at high prices. In the case of buying land in outlying areas without infrastructure or unclear legal status, the transfer will be very difficult.

Therefore, when investing, people should choose areas with reputable investors and complete infrastructure to ensure capital safety and increase profitability in the long term.

Why Do Social Housing Prices Tend to Rise?

The social housing prices in Hanoi are on an upward trend, with some projects reaching an unprecedented price range of 26-27 million VND per square meter. This surge in prices for affordable housing, originally intended for low-income earners, calls for immediate and effective solutions to stabilize this market segment.

Transforming Land Usage: A Hefty 300% Rise in Fees

The new land pricing policy has resulted in a significant increase in taxes for those wishing to change their land usage. With a 250-300% surge in taxes for converting agricultural land to residential use, many individuals are now facing financial challenges due to the substantial rise in land use conversion costs.

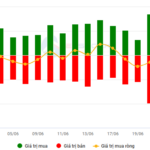

“Vietstock Daily Recap: Liquidity Woes Persist”

The VN-Index eased slightly after a tug-of-war session, with trading volume continuing to plunge below the 20-day average. This reflects investor caution as the index hovers at its highest level in over three years. The Stochastic Oscillator, a momentum indicator, has now entered the overbought territory and is starting to flash a sell signal. Investors should remain vigilant in the coming days as a drop below this level could trigger increased short-term corrective pressure.