One of the notable insights shared by Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS), during the Vietnam and the Indices program on June 30, 2025.

Mr. Tran Hoang Son, Director of Market Strategy at VPBankS, shares insights at the Vietnam and the Indices program on June 30, 2025.

|

Profit Waves: Which Industries Will Ride Them?

Mr. Son revealed that after the hot profit growth of the entire industry in 2023 – the post-COVID19 and recovery phase – the momentum slowed down in Q1-Q2/2024, although it remained at a very high level. From late 2024 to early 2025, the pace decelerated towards a stable growth state. Notably, the strong growth in late 2023 was built on the very low base of 2022; thus, a slowdown after that low-base period is understandable.

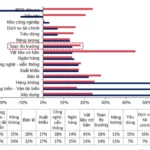

In Q1/2025, the financial group continued to lead with a 13.4% growth in post-tax profit, followed by the non-financial group, which increased by 10.4%. This was against the backdrop of a 12% average growth for the overall market. The real estate, retail, information technology, personal goods, basic resources (mainly steel), and banking sectors maintained robust growth momentum in Q1/2025 and previous quarters.

Notably, the real estate group witnessed a significant improvement in quarter-over-quarter and year-over-year growth. It grew by only around 7.7% in Q3 last year, then surged to 92% in Q4 and an impressive 346% in Q1/2025, with many companies reporting profits from new projects. The industry is recovering quickly, thanks to more relaxed policies and improved legal support.

The retail group also rebounded robustly, following the economic cycle. The information technology group performed similarly in a year where digital transformation took center stage. As usual, the banking sector led the growth and set the trend.

Among the recovering sectors, chemicals and utilities rebounded after a slowdown in late 2024. The decelerating groups included food and beverages. The declining groups showed a divergence, notably in financial services (mainly securities) and oil and gas.

Financial services showed a clear sign of slowing profit growth in Q4/2024 and Q1/2025, impacted by declining market liquidity. During the sharp decline caused by the tariff shock, investors became more cautious about securities companies with large proprietary trading portfolios, which led to the overall weak recovery of these stocks in May-June.

Looking ahead to the Q2 earnings season, Mr. Son believes there are signs of a stronger recovery as the market has weathered most of the significant fluctuations.

In the banking sector, many banks are expected to report solid growth, especially with the legalization of Resolution 42 on bad debt handling in the amended Law on Credit Institutions, which will continue to facilitate bad debt handling in the final months of the year.

Retail and residential real estate businesses are also forecast to grow in Q2, while industrial real estate and logistics may experience some divergence. The oil and gas group is not expected to turn positive soon.

Quickly Regaining the 1,400-Point Level

Commenting on market movements, the VPBankS expert said that the VN-Index had a pivotal week from June 23 to 27, surpassing the crucial resistance level of 1,360 points for the first time – the trendline connecting the peaks in the last 2.5 years. The market broke through resistance spectacularly, with most sectors participating.

Entering the week of June 30 – July 4, the market embarked on a new uptrend, associated with the legalization of new laws and decrees. Banking, securities, technology, and real estate stocks were on the rise, along with sectors expected to benefit from a potential reasonable tariff agreement with the US, such as textiles and seafood. In the coming week and possibly the following one (July 7-11), the market is projected to reach the 1,380-1,400-point range.

In the last two weeks, a closer look reveals that the index gained significantly, partly driven by large-cap stocks. Due to the unclear breadth of the rally, liquidity increased marginally, by about 5-7%, compared to the previous weeks’ averages. Nonetheless, Mr. Son believes that the market’s breakthrough of strong resistance levels will be pivotal in boosting liquidity and propelling Mid Cap and Penny stocks.

– 11:26 01/07/2025

“Proposed Establishment of a State-Run Real Estate Trading Center”

The Ministry of Construction has been working in close collaboration with the Vietnam Real Estate Brokerage Association to research and develop supportive practice mechanisms. Notably, they have proposed the establishment of a state-managed Real Estate Trading Center, which stands out as a significant initiative.

“The “Super Pillar” VCB Fails to Save the Market”

The morning’s robust selling pressure sent stock prices tumbling in the latter half of the session. Initially, the number of stocks rising outnumbered those falling by a ratio of 3:2 when the VN-Index peaked. However, by the end of the morning session, this trend had reversed, with declining stocks outpacing advancing ones by a ratio of 2:1.

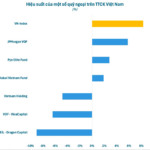

The Smart Money Loses Out to VN-Index

The top foreign-owned funds in Vietnam’s stock market have underperformed the VN-Index so far this year.