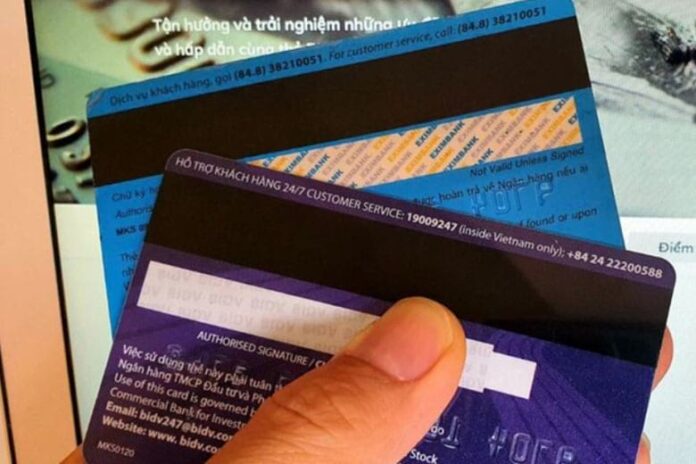

The State Bank of Vietnam’s (SBV) Circular 18 on bank card operations mandates a cessation of transactions using magnetic stripe cards across all banks from July 1st onwards. This directive applies to all types of stripe cards, including those with stripes only and hybrid chip-and-stripe cards.

Magnetic stripe cards will be unusable from July 1st.

As of July 1st, cards that have not been switched from stripe to chip technology will be unable to perform transactions such as cash withdrawals and deposits at ATMs and CDMs, payments at POS terminals, and interbank transactions. In some cases, stripe cards may be completely blocked.

A common question on many cardholders’ minds is: “What happens to the money in the bank account linked to these cards?”

What happens to your money if your magnetic stripe card is blocked?

The discontinuation of magnetic stripe cards is a necessary step in Vietnam’s banking industry’s card technology migration plan, aimed at ensuring maximum security for users. However, it’s crucial to emphasize that this change only affects the physical means of transaction (the card) and has no impact on your assets (the funds in your account).

Think of your bank card as a key to accessing your house (bank account). When you replace an old, damaged, or insecure key with a new, modern one, all your possessions and valuables inside remain untouched.

Similarly, your bank account securely holds your money at the financial institution. The bank card, whether magnetic stripe or chip-based, is merely a tool provided by the bank to facilitate transactions like cash withdrawals, transfers, and payments at ATMs and POS terminals.

Therefore, when a magnetic stripe card is blocked or becomes invalid, the entire balance in your account remains safely managed and protected by the bank at all times.

Cardholders are advised to switch to chip cards before July 1st to avoid transaction disruptions.

Why the phase-out of magnetic stripe cards?

This decision stems from the SBV’s requirement outlined in Circular 41/2018/TT-NHNN. The primary reason is that magnetic stripe technology is outdated and susceptible to security breaches:

-

Vulnerable to data theft (Skimming): The black magnetic stripe on the back of the card can easily be copied by high-tech criminal devices.

-

High risk of fraud: Criminals can use stolen information to create duplicate cards and withdraw money from your account.

In contrast, chip cards (those with a small metal chip on the front) offer superior security. Each transaction generates a unique, dynamic encryption, making it nearly impossible to replicate or counterfeit chip cards.

What should cardholders do now?

If you still have a magnetic stripe card, take the following proactive steps to ensure uninterrupted transactions and better protect your assets:

Check your card: Look at the front of your card. If there’s a small, square metal chip (similar to the chip on a SIM card), it’s a chip card. If it only has a black magnetic stripe on the back without the metal chip, it’s a stripe card, and you need to replace it.

Contact your bank to switch cards: You can visit the branches or transaction offices of the card-issuing bank. Most banks now offer free and swift chip card replacement services, and some even allow card replacement requests through their mobile banking applications.

Don’t delay: While your money remains safe, a blocked stripe card will prevent you from accessing your funds at ATMs or making payments at stores, causing inconveniences.

“Unraveling the Mystery of Bank Cards: Which Ones Will Be Affected by the July 1st Changes?”

As of July 1st, all ATM cards utilizing magnetic stripe technology will no longer be accepted for transactions across the entire banking network. This is in accordance with Circular 18 issued by the State Bank, pertaining to the operations of bank cards.

“From June 1st, Transactions of This Kind Will Be a Thing of the Past for Some Banks; Attempting Them Will Result in Rejection”

As of July, a slew of banks, including Vietcombank, Agribank, MB, and SHB, will officially cease dealings with similar entities. This decision underscores a broader trend in the financial industry, as institutions distance themselves from certain operations to mitigate risks and align with evolving regulatory landscapes.

What Do Banks Have to Say About the Sudden Halt of Magnetic Stripe Card Transactions?

“With the ever-evolving landscape of technology, banks are now encouraging their customers to switch from magnetic stripe ATM cards to the more secure chip-based cards. This shift is essential as it enhances security and protects users from potential fraud and unauthorized transactions. The new chip-enabled cards offer a more robust defense mechanism against malicious activities, ensuring that users can transact with peace of mind.”

The Great Magnetic Shift: Why Banks Are Phasing Out Magnetic Strip Cards

“By 2024, a significant number of people still relied on magnetic stripe cards (or ATM cards) for their transactions and withdrawals, hesitant to make the switch to the newer, more secure chip-based cards.”

The Latest Updates: A Comprehensive Guide to the New Bank Card Regulations

On August 16, 2024, the Bank Card Club (Vietnam Bank Association) hosted its annual conference for 2024 and the tenure conference for 2024-2027 in Quang Ninh. The event was themed “Cards in the Context of Digital Payment Trends,” reflecting the industry’s focus on adapting to the evolving landscape of digital payments.