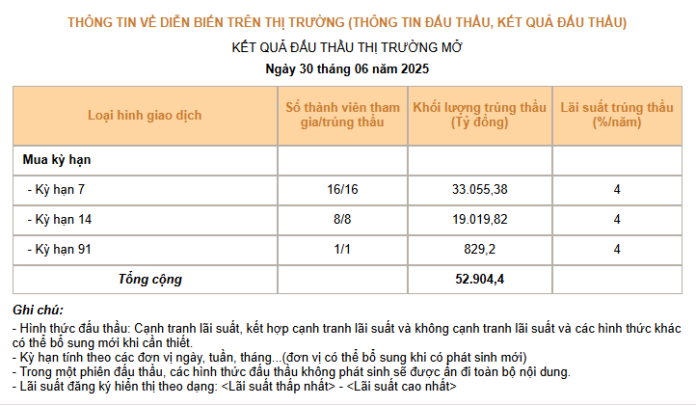

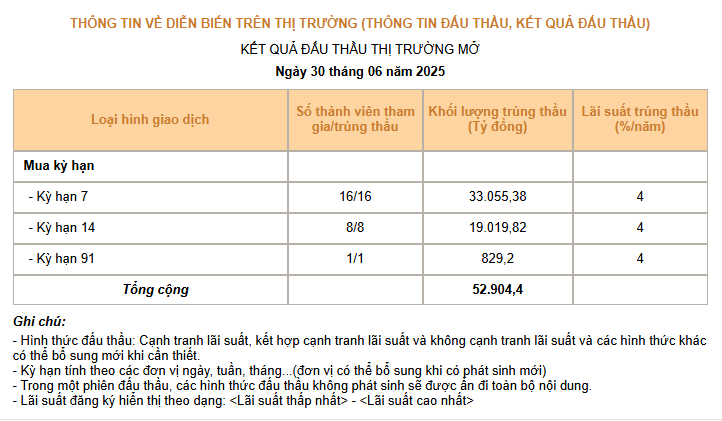

On June 30, 2025, the State Bank of Vietnam (SBV) continued to inject large amounts of liquidity into the banking system through its open market operations (OMO) lending facility.

Source: SBV

|

Specifically, the SBV provided 16 market participants with VND 33,055 billion in funds at a 7-day tenor, 8 participants with nearly VND 19,020 billion at a 14-day tenor, and 1 participant with over VND 829 billion at a 91-day tenor. In total, the SBV injected more than VND 52,904 billion into the banking system through OMO on June 30. The auction interest rates were all at 4%/year.

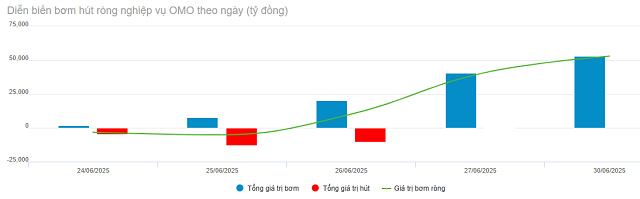

Prior to this, on June 24, the SBV resumed its issuance of treasury bills after a nearly four-month hiatus. From June 24 to June 30, the SBV net injected a total of VND 94,558 billion into the market.

|

SBV net injected nearly VND 95,000 billion

Source: VietstockFinance

|

Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University assessed that the SBV’s move was a strategic, flexible, and probing step.

Throughout the first quarter and the beginning of the second quarter of 2025, the SBV pursued a policy of aggressive liquidity injection to maintain low-interest rates and stimulate credit growth. This was in line with the need to support the economy’s recovery from the slowdown in 2023-2024.

However, starting in June, the banking system began to experience excess liquidity, with interbank rates remaining below the policy rates. Instead of flowing into production and business activities, funds showed a tendency to gravitate towards speculative assets, raising concerns about localized bubbles.

The SBV’s issuance of treasury bills served to temporarily withdraw excess funds from the system, signaling its commitment to managing inflation and exchange rate expectations. It also allowed the SBV to gauge market reactions in preparation for the next phase of monetary management. This “soft” move did not imply a tightening of monetary policy but rather aimed to maintain a proactive stance and balance market psychology.

After two sessions of net withdrawal, the SBV quickly reverted to net injection, demonstrating a “dynamic adjustment” attitude, free from fixed tightening or loosening cycles. The swift reversal after two net withdrawal sessions indicated the SBV’s priority to support short-term liquidity balance and prevent disruptions to production and business capital flows, especially during the sensitive period of semi-annual financial reporting. It reflected not a U-turn in monetary policy but rather a flexible approach that follows the market’s rhythm.

Allowing exchange rate flexibility within a controlled range

However, June also marked the peak season for corporate disbursements. Businesses simultaneously made substantial disbursements to settle import orders, pay suppliers, and service interest payments due before the semi-annual reporting deadline. This period also saw companies paying cash dividends or purchasing raw materials for third-quarter orders, resulting in heightened demand for both domestic currency and foreign exchange.

There was a slight increase in the tendency to hoard foreign currency due to uncertainties surrounding oil prices and geopolitical risks in the region. Some businesses repatriated profits, and foreign investment organizations made portfolio adjustments after the first half of the year.

Meanwhile, the supply of USD fell short of expectations due to delayed FDI disbursements, slower inflow of remittances in the first half, with a significant portion expected in the fourth quarter, and large export corporations retaining USD as a buffer against raw material fluctuations instead of selling it in the market.

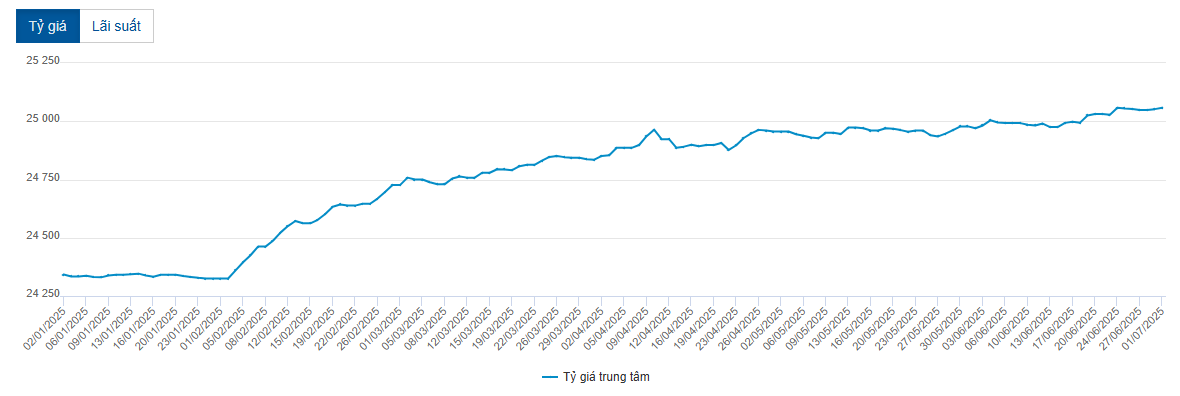

Consequently, the SBV refrained from aggressive intervention to maintain a “rigid” exchange rate, opting instead to let the rate reflect actual supply and demand dynamics and avoid market expectation mismatches.

Allowing a “soft” increase in the exchange rate within a safe range also supported exports amid competitive currency devaluations in the region. Additionally, it enhanced the attractiveness of investing in financial assets denominated in VND.

On July 1, 2025, the SBV set the daily reference exchange rate at 25,058 VND/USD, following a few sessions of slight decreases. Meanwhile, USD selling rates at commercial banks surpassed the 26,310 VND/USD threshold.

|

Reference exchange rate movement since the beginning of the year

Source: VietstockFinance

|

Looking ahead to the second half of 2025, Mr. Huy anticipates continued exchange rate pressure but believes it can be managed if the US Federal Reserve (Fed) cuts interest rates in September and December 2025. Additionally, exports are expected to recover, particularly from the FDI sector. The SBV will likely continue to employ derivative tools, currency swaps, and treasury bills to fine-tune the market.

However, it is important to remain vigilant about potential localized USD speculation, especially amid volatile gold and oil prices. Foreign investment flows will likely become more polarized, underscoring the necessity of transparent and stable exchange rate policies to sustain investor confidence.

– 16:44 01/07/2025

What Do Stock Market Experts Say About the State Bank Resuming Money Absorption Through Bills After a Four-Month Hiatus?

“Experts agree that this is a prudent move given the persistent upward trajectory of the USD/VND exchange rate in recent times.”

The Art of the Central Bank’s Rate Cut: A Step-by-Step Guide from the Experts

“Mr. Tran Ngoc Bau predicts that the State Bank of Vietnam (SBV) will definitely cut interest rates, with the speed of the cut depending on the movement of foreign capital. This interest rate cut will apply to both the retail market and the interbank market, affecting loans and savings products for individuals and businesses alike.”

The Greenback’s Rally: USD/VND Hits All-Time Highs, Pushing Banks to the Upper Limit

The U.S. dollar index (DXY) hovers around a four-month high as markets react to Donald Trump’s decisive victory in the U.S. presidential election.