|

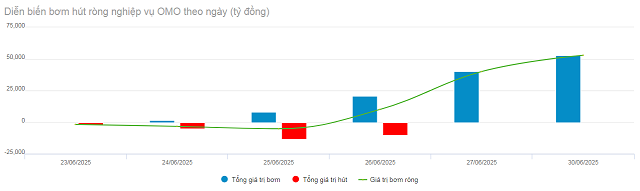

OMO net pumping evolution last week (06/23-06/30/2025). Unit: Billion VND

Source: VietstockFinance

|

Specifically, in 3 days from 06/24-06/26, SBV issued 22,500 billion VND of bills with interest rates ranging from 3.45-3.5%/year. This is the first time since 03/05 that the bill channel has been reopened after a long interruption.

Immediately after that, SBV promoted liquidity pumping through the term buying channel (repo) from 7-91 days, with a total volume of up to 123,095 billion VND, mainly implemented in the last 3 days of the month (06/26-06/30). Repo interest rates remained stable at 4%/year.

In the opposite direction, only 7,833 billion VND on the term buying channel matured and returned to the SBV, thereby the authority net injected 92,762 billion VND into the system in the week. By the end of June, the circulating capital through the term buying channel reached 159,359 billion VND, while the volume of circulating bills in the market was 22,500 billion VND.

|

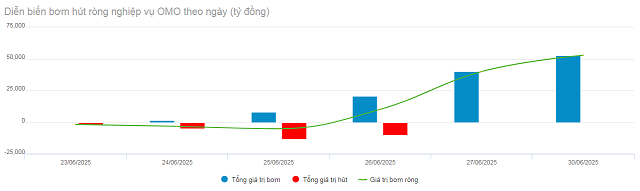

Interbank overnight interest rate movement since the beginning of 2024. Unit: %/year

Source: VietstockFinance

|

In the context of system liquidity being under pressure due to seasonal factors at the end of the quarter, the interbank overnight interest rate increased sharply by 303 basis points to 4.86%/year – ending the downward trend and reversing after nearly touching a 1.5-year low in the previous week. The average trading volume also increased by 39% over the previous week, reaching more than 597 thousand billion VND/day.

|

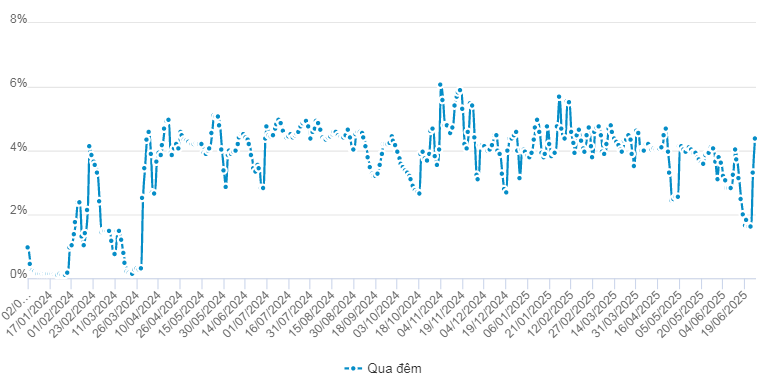

DXY movement in the last 5 years

Source: tradingview

|

In the international market, the USD Index (DXY) fell sharply by 1.52 points to 97.25 points, after news emerged that US President Donald Trump is considering nominating a replacement for Fed Chairman Jerome Powell earlier than expected. This development raises concerns about possible White House intervention in monetary policy, while reinforcing expectations that the Fed may soon ease policy to meet White House pressure.

Domestically, the exchange rate listed at Vietcombank on 06/27 decreased by 12 VND in both ways compared to the previous week, to 25,880-26,270 VND/USD (buying – selling).

– 10:28 01/07/2025

The Ultimate Guide to Forecasting Exchange Rates and Interest Rates

The skillful maneuvering of open market operations and credit support policies by the State Bank has maintained low-interest rates, ensuring liquidity and fostering growth amidst challenging global conditions.

“Vietnamese Dong Devalues Against Major Currencies: Down 14% Against Euro Since January, 7-11% Against Pound, Yen, and Aussie Dollar”

The Vietnamese Dong has witnessed a significant depreciation against major currencies, given its relatively pegged status to the US Dollar. Since the beginning of the year, the US Dollar has weakened yet remained strong against the Vietnamese currency, presenting a challenging scenario for the country’s economy and those transacting in the local currency.