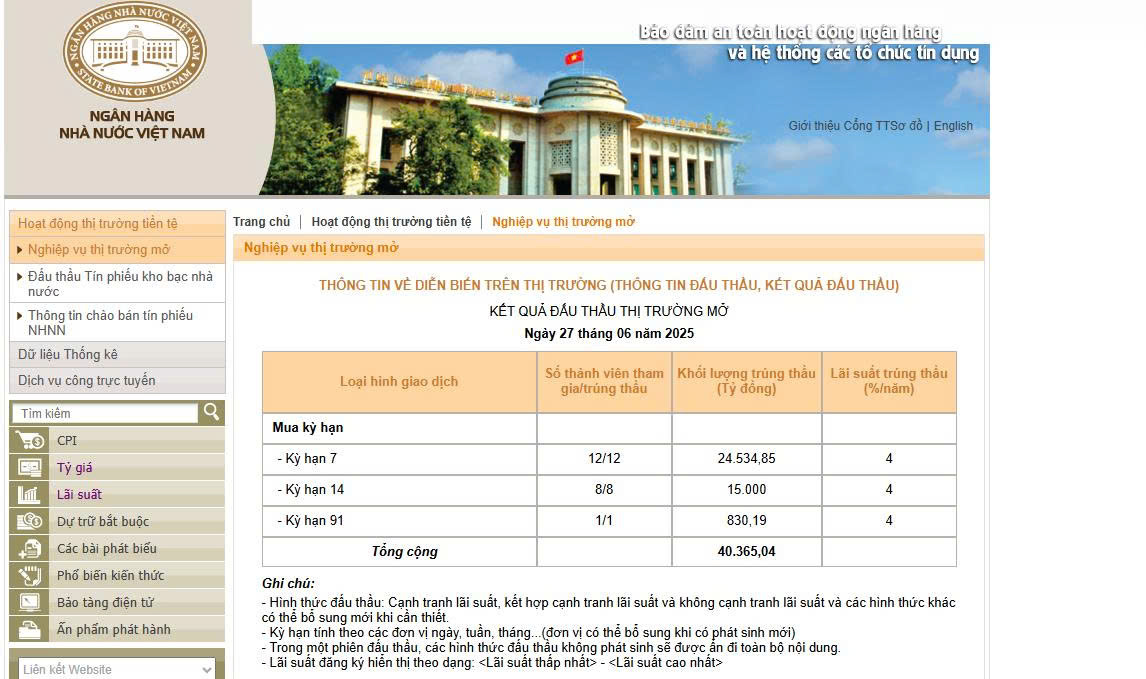

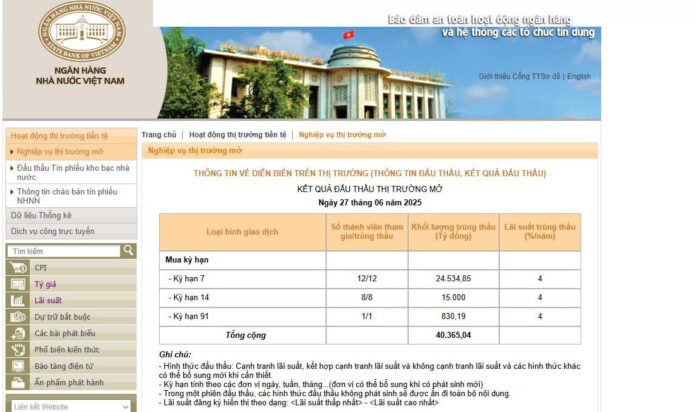

The trading session on June 27 witnessed notable developments in the open market as the State Bank of Vietnam (SBV) successfully auctioned a total of over VND 40,365 billion on the collateralized lending channel (OMO). Accordingly, 12 market members “borrowed” VND 24,535 billion from the SBV at a term of 7 days, 8 members borrowed VND 15,000 billion at a term of 14 days, and 1 member borrowed over VND 830 billion at a term of 91 days. The auction interest rate was 4%/year.

Meanwhile, nearly VND 323 billion in OMO matured. Overall, the SBV net injected more than VND 40,042 billion into the banking system through the OMO channel in the June 27 session – the highest level in more than a year.

In parallel with open market operations through the collateralized lending channel, the SBV also halted the issuance of bills on June 27. Previously, the SBV had resumed bill auctions after nearly 4 months of suspension since the June 24 session and withdrew a total of VND 22,500 billion in 3 sessions (June 24-26).

In total, during the past week (June 23-27), the SBV lent market members a total of nearly VND 70,191 billion at an interest rate of 4% on the collateralized lending channel. Meanwhile, the volume of OMO maturities was VND 7,833 billion.

On the bill channel, the regulator issued VND 22,500 billion worth of bills in the week of June 23-27 and did not record any bill maturities, resulting in a net withdrawal of VND 22,500 billion through this channel.

Thus, the SBV net injected VND 39,858 billion in the past week.

These moves by the SBV were made against the backdrop of typically rising liquidity demand in the system towards the end of each quarter. And with the winning contracts mainly at terms of 7-14 days, the money injected by the SBV into banks through the OMO channel will be withdrawn again in the first half of July.

Previously, the SBV had consistently been in a net withdrawal status in April and May as the system’s liquidity was abundant and interbank rates fell sharply. The overnight lending rate in VND dropped to the lowest level since March 2024, causing the overnight VND-USD interest rate spread to narrow to the level of September 2024 and putting pressure on the exchange rate.

After the SBV resumed bill issuance, the overnight lending rate gradually recovered to 4.37%/year as of the June 26 session.

Market Beat: Foreigners Turn Net Buyers, VN-Index Hits 2-Year High

The trading session concluded with the VN-Index climbing 4.63 points (+0.34%), reaching 1,376.07. Meanwhile, the HNX-Index witnessed a rise of 1.41 points (+0.62%), closing at 229.22. The market breadth tilted towards the bulls, as advancers outnumbered decliners by a margin of 469 to 269. Similarly, the VN30 basket echoed this bullish sentiment, displaying 16 gainers, 10 losers, and 4 unchanged stocks.

The Battle for Home: Unraveling the Dispute Plaguing Ho Chi Minh City’s Apartment Complexes

There are two primary reasons why disputes and complaints arise in Ho Chi Minh City’s condominium communities. The first stems from developers violating criminal laws, leading to prosecutions, investigations, or issues related to the management, operation, and utilization of the condominium properties. This includes delays in providing ownership certificates to residents and failure to hand over maintenance funds.

The Flow of Funds: What Does the Hesitant Money Trail Tell Us?

The VN-Index witnessed its second consecutive week of robust gains, surging past the 1370-point mark. The bulk of these gains were concentrated in the first two trading sessions, with the latter three sessions experiencing minimal fluctuations. Notably, excluding the high-volume trading session on June 24th, the average weekly trading volume was relatively low.

The Power to Tackle Bad Debt: A New Era for Vietnam’s Banks

On June 27, with an overwhelming majority of 93% of the delegates in favor, the National Assembly passed the Law amending and supplementing a number of articles of the Law on Credit Institutions. The law will come into effect on October 15.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)